As small businesses struggle to stay afloat one year into the coronavirus pandemic, the federal Paycheck Protection Program — created to help keep employees on the job and doors open — is set to expire at the end of the month, cutting off access to funding. Now a bipartisan group of lawmakers is pushing to extend the deadline, potentially giving hard-hit businesses more time to get government aid heading into late spring and summer.

The legislation introduced in the House by a bipartisan group Thursday would extend the March 31 Paycheck Protection Program deadline by two months to May 31. It would also provide the Small Business Administration an additional 30 days through the end of June to process loans submitted by the new deadline.

“The demand for PPP loans right now is a testament to the program’s effectiveness and the lingering impacts of this pandemic,” said Representative Nydia Velazquez, one of the bill’s co-sponsors and the chairwoman of the House Committee on Small Business, in a statement. “That’s why we cannot cut off aid now and this short-term extension is so important.”

As of the end of last week, the Paycheck Protection Program has approved more than 7.5 million loans totaling more than $687 billion since it was created nearly a year ago as part of the first round of coronavirus relief. A second round of PPP funding was included in the December relief package.

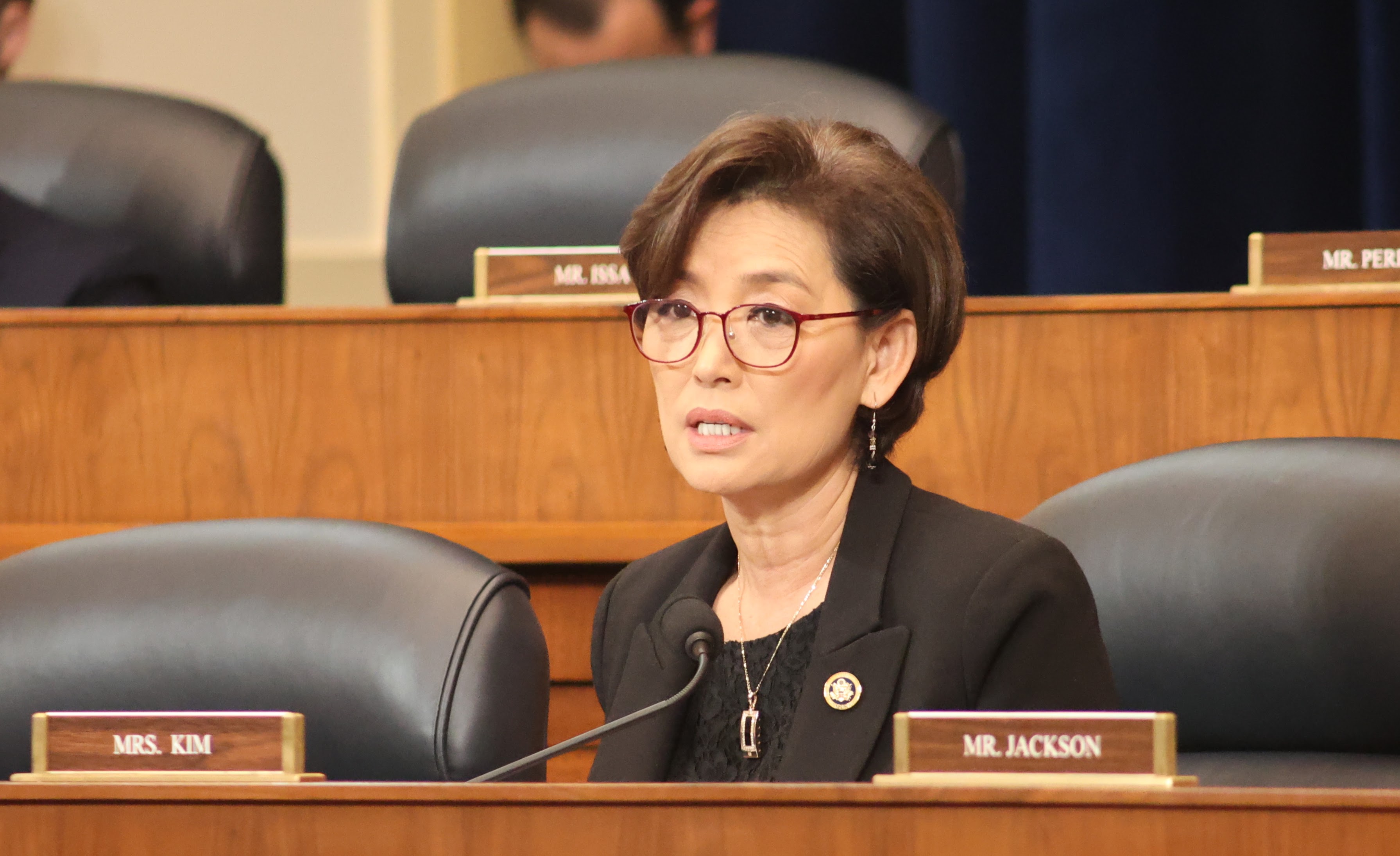

The support for the program’s extension — Velasquez, a Democrat from New York, was joined by the committee’s Ranking Member Blaine Luetkemeyer of Missouri and Representatives Young Kim, a Republican from California, and Carolyn Bourdeaux, a Democrat from Georgia — is a rare moment of bipartisanship after Democrats this week passed the latest coronavirus relief package this week along party lines. Mirroring legislation sponsored by Senators Susan Collins of Maine, a Republican, Ben Cardin, a Maryland Democrat, and Jeanne Shaheen, a Democrat from New Hampshire, was also introduced Thursday in the Senate.

“As America begins to open up for business and vaccines become more widely distributed across the country, we must provide targeted relief for small businesses that need it most,” said Luetkemeyer of the proposed extension in a statement.

While the program has been popular for helping businesses stay afloat amid the pandemic, critics have pointed to its challenges getting funds to smaller and minority-owned businesses. The program’s second round launched in January with a more targeted approach.

In late February, the Biden administration announced several additional changes to the program, including a 14-day window where only businesses with fewer than 20 employees could apply and a revised loan formula to help get more money to sole proprietors, independent contractors and self-employed people, among other measures.

Early indicators suggest the changes are working. As of the end of last week, Small Business Administration data shows average loans to minority-owned businesses were up 20% during the two-week exclusive window from the average over the previous 10 days, and loans to women owned businesses were up 14% and loans to small businesses in rural areas were up 12% over the same periods.

For all 2021 loans by the program, 73.5% are for $50,000 or less, 85% are for $100,000 or less and almost 91% are for $150,000 or less. The loans will be forgiven if businesses comply with requirements like keeping employees on the payroll and maintaining wages.

On March 10, the House Small Business Committee held a hearing on the next steps for the Paycheck Protection Program. During the hearing, lawmakers and witnesses raised concerns the Small Business Administration will stop processing loans at the end of the month, leading some lenders to stop accepting applications ahead of the deadline. This has prompted calls by some for the extension, including time for processing.