Washington, DC – Today, U.S. Representative Young Kim (CA-39) introduced two bipartisan bills to improve the Small Business Administration (SBA)’s 504 Loan Program.

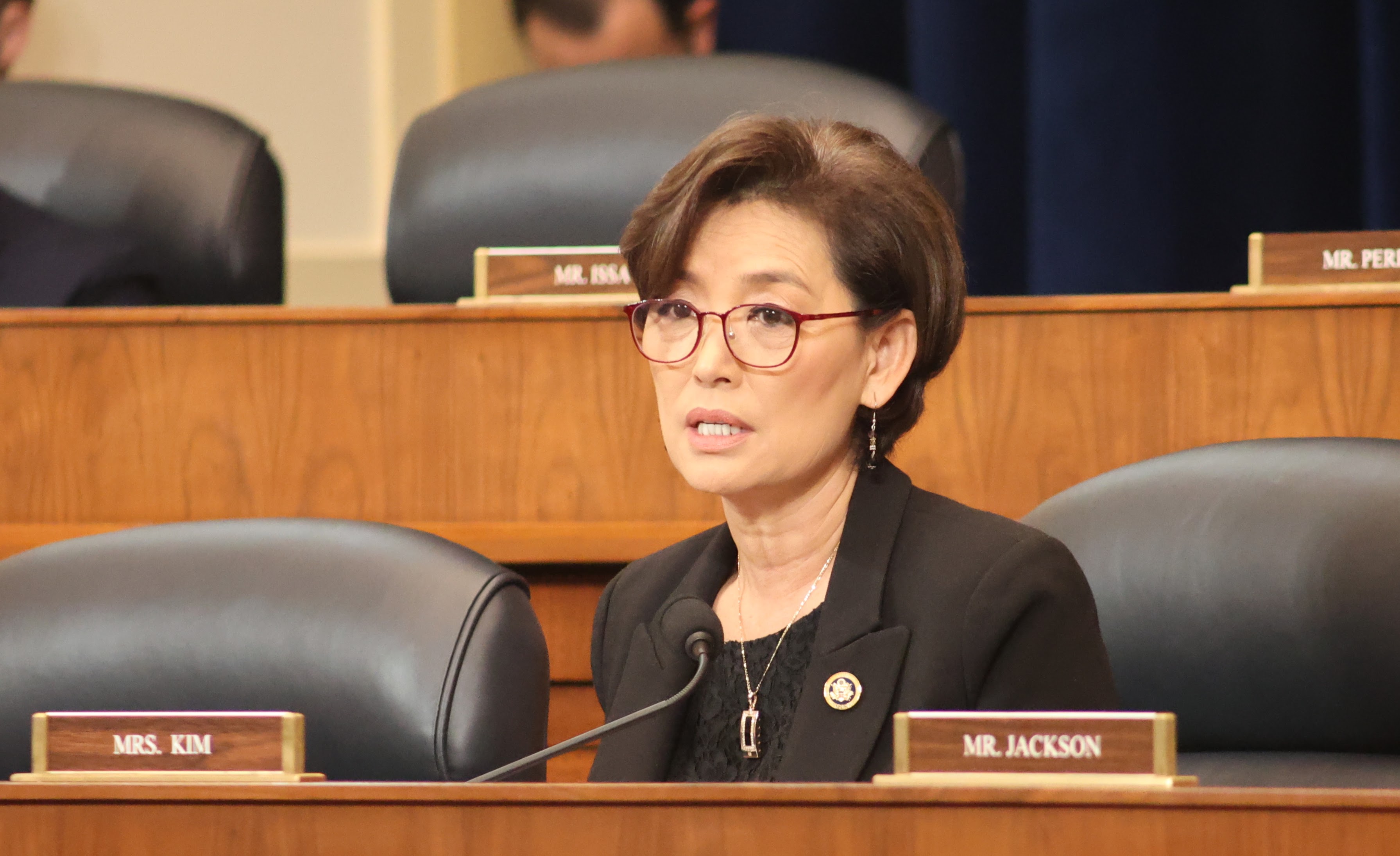

“The COVID-19 pandemic has left many small businesses struggling over the past year through no fault of their own. We must do everything in our power to provide our small businesses the resources and support they need to keep their doors open,” said Kim. “The 39th District is home to many small manufacturers that produce everything from the clothing we wear to the technology powering our lives, and these businesses are the source of thousands of good-paying jobs. I am proud to introduce these two important, bipartisan bills with my colleagues to improve the SBA’s 504 Loan Program and help our small businesses get the relief they deserve.”

“At a time when we need our economy “jump-started”, H.R. 1490 will aid in streaming the process for obtaining financial resources for small businesses as well as clean up outdated language currently in the process. We applaud Congresswoman Kim on addressing the needs of our small business community and more specifically, our local manufacturers,” said Heidi Gallegos, President and CEO, Brea Chamber of Commerce.

The bipartisan 504 Modernization and Small Manufacturer Enhancement Act improves the loan guaranty program and helps small manufactures access capital by streamlining the loan process and providing support to manufacturers who apply for the loan from local Small Business Administration (SBA) District Offices, among other provisions. Rep. Kim joined Reps. Angie Craig (MN-02), Steve Chabot (OH-01), and Sharice Davids (KS-03) in introducing this bill.

The bipartisan 504 Credit Risk Management Improvement Act clarifies provisions of the 504 loan program and the role of the Office of Credit Risk Management in the 504 loan program. The bill would make improvements to the overall oversight of the 504 loan program, making it more accessible and secure for small manufacturers to participate in. Together, these bills would make improvements to a program that promotes the economic development of small manufacturers, job creation and retention and expansion of small businesses through a three-part partnership.

Specifically, the 504 Modernization and Small Manufacturer Enhancement Act:

- Increases the maximum loan amount to $6.5 million for small manufacturers

- Requires SBA District Offices to partner with SBA Resource Partners to provide entrepreneurial development assistance to small manufacturers

- Decreases project costs for small manufacturers and adjusts the job creation/retention requirements for small manufacturers

- Adjusts building occupancy standards, collateral requirements, and debt refinance parameters for small manufacturers

- Streamlines numerous administrative processes associated with the 504 loan closing process by allowing accredited Certified Development Companies to perform numerous closing-related tasks, such as reducing project costs.