Washington, DC – Today, U.S. Representatives Young Kim (CA-40) and David Scott (GA-13) introduced the Financial Inclusion in Banking Act (H.R. 4067), a bipartisan bill to expand access to financial opportunities.

The Financial Inclusion in Banking Act directs the Consumer Financial Protection Bureau (CFPB) to focus its attention on finding solutions for underbanked and underserved communities and improve coordination between federal agencies, trade associations, and financial institutions to improve consumer access to banking.

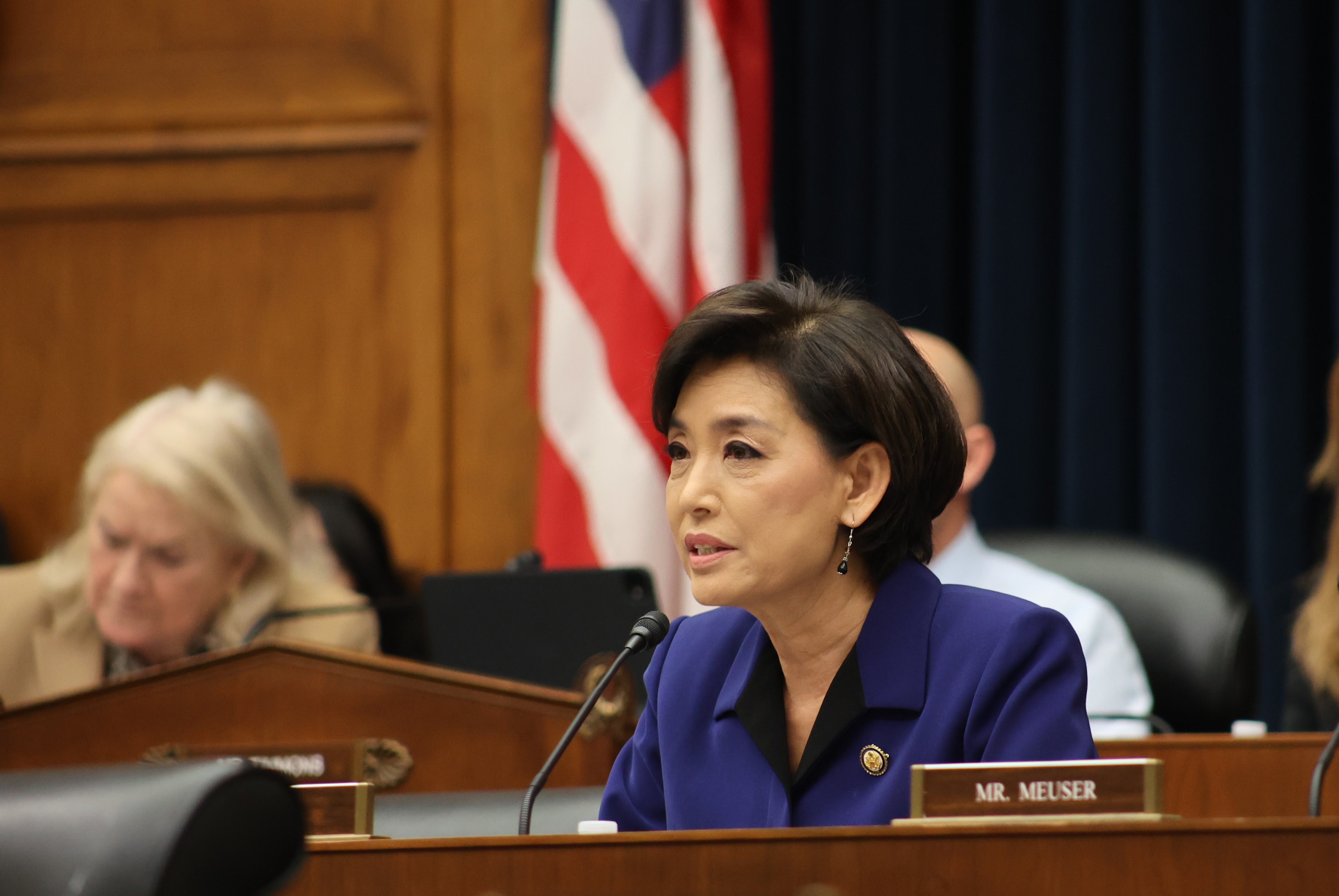

“All Americans should be able to access the tools needed to achieve their dream. As an immigrant and small business owner, I have seen firsthand the challenges to accessing capital and knowing what resources are available,” said Rep. Young Kim. “I’m proud to co-lead this bipartisan bill to help underserved communities access financial opportunities. As co-chair of the Financial Literacy and Wealth Creation Caucus, I’ll keep fighting to ensure all Americans can grow their wealth, succeed, and achieve their dream.”

“It is expensive to be unbanked or underbanked in the United States. Far too many Americans are forced to pay astronomically high fees for everyday services like cashing a check or transferring funds. Fees often add up to hundreds of dollars each year,” said Congressman Scott. “In order to expand banking services and close the wealth gap, it is vital to work with a broad and diverse group of stakeholders. The Financial Inclusion in Banking Act will accelerate the access of unbanked and underbanked communities to affordable mainstream accounts and expand access to more low-cost banking and alternative financial products.” Scott concluded.

The Financial Inclusion in Banking Act requires the CFPB to:

- Lead a coordinated effort with banking trade associations, consumer groups, civil rights groups and other federal agencies to assess those findings;

- Identify strategies to increase financial education; and,

- Submit a report to Congress every two years on legislative and regulatory recommendations to promote participation in the financial system.