A bipartisan group of members from the SALT Caucus met today to talk strategy for the 2025 tax fight, according to multiple lawmakers at the meeting.

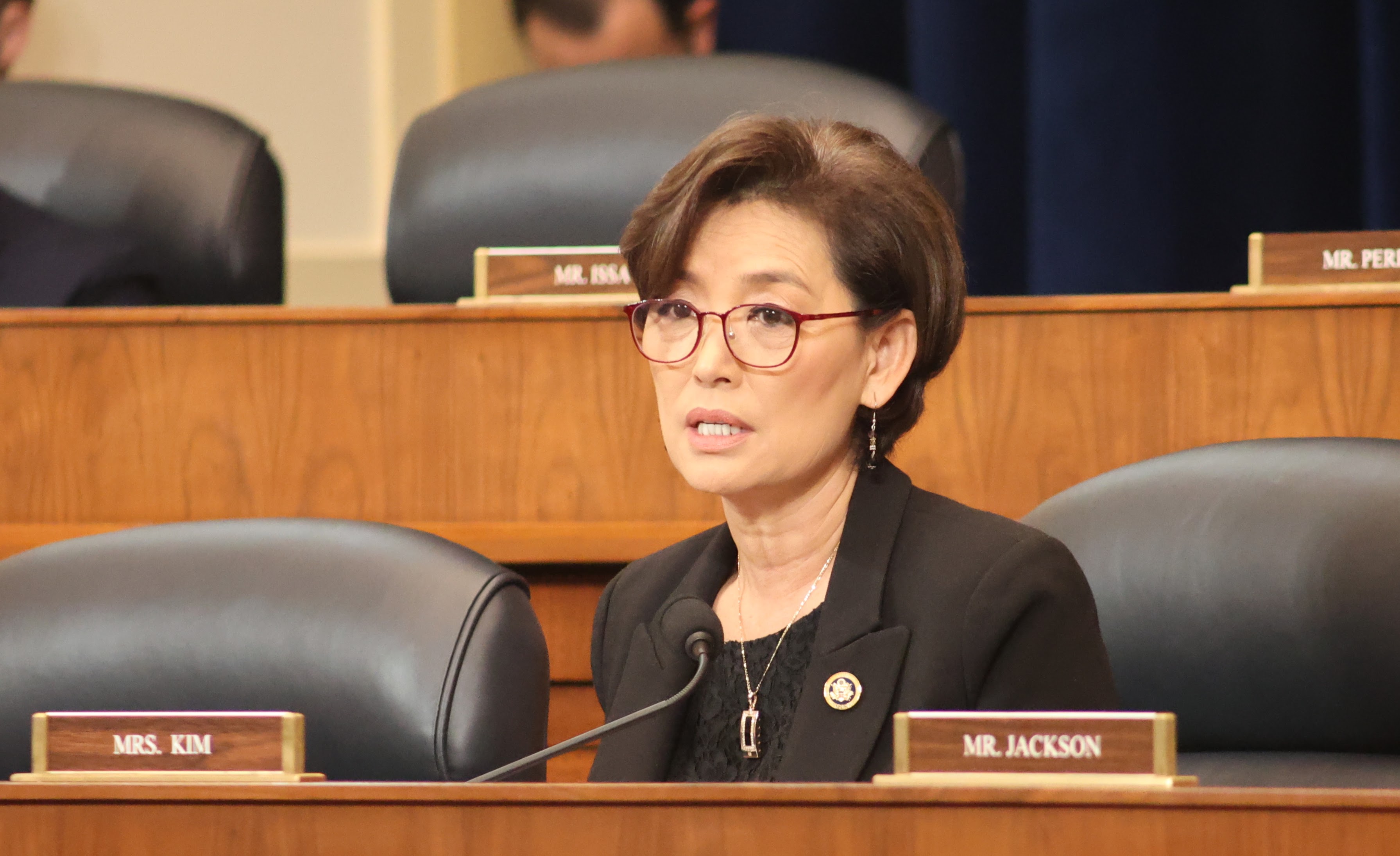

Attendees included Democratic Reps. Josh Gottheimer (N.J.) and Tom Suozzi (N.Y.), along with New York Republican Reps. Andrew Garbarino, Mike Lawler and Nick LaLota, plus California GOP Rep. Young Kim, according to a person familiar with the meeting.

Republicans created the current $10,000 cap on deducting state and local taxes in their 2017 tax law, generally known as the Trump tax cuts. But the SALT cap caused heartburn for lawmakers from high-tax blue states like New York, New Jersey and California. With the elections looming, some House Republicans made a push this year for SALT relief, though it fizzled fast.

The SALT cap expires at the end of next year with much of the rest of the 2017 law. Blue-state lawmakers are getting ready to battle against colleagues who will want to extend it.

Lawler told us he expects the group to have more meetings and conversations about strategy going forward. Here’s more:

“As it stands the cap expires in 2025, and that’s our position. So we certainly want to make sure that as the new tax bill is negotiated, our constituents are not penalized and not double-taxed. This is obviously going to be a big priority for all of us in the SALT Caucus in these negotiations next year.”

Suozzi said in a statement that restoring SALT will require “that we rebuild a nationwide coalition of Democrats and Republicans, mayors and other state and local officials, teachers and firefighters, realtors and homeowners.”

Kim said in a statement that lowering taxes for her constituents is a priority, “which is why I will continue to work with the bipartisan SALT Caucus and House leadership to find a solution as discussions begin for the 2025 tax package.”

House Ways and Means Committee Chair Jason Smith (R-Mo.) said he’s “never stopped” having conversations about handling SALT in 2025. Smith told us earlier this year that he doesn’t think either party can fully eliminate the SALT cap because higher-income households benefit from the deduction. Plus, it was a big pay-for in 2017.

– Laura Weiss