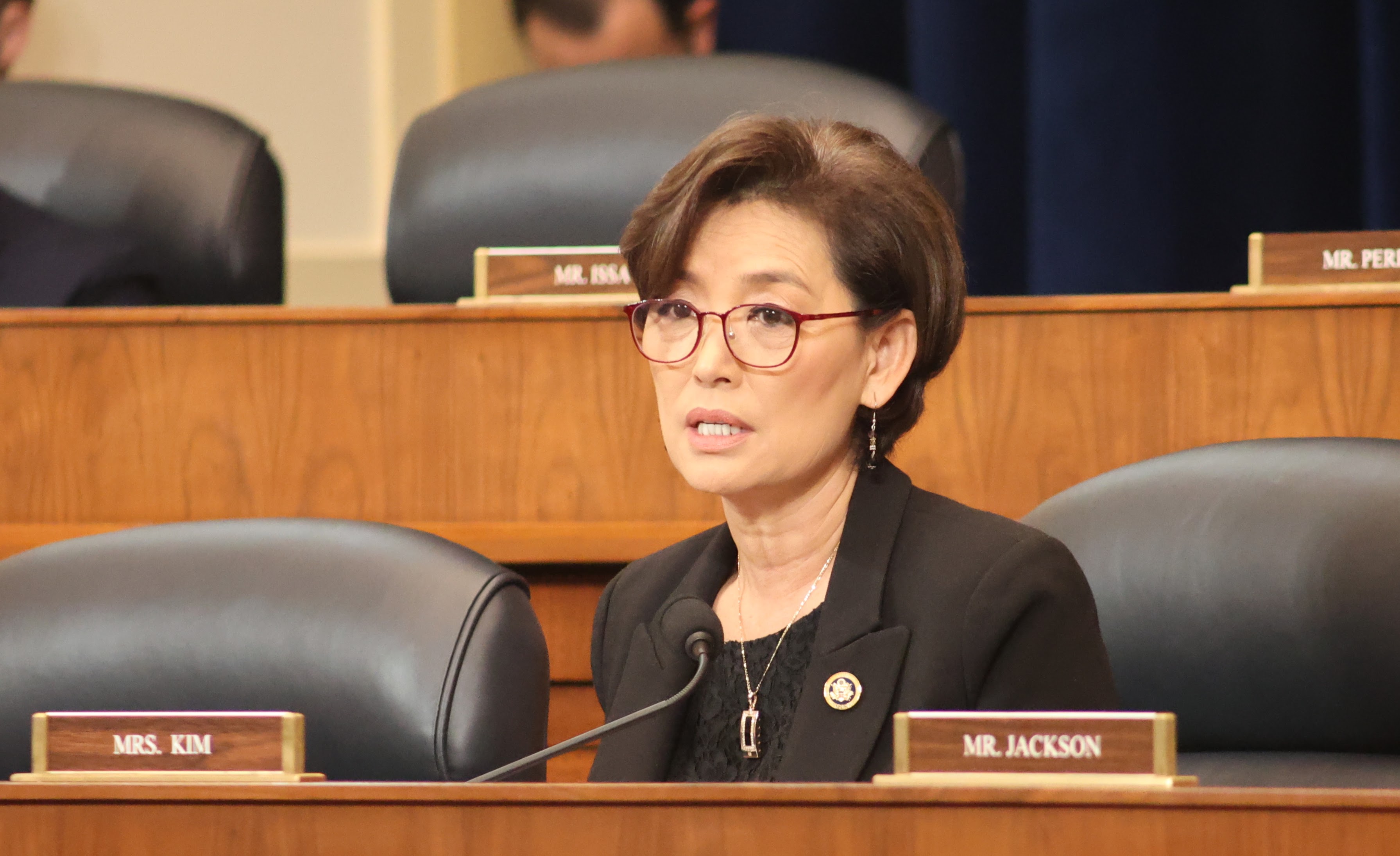

U.S. Rep. Young Kim (R-CA) on Jan. 9 introduced a bipartisan bill to target credit repair organizations (CROs) that exploit consumers by charging high fees without delivering on promises to improve their credit scores.

By strengthening CROs regulations, the bill aims to ensure transparency and accountability in the industry, according Rep. Kim, who cosponsored the Ending Scam Credit Repair Act, H.R. 306, alongside bill sponsor U.S. Rep. Sarah McBride (D-DE).

“Fraudulent CROs should not get away with scamming hard-working Americans seeking to improve their scores and unlock their American dream,” Rep. Kim said. “The Ending Scam Credit Repair Act helps consumers and hikes penalties for scammers.”

If enacted, H.R. 306 would ensure consumers that CROs only receive payment after delivering documented improvements to credit reports, and would increase civil penalties for violations, according to the lawmakers’ summary of the bill, which has been referred for consideration to the U.S. House Financial Services Committee.

Rep. McBride pointed out that CROs exploit legal loopholes to target cash-strapped consumers who have low credit scores.

“Our bipartisan bill eliminates those loopholes that have allowed predatory practices to flourish by banning upfront fees, improving transparency, and enhancing consumer protections,” she said. “I am grateful to Congresswoman Kim for working across the aisle with me on common-sense solutions to deliver for our constituents.”