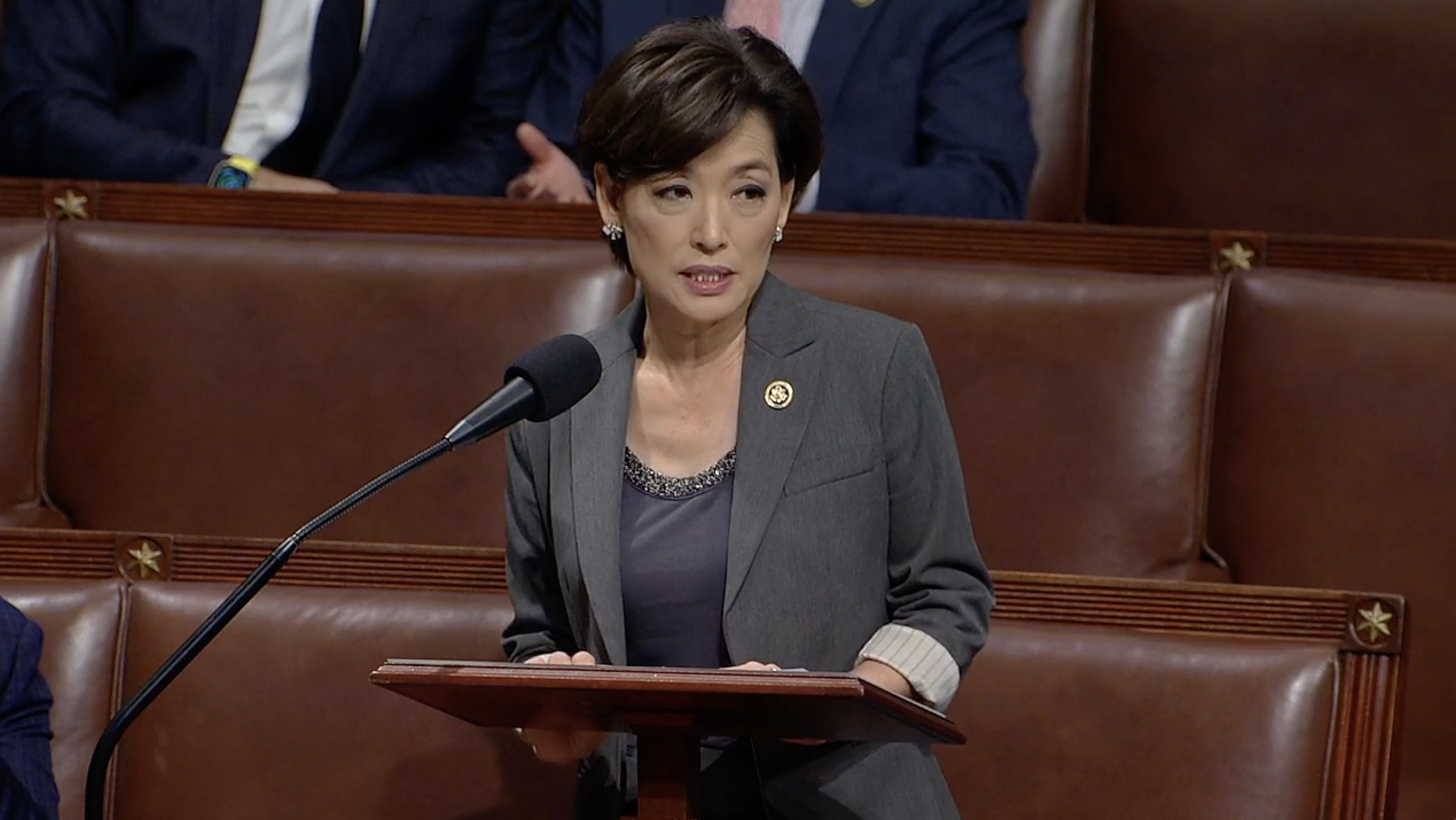

Washington, DC – Today, U.S. Representative Young Kim (CA-40) spoke on the House floor in support of the rule to bring to the floor the SALT Marriage Penalty Elimination Act (H.R. 7160), which Rep. Kim helped introduce with Rep. Mike Lawler (NY-17) to increase the state and local tax (SALT) cap from $10,000 to $20,000 for married couples – fixing an unfair loophole that currently exists in the tax code.

Rep. Kim serves as co-chair of the bipartisan SALT Caucus and recently voted in favor of the Tax Relief for American Families and Workers Act of 2024 (H.R. 7024), which passed the House in an overwhelmingly bipartisan manner to make life more affordable and support U.S. jobs and competitiveness.

Watch HERE or read her remarks below.

Mr. Speaker, I rise in strong support of the Rule and the underlying bill – H.R. 7160, the SALT Marriage Penalty Elimination Act – to allow families to keep more of their hard-earned money in their pockets.

I thank my colleague, Representative Lawler, for his leadership to introduce this bill and push for its consideration.

H.R. 7160 will eliminate the so-called marriage penalty on the state and local tax – or SALT – deduction for families who file their taxes jointly.

Under the current tax code, married couples filing jointly are penalized and have the same SALT cap of $10,000 as single filers.

H.R. 7160 doubles the SALT deduction cap for married couples to $20,000 and does right by them.

Limited housing supply, high mortgage rates not seen in decades, and high housing costs, are making it impossible for many first-time homebuyers to purchase a home and reach the American Dream.

The SALT cap is not and should not be a blue vs. red issue. We’re simply advocating for our constituents who want us to consider pro-growth, pro-family policies.

In my district, the median price of a home is over a million dollars. However, we can pass this rule today to allow us to provide much-needed tax relief and stop discriminating against families through the tax code.

H.R. 7160 will not mark the end of our fight to provide full SALT tax relief for our constituents – this is only the first step to get us there. I’ll always fight to make life more affordable for my constituents. I urge my colleagues to support the Rule and the underlying bill.

I yield back my time.