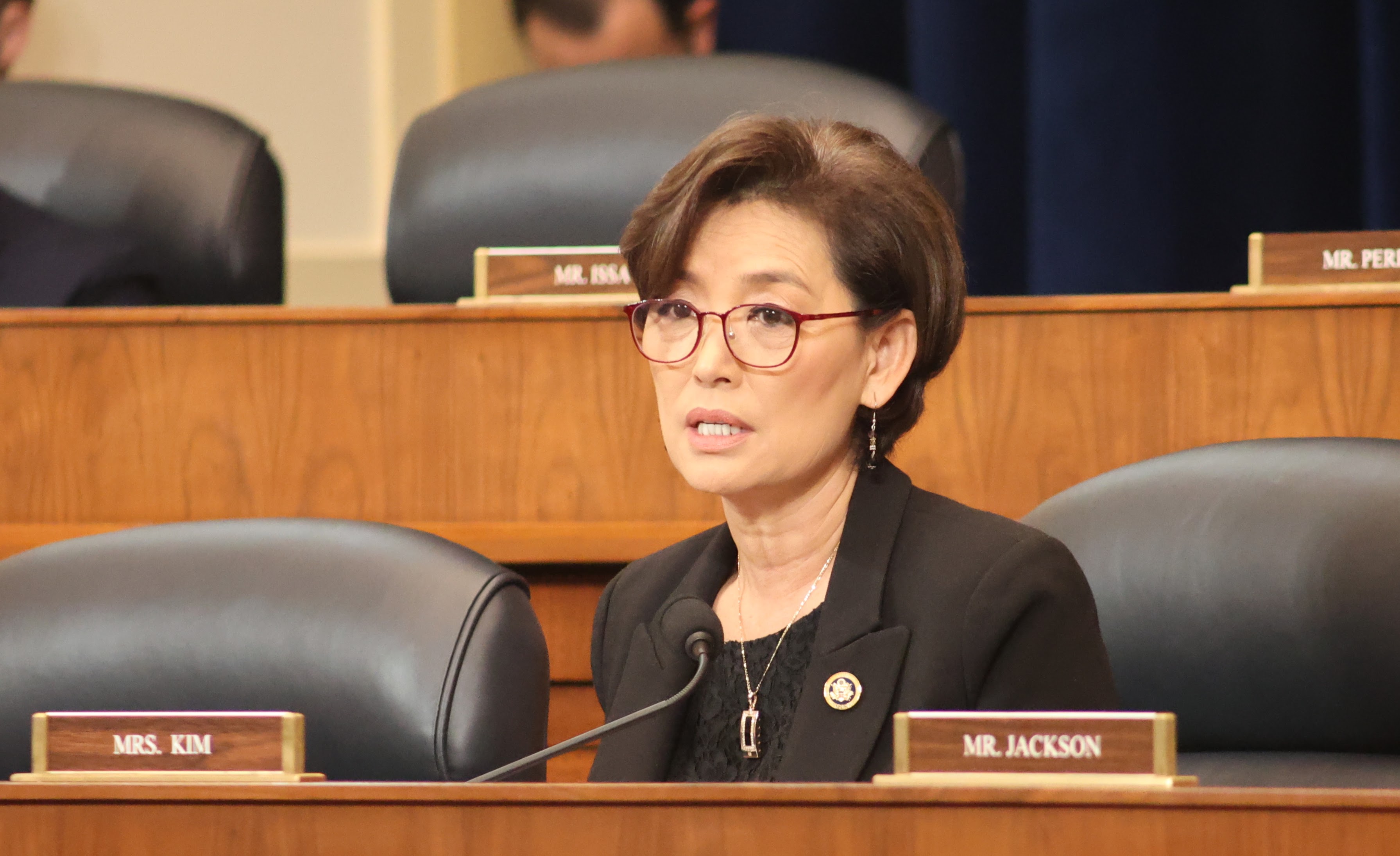

Washington, DC – Today, U.S. Representative Young Kim (CA-40) testified to the House Committee on Ways on Means on the importance of fixing the cap on state and local tax (SALT) deductions.

Rep. Kim serves as co-chair of the bipartisan SALT Caucus and has helped introduce the SALT Deductibility Act (H.R. 430) to fully repeal the SALT cap.

Watch her speech HERE and read her remarks below.

Thank you, Chairman Smith, and Ranking Member Neal, and members of this committee. Thank you for having this important Member Day hearing to learn about our priorities for our respective districts.

I represent the hardworking people of California’s 40th District. My constituents primarily reside in the counties of Orange and San Bernardino, and a small portion of Corona in Riverside County.

For most of my constituents – as I am sure many of your constituents –increasing living costs and home affordability are top of mind.

As the Ways and Means Committee begins the process of writing a tax package, I ask that your Members consider fixing the state and local tax, or SALT, deduction cap imposed by the Tax Cuts and Jobs Act.

The TCJA SALT Cap also discriminated against families who filed their taxes jointly because it imposed the same $10,000 cap as individual filers. The Committee must also consider fixing this marriage penalty.

The SALT deduction originated from the Revenue Act of 1913, which included a provision that allowed the deduction of state and local taxes in order to prevent double taxation.

For over a century, the SALT deduction was a bedrock of tax law and allowed more families to keep more of their hard-earned money in their pockets. Unfortunately, the SALT cap made home ownership unattainable for districts like mine.

According to the Federal Housing Finance Agency’s national House Price Index, a metric of how selling prices for single-family homes have changed, we saw an increase of nearly 60 percent from July 2019 to July 2024, all the while the SALT cap remains the same.

Fixing the SALT cap is not a red or blue state issue – it’s all about making homes affordable for my constituents no matter who they voted for.

I also would like to encourage the Committee to consider Rep. LaHood’s Affordable Housing Credit Improvement Act, which I have strongly supported as an original cosponsor.

The bill would finance more affordable housing by expanding and strengthening the Low-Income Housing Tax Credit.

Additionally, I urge the Committee to follow the Speaker’s thinking on the energy tax credit enacted by the Inflation Reduction Act and use a scalpel and not a sledgehammer when thinking about which tax credits to repeal.

Chairman Smith, I look forward to continuing to work with you and your team to address many of my constituents’ concerns. Thank you again for listening and for the opportunity to speak with you today. I yield back.