Regina Leader-Post

Washington D.C. today- (Bloomberg) — House Republicans from New York and other high-tax states remain at odds with House leaders over how high to raise the $10,000 cap on the state and local tax deduction, highlighting the deep divisions in the party as they seek to pass President Donald Trump’s legislative agenda.

(Bloomberg) — House Republicans from New York and other high-tax states remain at odds with House leaders over how high to raise the $10,000 cap on the state and local tax deduction, highlighting the deep divisions in the party as they seek to pass President Donald Trump’s legislative agenda.

The pro-SALT Republicans failed to reach agreement during a private meeting Wednesday with House Speaker Mike Johnson and top tax-writer Jason Smith of Missouri.

The continued failure to reach a deal threatens to delay the speaker’s schedule to have the tax writing committee vote on its portion of the bill next week. But participants said they were optimistic a deal could be reached soon and plan to meet Thursday.

The lawmakers discussed a $25,000 SALT cap for individuals, according to a person familiar with the matter, who said that was just one figure discussed and not a formal offer from House leaders. The person requested anonymity to discuss private matters.

“It was a lively discussion,” Representative Nick LaLota said. “We are still far away from each other.

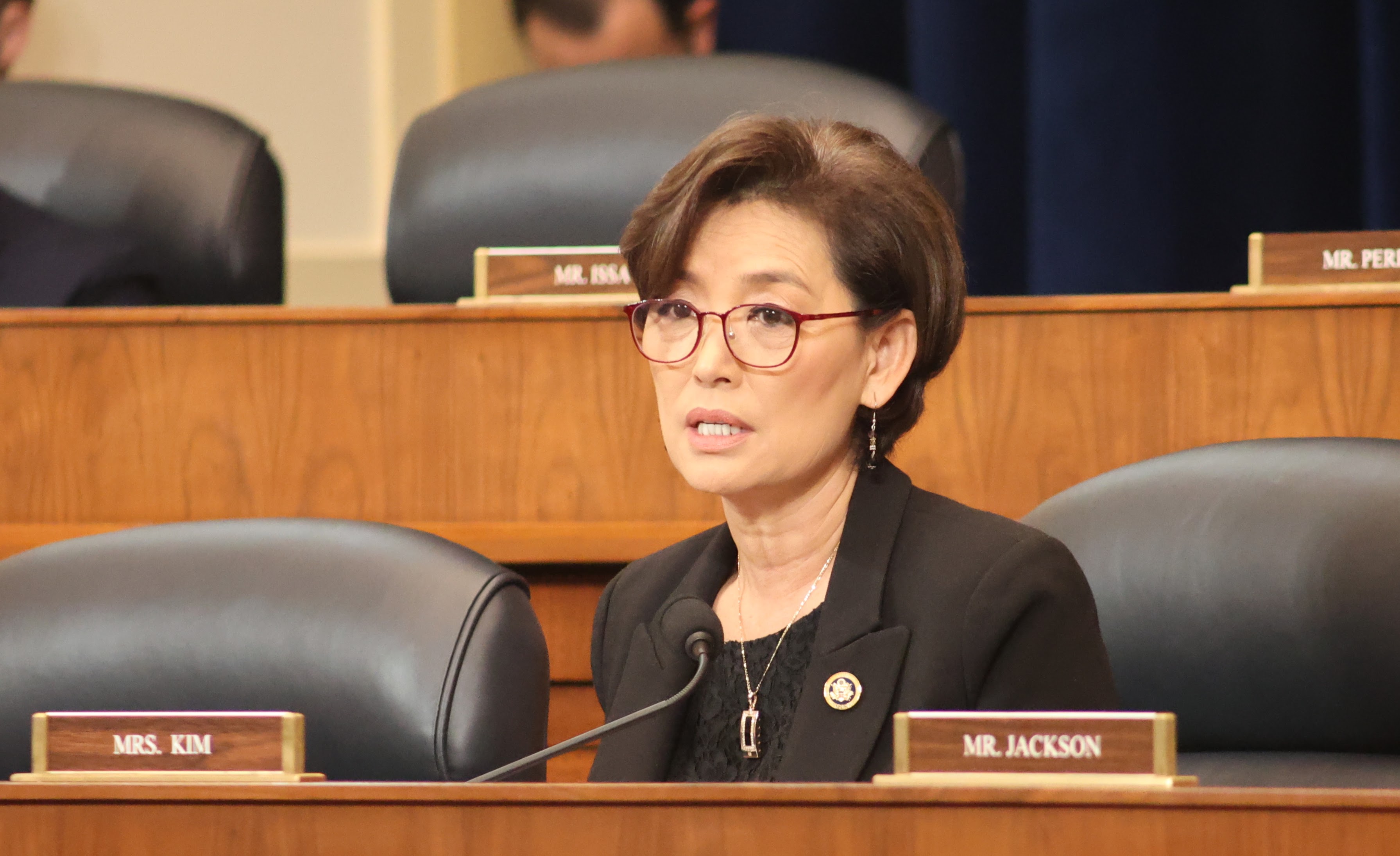

The lawmakers — New York’s LaLota, Mike Lawler and Andrew Garbarino, New Jersey’s Tom Kean and Young Kim of California — have threatened to reject any tax package that does not raise the SALT cap sufficiently.

“There needs to be a fixed result or there won’t be a bill,” Lawler said after the meeting. “So we’re continuing to work through that, and I think it’ll end in a positive place. But as with all this, it’s a negotiation, it’s a process.”

The SALT issue has been one of the thorniest for the House GOP to resolve as party leaders try to ram a multi-trillion-dollar tax cut package through the House in May. The larger the cap adjustment is, the less money there will be for other tax cuts on the Republican agenda.

LaLota said he does not want to offset the cost of expanding the SALT deduction by capping the state and local taxes corporations can deduct, an idea House members have considered. He added he is opposed to expanding the alternative minimum tax, a section of the tax code that restricts SALT deductions.

House Republicans are trying to keep revenue losses from their tax cut package down to a self-imposed limit of $4.5 trillion. They are also aiming for $2 trillion in spending cuts.

The ceiling must accommodate a nearly $4 trillion extension of the expiring 2017 Trump tax cuts as well as new cuts to taxes on tips and overtime. Republicans also want new tax breaks for seniors, car buyers and businesses building factories in the US. The amount of new tax cuts could be higher if the tax-writing Ways and Means Committee eliminates green energy tax breaks under its jurisdiction.