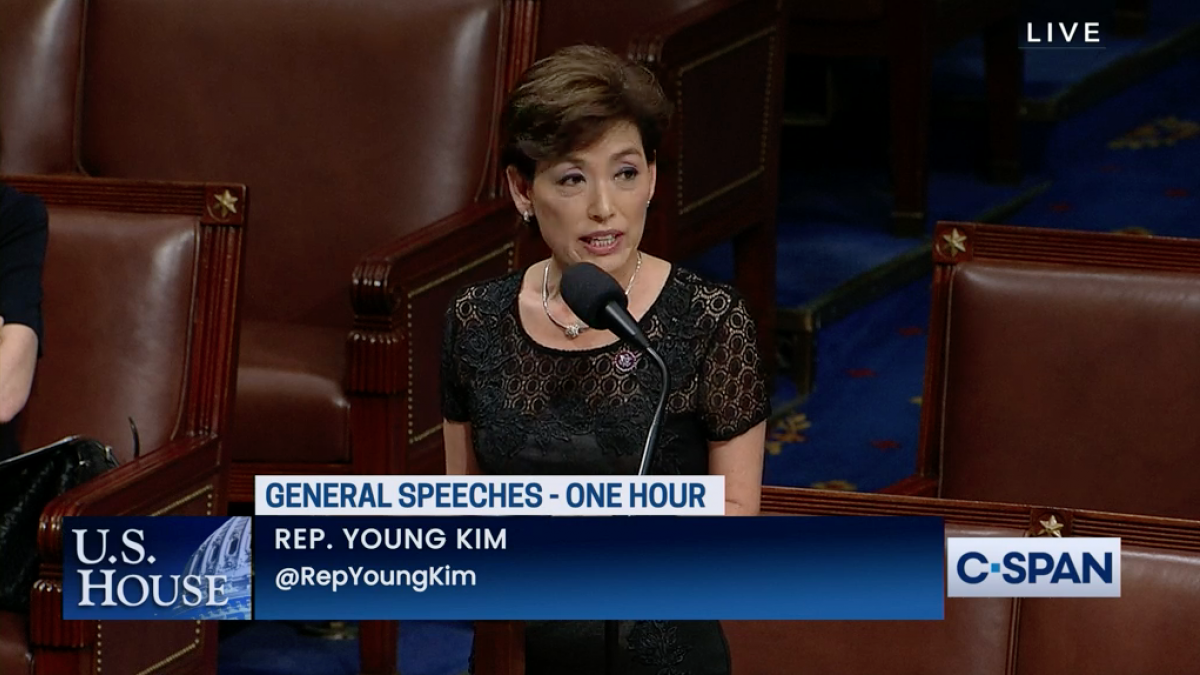

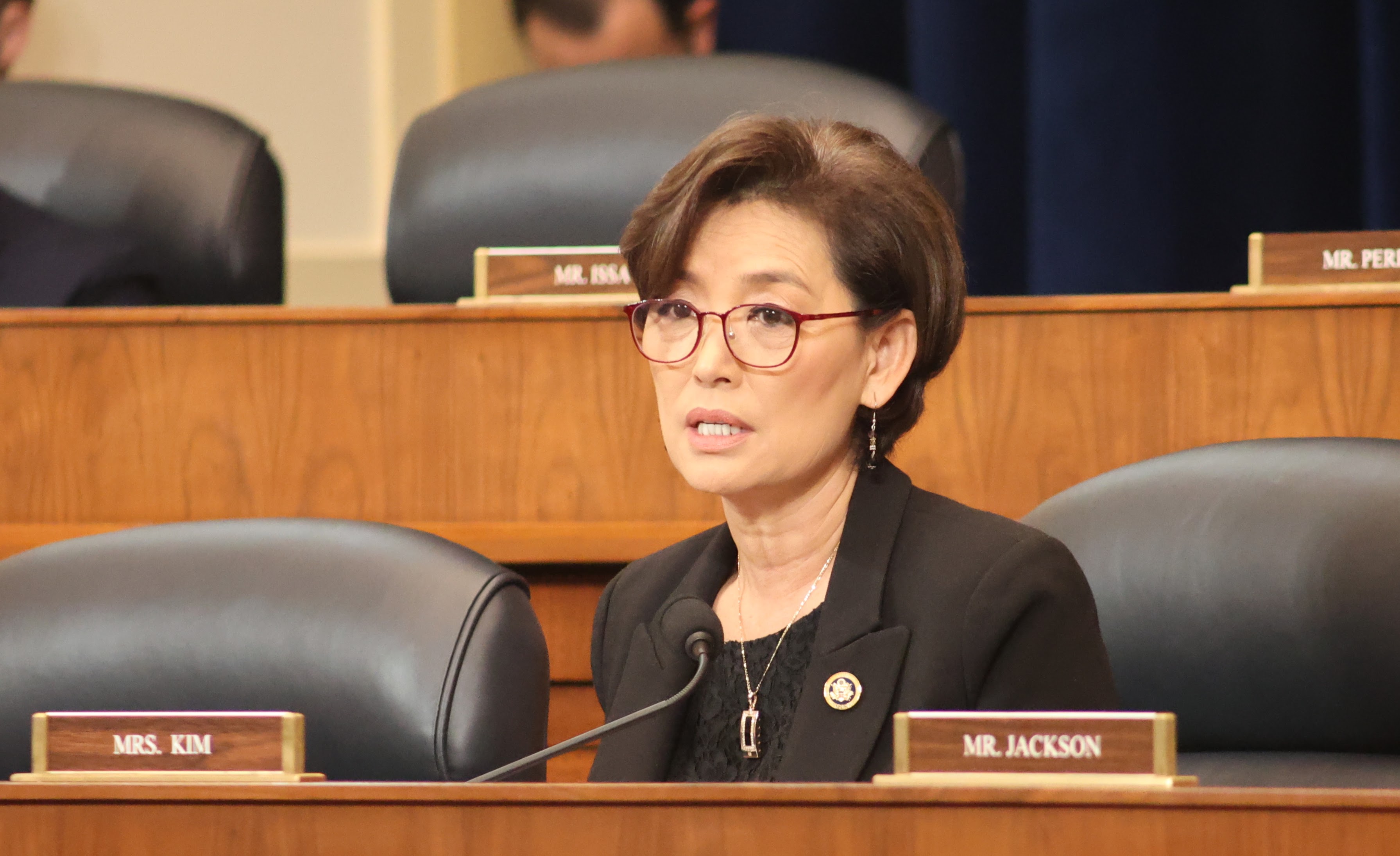

Washington, DC – Today, U.S. Representative Young Kim (CA-39) voted against H.R. 5376, a multi-trillion spending and tax hike plan over ten years.

According to the Tax Foundation, H.R. 5376 will cause California taxpayers to pay $14,095 in more taxes over the next 10 years, with a $755 annual tax increase for the average taxpayer in 2022 that increases to $1,923 by 2031. Additionally, according to the Congressional Budget Office, H.R. 5376 will add $367 billion to the debt over the next ten years.

“Americans across the country are facing new challenges making ends meet due to record-high prices on everyday goods, housing costs, taxes, and supply chain shortages, and nearly half of small business owners have been unable to find workers. Unfortunately, Californians are bearing the brunt of these economic crises due to high costs of living, all-time high gas prices, record-high inflation and some of the highest state and local taxes in the nation.

“I came to Congress to bring some commonsense to Washington, make life more affordable and expand opportunities so all Americans can achieve their dream like I did. Unfortunately, the House majority has been gridlocked for months over how many trillions worth of taxpayer dollars they can get through on a partisan basis, instead of pursuing commonsense policies that will improve our economy and lower costs on Americans. Now that this reckless spending and tax hike plan has passed the House, I hope the Senate will listen to the American people and keep this bill from becoming law. Our nation’s future is at stake, and this massive spending and tax hike plan puts our country on the wrong track. I strongly oppose this proposal and urge my colleagues on the other side of the aisle to work with us to get America back on track so we can leave a better nation for our children.”

Other provisions of the bill include:

- $80 billion to IRS to double its number of agents in order to snoop on Americans’ finances;

- Over $400 billion in taxes on America’s small businesses;

- $800 billion in tax increases on companies that compete domestically and abroad; and,

- A Toddler Tax that will force middle income families to pay $13,000 more a year for childcare.