Washington, DC – Today, U.S. Representative Young Kim (CA-39) joined Rep. Tom Suozzi (NY-03) and a bipartisan group of colleagues on the House floor to push for a full repeal of the cap on State and Local Tax (SALT) deductions hurting American workers and families.

Rep. Kim is an original cosponsor of the bipartisan SALT Deductibility Act which would fully repeal the cap on SALT deductions and is a founding member and co-chair of the bipartisan SALT Caucus with Reps. Suozzi, Andrew Garbarino (NY-02) and Josh Gottheimer (NJ-05).

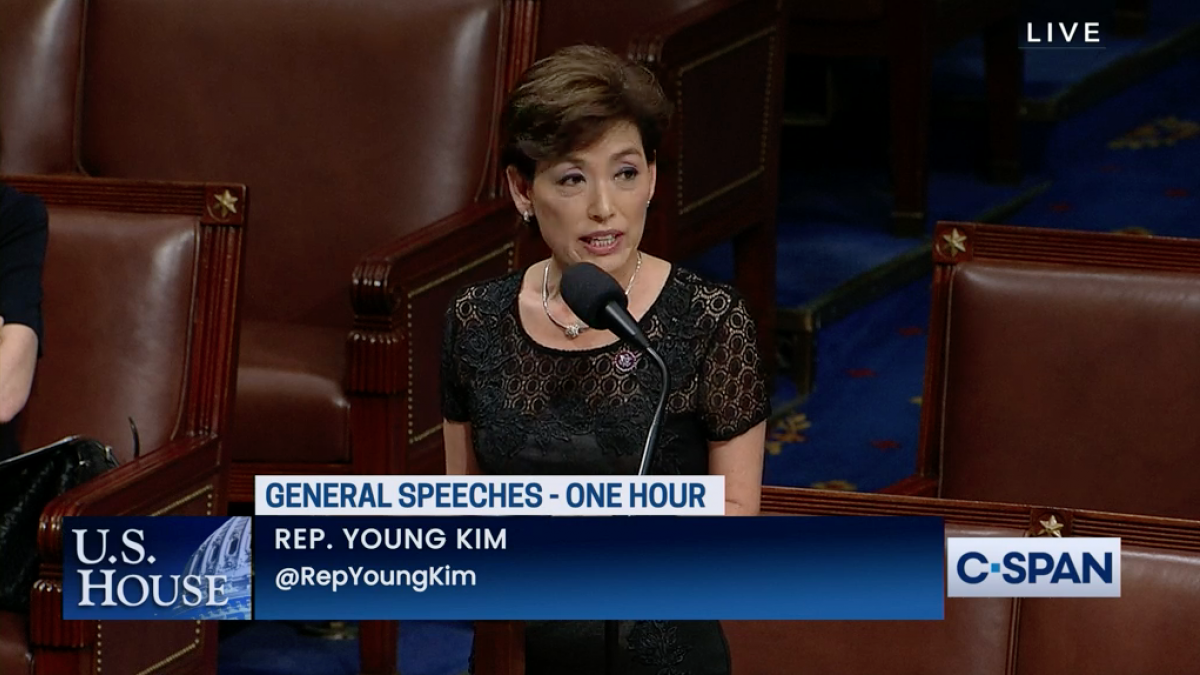

Rep. Kim spoke on the House floor in support of repealing the SALT cap. You can watch her remarks HERE and read a transcript below.

Remarks as Prepared for Delivery

Thank you Congressman Suozzi for yielding and for working with me in a bipartisan push to repeal the cap on SALT deductions that is hurting American workers and families.

Californians in the 39th District which I represent and across our state have been burdened enough by high state and local taxes in addition to high costs of living and housing.

The last thing they need is to be hurt even more for these high state and local taxes at the federal level.

I’ve heard from many of my constituents about the burdensome taxes that they have to pay as a result of the SALT Cap. These are workers, business owners and families who are struggling to survive due to the COVID-19 pandemic.

It is estimated that in the 2022 tax year, California’s 39th District will pay on average more than $600 million more in taxes. In 2018 alone, Californians paid an additional $11.2 billion in federal taxes because of the SALT Cap, which translated into 55,000 fewer jobs and a loss of $3.4 billion in wages.

Assuming a middle-of -road rate of 25 percent, an average taxpayer who claimed itemized deduction would have saved $6,521 in taxes if the SALT deduction were not capped at $10,000.

These high tax rates are on top of the skyrocketing housing prices across the state. In fact, according to the National Association of Realtors, the median price for a single-family home in California has increased by more than 39 percent in the past year alone, surpassing the $800,000 threshold for the first time in April of this year.

That is why it is a top priority of mine in Congress to make life more affordable for Californians and repeal the SALT cap hurting my constituents and many middle class Americans across the nation.

I was proud to join my friend Representative Suozzi as an original cosponsor of the SALT Deductibility Act. This bill would simply repeal the cap on SALT tax deductions and send a message: no more to burdensome taxes and yes to our families keeping more money in their hands.

I am also proud to serve as co-chair of the bipartisan SALT caucus as we continue to work together to repeal this cap and help lower taxes for my constituents and businesses. I will continue to do all I can to deliver results for California’s 39th District.

Thank you Representative Suozzi for organizing this special order and for your leadership to repeal the SALT Cap, with that I yield back.