Washington, DC – On May 24, the House Financial Services Committee passed the Increasing Financial Regulatory Accountability and Transparency Act (H.R. 3556), a bill U.S. Representative Young Kim (CA-40) helped introduce with Financial Institutions and Monetary Policy Subcommittee Chairman Andy Barr (KY-06).

Amid the recent failures of Silicon Valley Bank and First Republic, the Increasing Financial Regulatory Accountability and Transparency Act would bolster Congressional oversight of the Federal Reserve, Federal Deposit Insurance Corporation (FDIC), and the Financial Stability Oversight Council (FSOC).

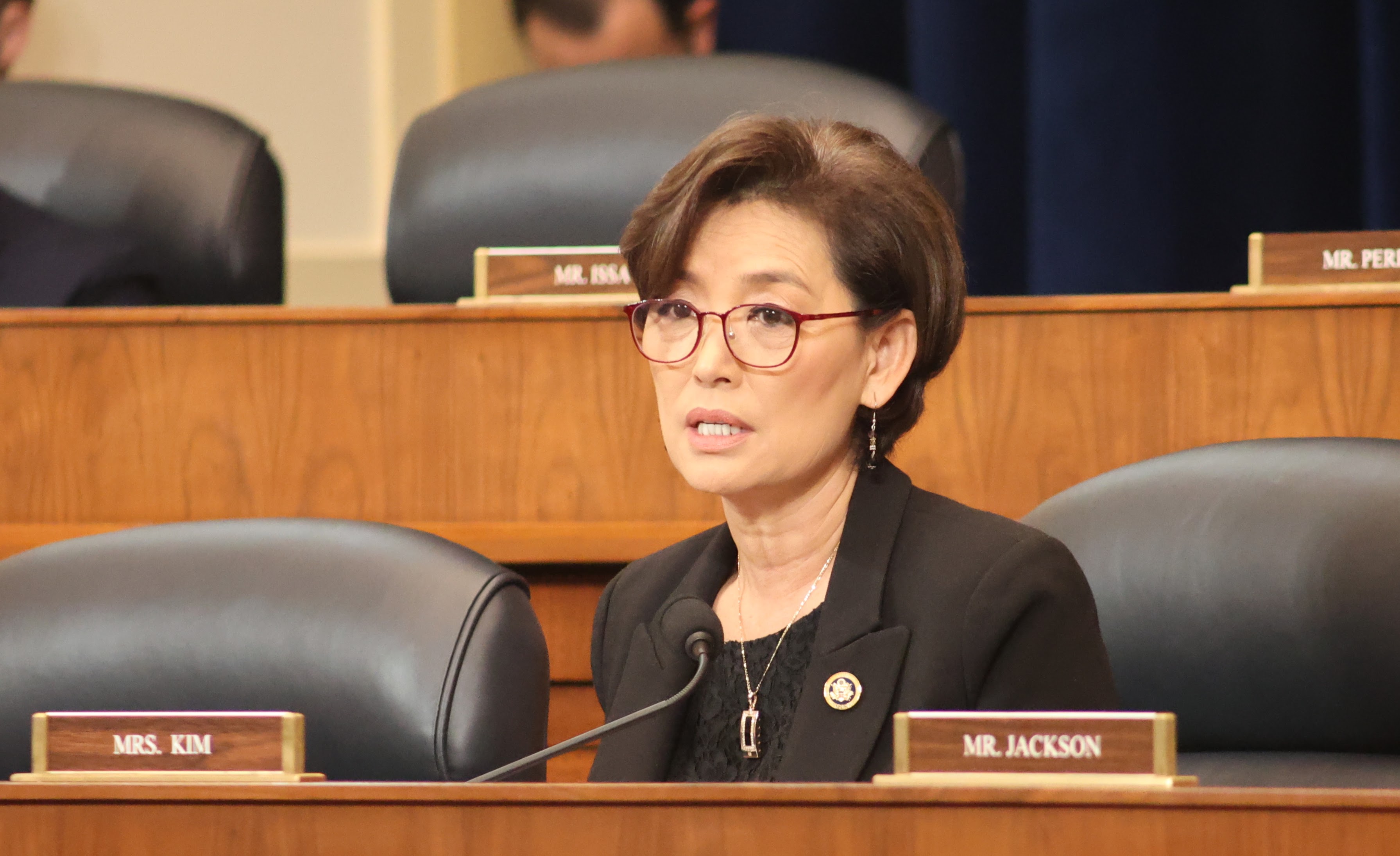

“Americans need to be able to trust our financial system. Federal regulators – while having existing laws in place to take proper action against the risks posed by recent bank failures – clearly dropped the ball on conducting proper supervision of Silicon Valley Bank and Signature Bank. We cannot afford for this to be a pattern,” said Congresswoman Kim. “The Increasing Financial Regulatory Accountability and Transparency Act will enact meaningful reforms to boost transparency of bank supervisors and ensure they are doing their jobs. As the only Republican from California on the Financial Services Committee, I will continue to demand answers, follow the facts and fight for American taxpayers.”

“The failures of bank supervisors significantly contributed to the largest bank failures in modern American history,” said Congressman Barr. “Simply put, bank supervisors were asleep at the switch, despite having all the tools necessary to prevent these banks from collapsing. These commonsense reforms take meaningful steps to increase Congressional oversight of bank supervisors to ensure they are effectively performing their function and to ensure the stability in our banking system going forward.”