Washington, DC – Today, the House Financial Services Committee passed the Community Bank LIFT Act (H.R.5276), a bill led by Congresswoman Young Kim (CA-40) to reduce burdensome regulations on community banks and empower them to reinvest in Main Street.

Specifically, the bill would expand the asset threshold for qualifying community banks from $10 billion to $15 billion, lower the Community Bank Leverage Ratio range from 8–10 percent to 6–8 percent, and require federal regulators to review and update the framework to simplify compliance and support new community bank formation.

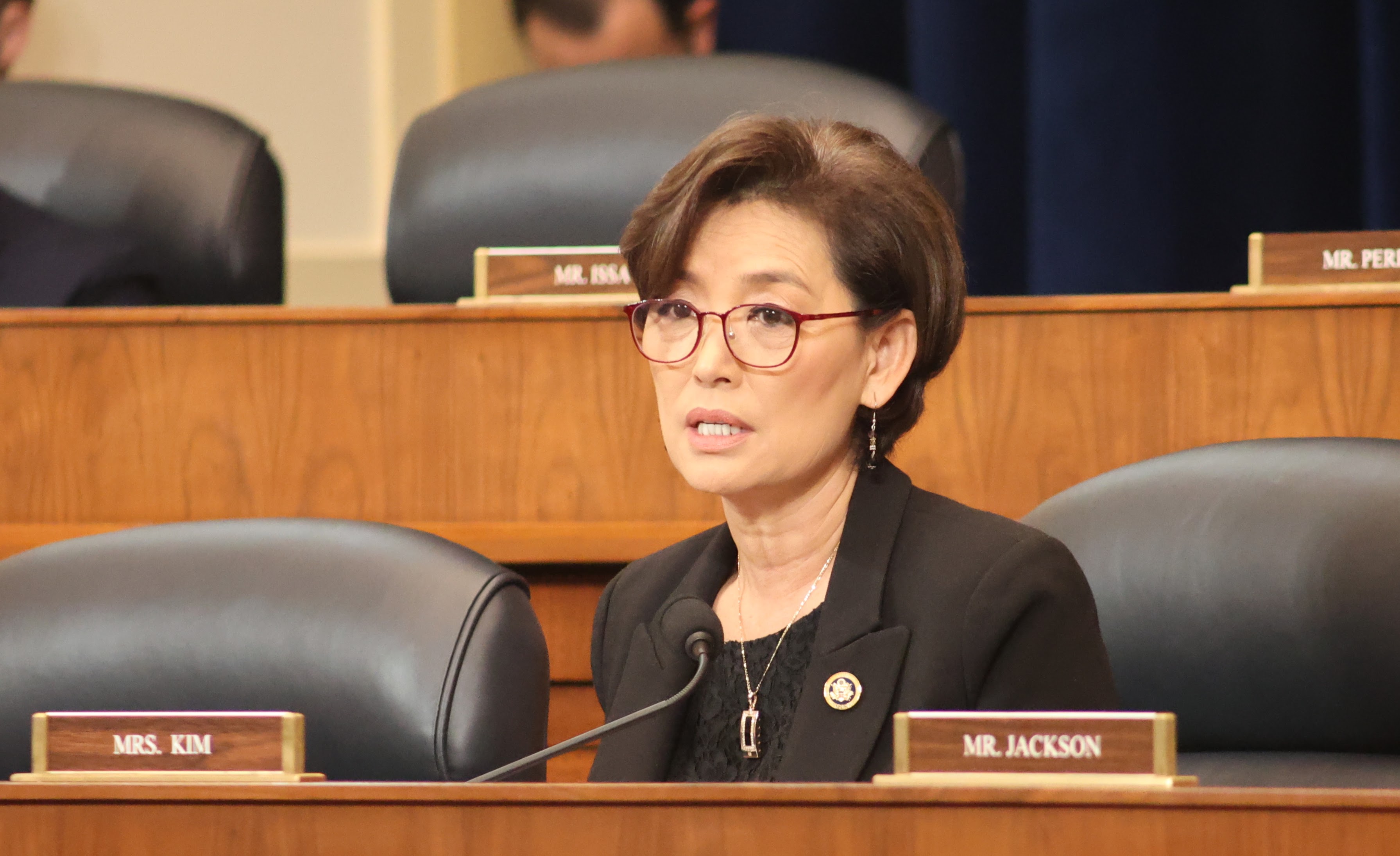

Rep. Kim spoke in Committee in support of the bill. Read her remarks below or watch HERE.

Thank you, Chairman Hill, for considering the Community Bank LIFT Act as a part of today’s markup.

In California, we have been experiencing the slow demise of our community banks.

Unfortunately, we are not seeing any new community banks either to replace them. In Southern California, only four new banks have formed since 2021. In Orange County, there has only been one bank formed since 2021.

When you start a small business and are looking for financing, you often go to your credit union or community bank first because you want a trusted partner that understands the local community.

When we lose community financial institutions and do not see new ones form, we are losing the lifeblood of Main Street America.

Part of the reason that we have not seen new community bank formation in Southern California is because of the complex regulatory climate that they face once these banks are up and running.

That is why my bill would make needed reforms to the Community Bank Leverage Ratio by lowering the range from eight to ten percent to six to eight percent. It would also require the regulators to examine ways to modify the Community Bank Leverage Ratio definitions and criteria for a qualifying community bank to ensure that the ratio does not become stagnant.

By lowering the ratio by just a single percent, over 500 banks would now become eligible to utilize the Community Bank Leverage Ratio.

As my colleagues consider this legislation, I would remind them that the former Chairman of the National Bankers Association, which represents the mission-driven community banks, testified that my bill could further enhance the ability of community banks to deploy capital.

This is the type of legislation we need to ease the regulatory burden on community banks, like those in California, so that they continue to grow and keep the dreams of small businesses on Main Street alive.

I hope that my colleagues will join me in supporting the Community Bank LIFT Act and support legislation that would uplift their communities.

I yield back the balance of my time.