Today, Reps. Young Kim (CA-40), Mike Lawler (NY-17), and Joyce Beatty (OH-03) introduced the Community Investment and Prosperity Act to expand banks’ ability to make community investments that promote public welfare and local economic development.

Under current law, national banks and state member banks can invest up to 15% of their capital and surplus in projects that benefit the public good, such as affordable housing, small business lending, and community revitalization. The Community Investment and Prosperity Act would increase that cap to 20%, empowering banks to direct more private capital into projects that strengthen local economies and create opportunities for families and small businesses.

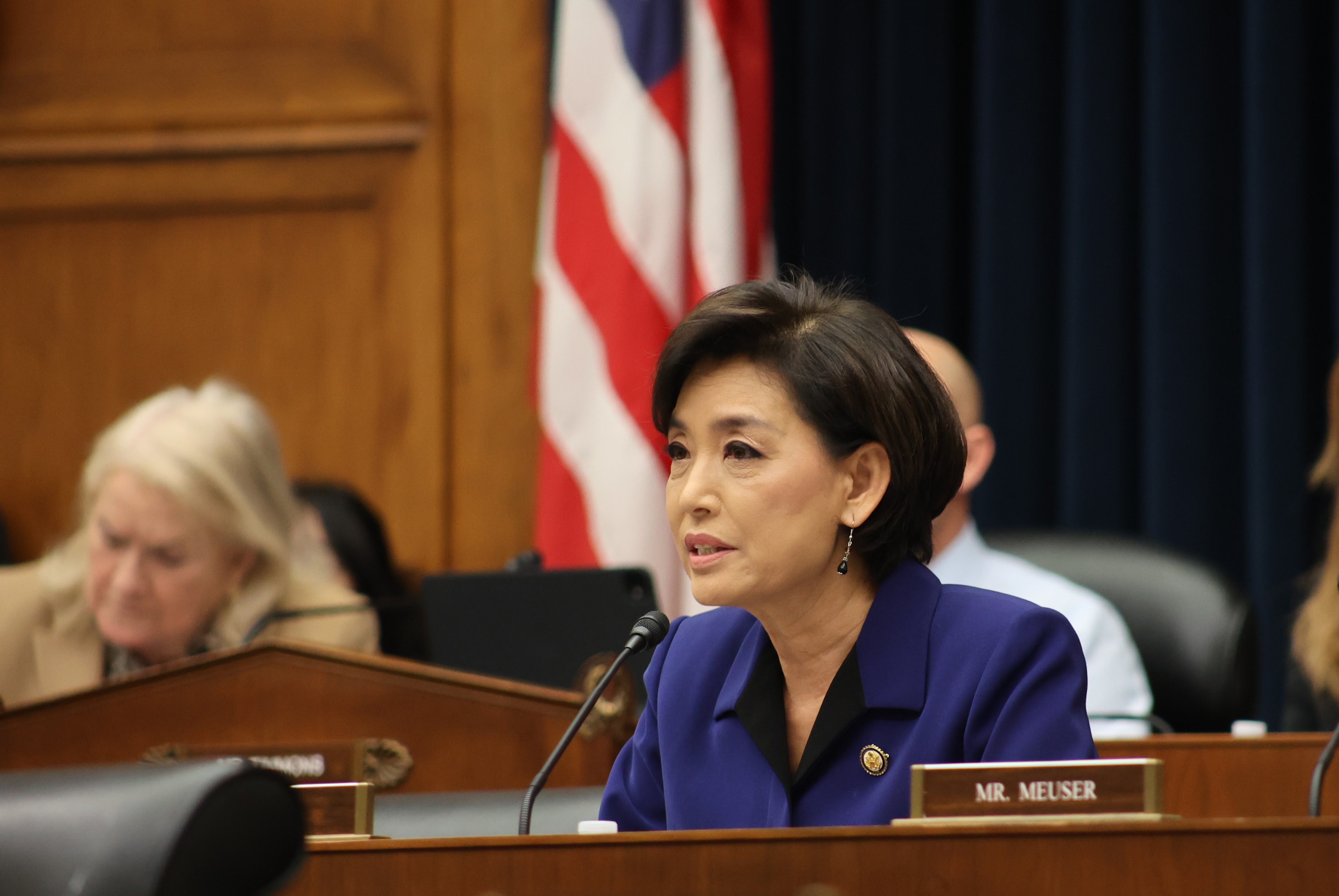

“When we give our banks the tools they need to invest in our communities, Main Street wins,” said Rep. Young Kim. “The Community Investment and Prosperity Act will help banks invest more in affordable housing and community development projects that create jobs and opportunity. I’m proud to join Rep. Lawler in leading this commonsense effort to strengthen our neighborhoods, empower community partners, and make the dream of homeownership more attainable for hardworking families.”

“Community investment is essential to revitalizing neighborhoods, expanding affordable housing, and supporting small businesses. By giving banks the flexibility to responsibly invest more in the communities they serve, this bill helps drive economic growth and improves quality of life, particularly in areas that need it most,” said Rep. Lawler.

“Families across America are facing a housing crisis that demands creative, bipartisan solutions,” said Rep. Beatty. “This commonsense legislation will free up capital for historic investments in affordable housing, small businesses, and community development, delivering results for hardworking families.”

“Banks are vital partners in building affordable housing and optimizing the Low-Income Housing Tax Credit and New Markets Tax Credit’s impact on communities through equity investments. Raising the amount of public welfare investments that banks regulated by the Office of the Comptroller of the Currency (OCC) and the Federal Reserve can make will mean more potential for investments in affordable housing and economic development,” said Sarah Brundage, President and CEO of the National Association of Affordable Housing Lenders. “We applaud Congressmembers Lawler and Kim for introducing this commonsense, no cost proposal and we strongly urge Congress to enact it immediately as part of a bipartisan housing package.”

“ABA applauds Reps. Lawler, Beatty and Kim for introducing the Community Investment and Prosperity Act, which amends the National Bank Act and Federal Reserve Act to increase the cap under which banks are allowed to make Public Welfare Investments. This important bipartisan legislation will make it easier for banks to make critical investments, including for Community Reinvestment Act purposes, in much-needed affordable housing, financial education and other critical community needs,” said Rob Nichols, President and CEO of the American Bankers Association.

“We appreciate the leadership of Congressman Lawler, Congresswoman Beatty and Congresswoman Kim that will expand needed investments in affordable housing and community development projects,” said Robert Likes, President, KeyBank Community Development Lending and Investment, Affordable Housing. “We are strong supporters of this bipartisan effort that will help neighborhoods across America grow and thrive, and make housing more affordable.”

This legislation was introduced as companion legislation to a bipartisan bill led by Chairman Tim Scott (R-SC) and Senator Blunt Rochester (D-DE) in the Senate, which was included in the ROAD to Housing package and has been endorsed by the American Banking Association, the Bank Policy Institute, Key Bank, the Affordable Housing Tax Credit Coalition, and the National Association of Affordable Housing Lenders.

Read full bill text HERE.