Washington, DC — Today, U.S. Representative Young Kim (CA-40) helped introduce the Bipartisan Premium Tax Credit Extension Act, a bill led by Jen Kiggans (VA-02) and Tom Suozzi (NY-03) to protect families, seniors, and small business owners from massive health care premium increases.

Under current law, the enhanced Premium Tax Credit—established by the Affordable Care Act (ACA), expanded during COVID under the American Rescue Plan Act (ARPA), and later extended through the Inflation Reduction Act (IRA)—is set to expire at the end of this year. The COVID pandemic is over and these tax credits must end, but there must be a reasonable approach so hardworking families can continue to afford healthcare.

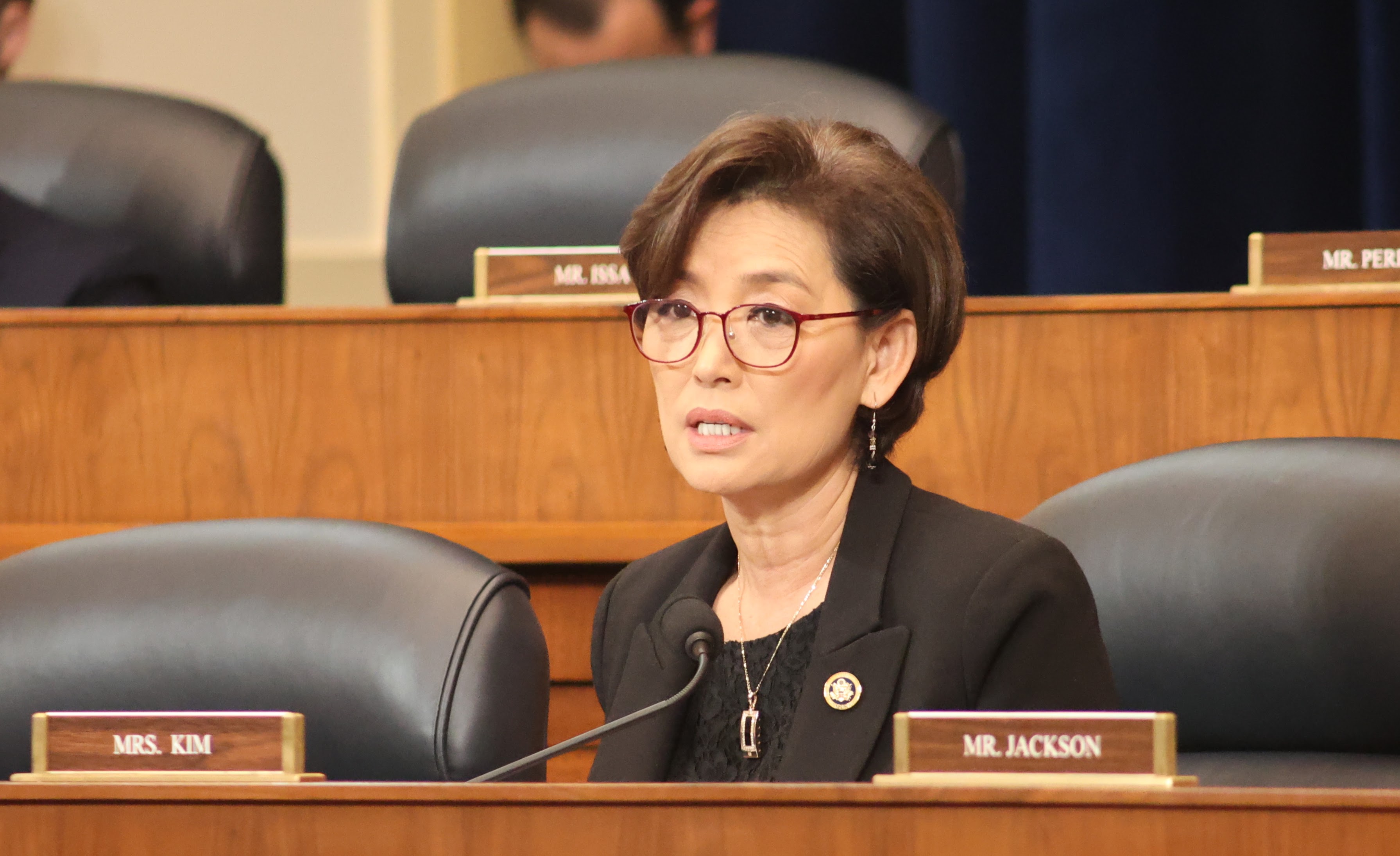

“Many in our community rely on healthcare premium tax credits to care for their loved ones and keep insurance affordable,” said Rep. Young Kim. “The Premium Tax Credits Extension Act is critical to ensuring that working-class Californians and the most vulnerable in our community can access essential healthcare coverage as Congress works towards a responsible, long-term solution. I am proud to partner with Congresswoman Kiggans on this timely bipartisan bill.”

“As a nurse practitioner, military spouse, and Mom, I understand firsthand how critical affordable health care is for working families,” said Rep. Jen Kiggans. “In Congress, I’ve made it my mission to ensure Virginians—especially our seniors, small business owners, and middle-class families—aren’t blindsided by skyrocketing costs they can’t afford. While the enhanced premium tax credit created during the pandemic was meant to be temporary, we should not let it expire without a plan in place. My legislation will protect hardworking Virginians from facing health insurance bills they can’t afford, thus losing much-needed access to care.”

Rep. Young Kim is joined by co-sponsors Brian Fitzpatrick (PA-01), Jared Golden (ME-02), Jeff Hurd (CO-03), Rob Bresnahan (PA-08), Young Kim (CA-40), David Valadao (CA-22), Carlos Gimenez (FL-28), Tom Kean (NJ-07), Juan Ciscomani (AZ-06), Mike Lawler (NY-17), and Don Davis (NC-01), Marie Gluesenkamp Perez (WA-03).