Today, U.S. Representatives Young Kim (CA-40) and Janelle Bynum (OR-06) introduced the bipartisan Credit Access and Inclusion Act to help Americans with little or no credit history more easily build and improve their credit scores.

Approximately 26 million Americans are considered “credit invisible,” or lack a history of traditional payments such as student loans, car loans, or mortgage payments. The Credit Access and Inclusion Act would allow hardworking Americans to build credit by expanding what counts toward their credit history, including rent, internet, phone, electricity, and utility payments.

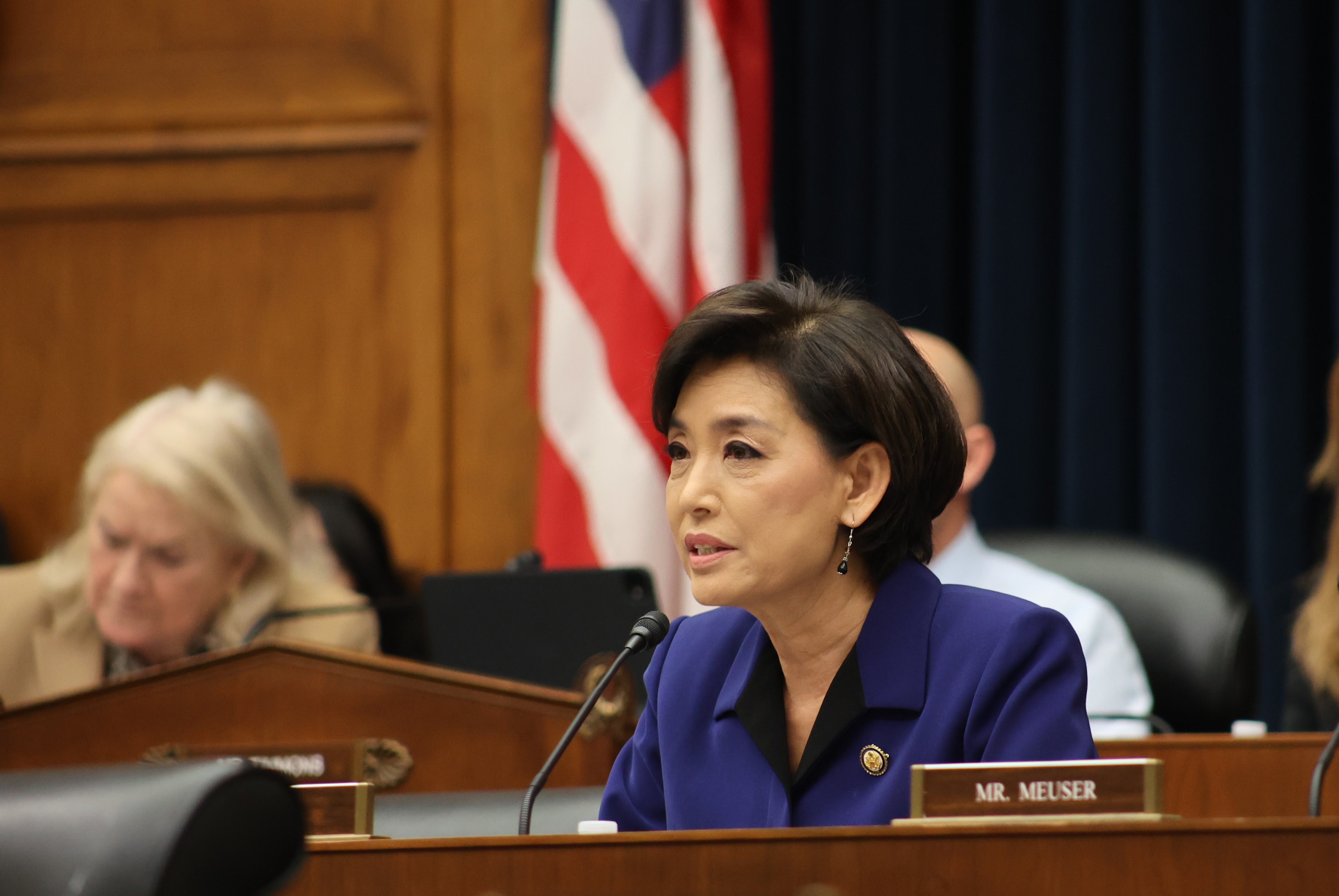

“Having good credit opens new doors for Americans. Unfortunately, our credit system has not kept up with technology, keeping Americans from building their credit score despite consistently practicing healthy financial behavior,” said Rep. Young Kim, co-chair of the House Financial Literacy and Wealth Creation Caucus. “The Credit Access and Inclusion Act brings credit reporting into the 21st century so hardworking Americans can grow their credit and get a leg up. I am proud to lead this commonsense bill with Rep. Bynum, and I will keep being a loud voice for access to opportunities that keep the American dream alive.”

“Every American should have the opportunity to participate in our economy – building credit plays a big role in making that happen,” said Rep. Bynum. “Everybody has to start somewhere, and making rent and utility payments on time should count. My bill makes it easier for people to build good credit when paying for their monthly expenses, and I’m proud of its bipartisan support. I’ll continue to work with anyone to make sure my constituents aren’t boxed out of the American dream.”

Specifically, the Credit Access and Inclusion Act would:

- Allow landlords, utilities, and telecom providers to report on-time payments to credit reporting agencies, helping consumers build and strengthen their credit.

- Protect consumers by allowing them to opt out of reporting these specific categories and ensuring utility companies cannot report late payments if the consumer is meeting the terms of a repayment or debt forgiveness program.

- Require a federal study on the impact of this expanded reporting and examine how additional data—such as cash flow and payroll deposit verification—could responsibly improve credit scores.

Read the bill HERE.