The years-long effort to restore the beloved SALT tax deduction is gaining traction, as Republicans push to get “one big beautiful” tax bill passed.

Why it matters: This would be an expensive deficit-expanding tax cut for folks in blue states that are relatively well-to-do.

- Giving them a break while cutting benefits to lower-income Americans, also under discussion, could be politically difficult to explain.

By the numbers: Only about 4 million people would take advantage of the state and local tax deduction, or SALT, if it were doubled for married couples as is under consideration,per an analysis from the Tax Policy Center.

- 94% of the benefits of doubling the deduction would flow to households earning more than $200,000 a year, according to an analysis from the nonpartisan Committee for a Responsible Federal Budget.

- It could cost $4.1 trillion over the next decade.

Catch up fast: Previously, you could deduct all state and local taxes from your federal bill. The 2017 tax law capped the deduction at $10,000, sending shockwaves through high-income households in the expensive suburbs of California, New York and New Jersey where taxes run into the tens of thousands of dollars.

- These are folks making a lot of money (relatively speaking) who don’t feel rich and mostly consider themselves middle class.

- During his campaign, Donald Trump said he would restore the tax break — flip-flopping from his previous position.

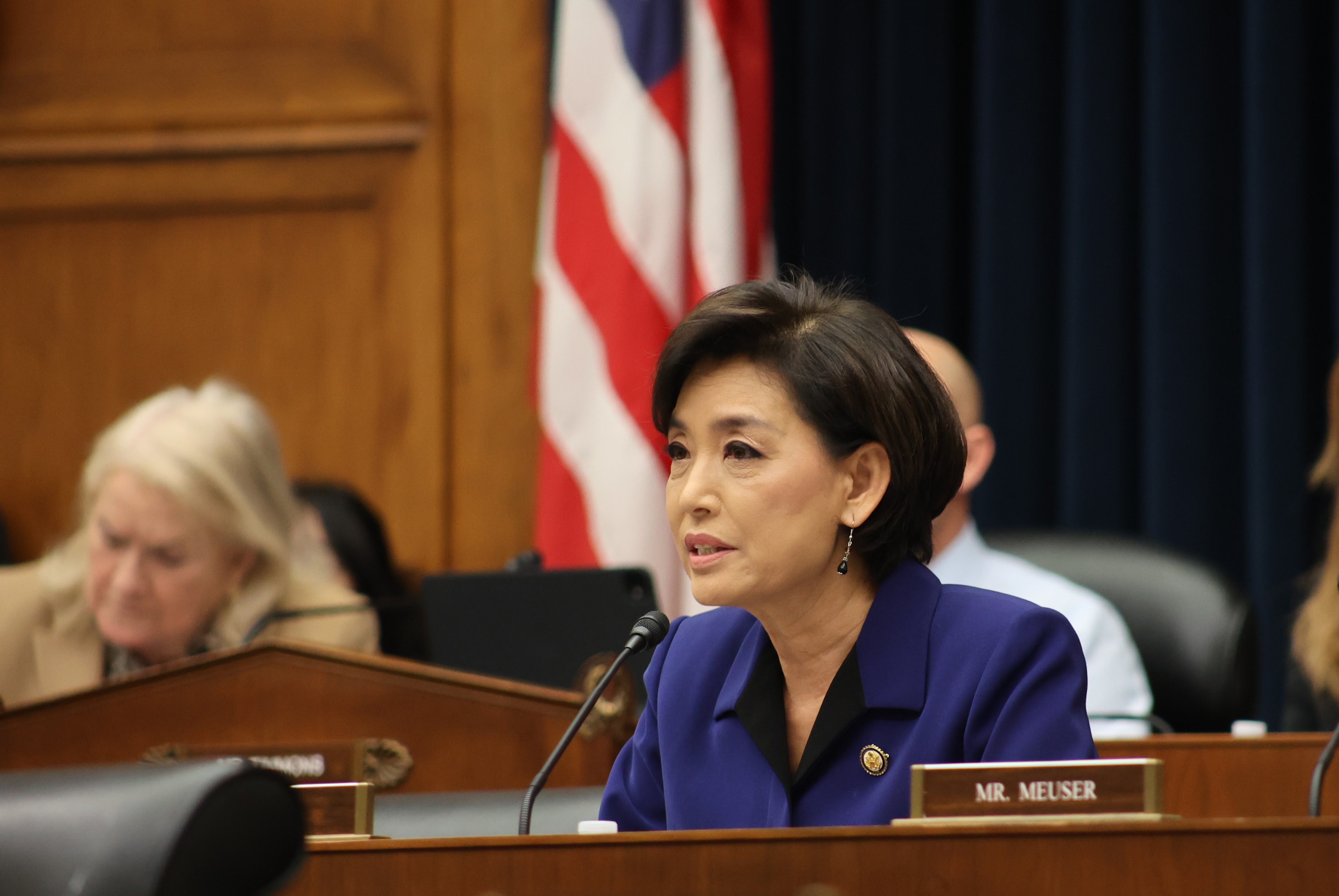

State of play: “Our constituents are burdened by the SALT cap, and President Trump committed to addressing this issue for our districts,” Republican Reps. Young Kim, from Orange County, Calif., and Andrew R. Garbarino, from Long Island, N.Y., said in a joint statement Saturday.

- They’re the co-chairs of the bipartisan SALT Caucus (yes that’s a thing).

- “We had a productive meeting tonight and will keep fighting to resolve this critical issue so our constituents can keep more of their hard-earned money,” they said.

- Republicans believe some moderate Democrats in the affected states might be persuaded to vote for a Trump mega-bill if it includes these SALT changes.