Washington, DC – Today, the House Financial Services Committee passed two bills by U.S. Representative Young Kim (CA-40) to support American consumers and cut federal red tape:

- The Reviewing the Expansion of Government (REG) Act (H.R. 7030), which was added to the SEC Reform and Restructuring Act (H.R. 8339) and would counter overregulation at the Securities and Exchanges Commission (SEC); and

- The Clarity in Lending Act (H.R. 8338), a package of several bills including the Small Dollar Loan Certainty Act (H.R. 8356), which aims to strengthen access to small-dollar loans for consumers and small businesses.

Watch Rep. Kim speak in favor of the SEC Reform and Restructuring Act HERE and the Clarity in Lending Act HERE.

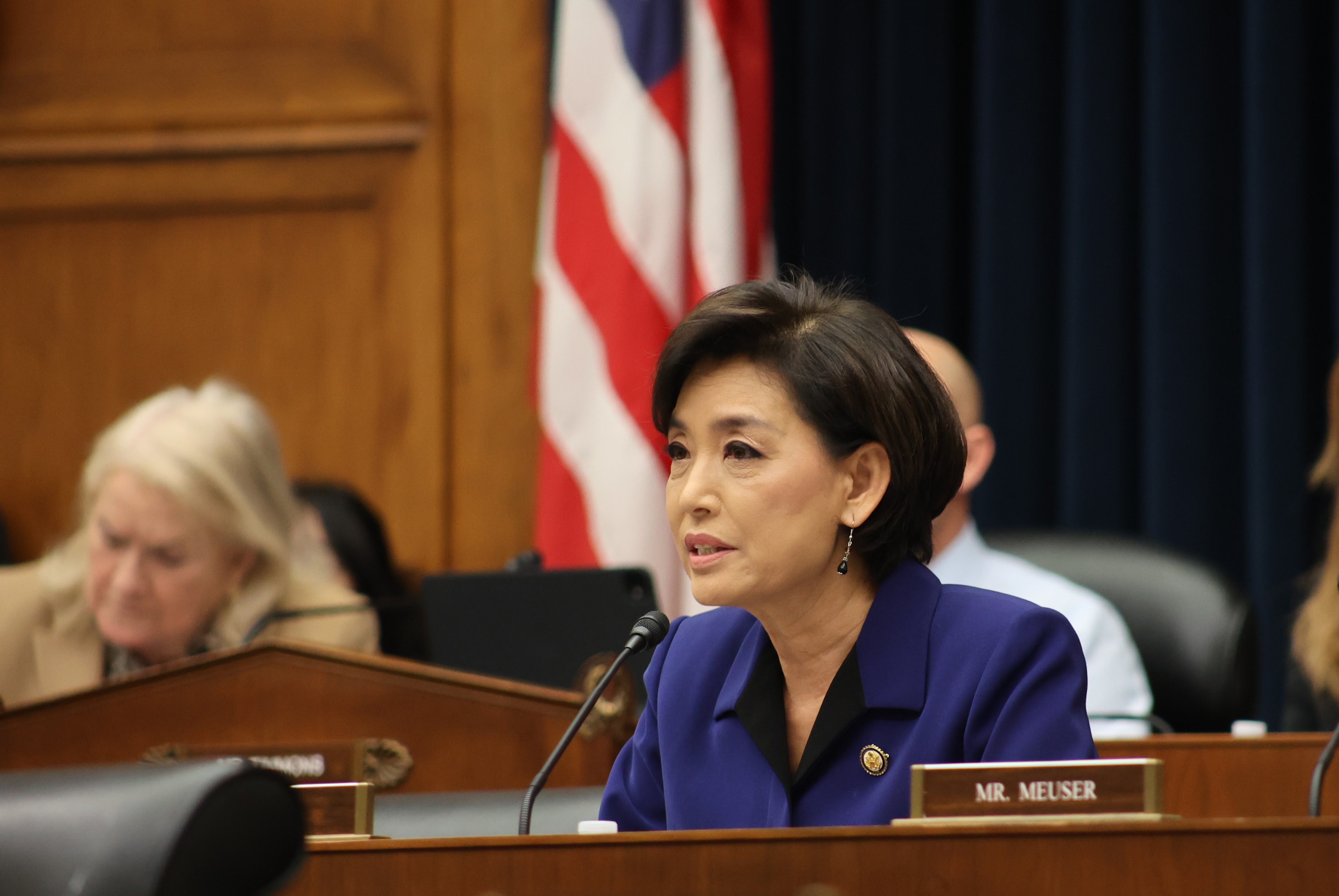

“Small business owners and taxpayers cannot afford more out-of-touch policies that put the American dream out of reach,” said Rep. Young Kim. “I thank my House Financial Services Committee colleagues for supporting my commonsense bills to cut through red tape and expand access to capital. I’ll keep doing my part to get these bills across the finish line to make life affordable and keep the American dream alive for future generations.”

The REG Act would counter overregulation and ensure rules are working as intended and not hurting small businesses by requiring the SEC to:

- Review final rules and regulations every five years;

- Determine whether revision or repeal of a rule is necessary or appropriate to fulfill the SEC’s three-part mission;

- Establish a plan to carry out the rule review process;

- Report to Congress with findings on the review process; and,

- Consider the cumulative costs of rules and regulations.

The Small Dollar Loan Certainty Act amends the Truth in Lending Act to allow covered entities – insured depository institutions or Federal credit unions – to offer small-dollar credit products to consumers by:

- Establishing requirements for providing small-dollar installment loans and lines of credit;

- Compelling the use of a robust underwriting process to determine creditworthiness;

- Requiring funds to be distributed to consumers within five days of approval;

- Banning fees against consumers associated with a small-dollar credit product; and,

- Creating a safe harbor for covered entities that comply with this bill.