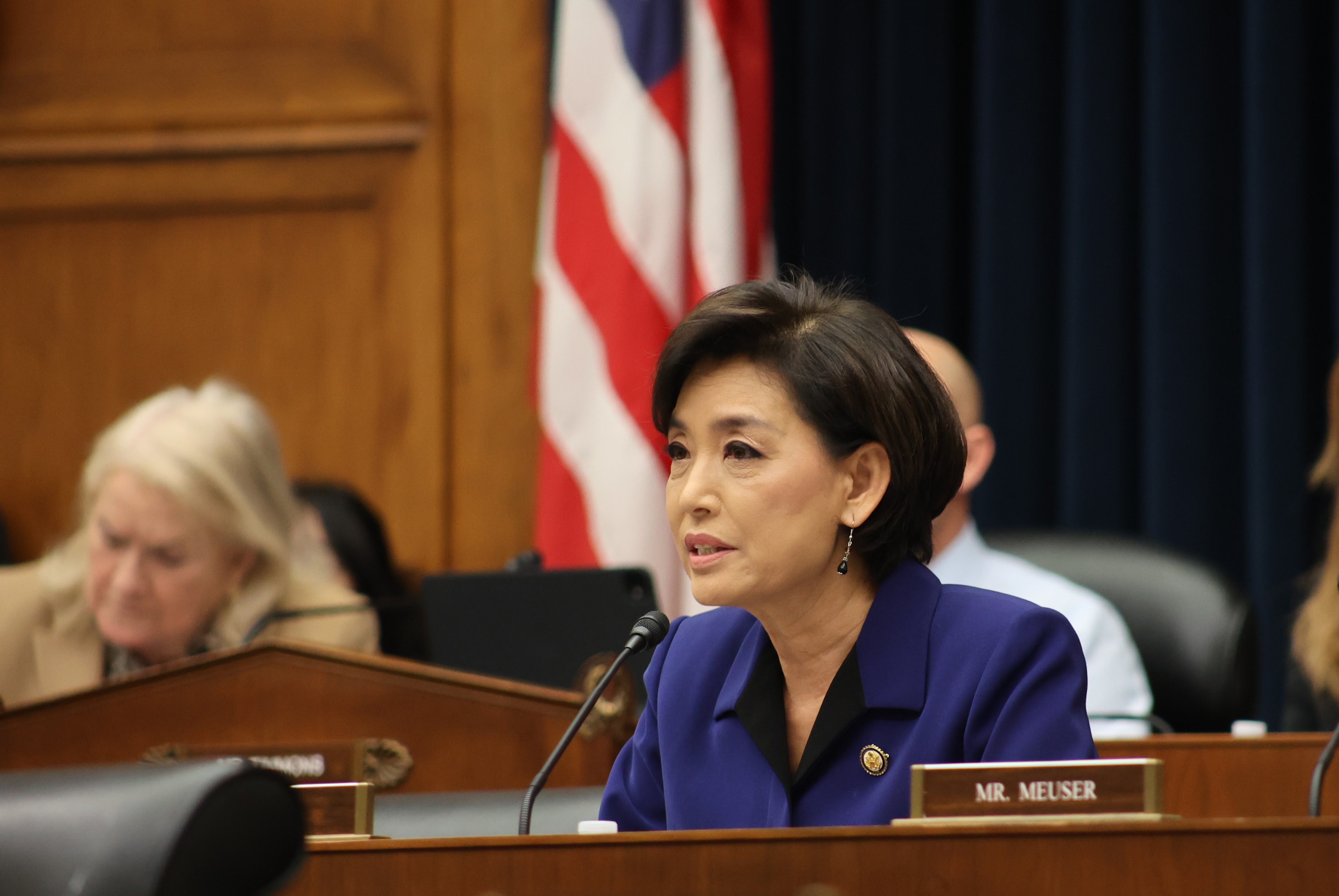

Today, U.S. Representative Young Kim (CA-40) introduced the Community Bank LIFT Act to reduce regulatory burdens on community banks and empower them to reinvest in small businesses and local communities.

This bill updates the Community Bank Leverage Ratio (CBLR) framework established under the Economic Growth, Regulatory Relief, and Consumer Protection Act by:

- Expanding the asset threshold for qualifying community banks from $10 billion to $15 billion.

- Adjusting the leverage ratio range from 8–10 percent down to 6–8 percent, giving regulators flexibility to calibrate the standard.

- Directing federal banking regulators to conduct a comprehensive review of the CBLR, including recommendations to make compliance simpler and more accessible, with a particular focus on smaller community banks.

“Community banks are the backbone of our neighborhoods across our Southern California. We should be uplifting them so that they can reinvest in small businesses, families, and local growth, instead of tying them up in red tape,” said Rep. Young Kim. “The Congressional Research Service estimated that even a one-point adjustment to the Community Bank Leverage Ratio could make 550 more banks nationwide eligible for relief—including eight right here in California. The Community Bank LIFT Act gives regulators the tools to make those reforms, so our banks can spend less time on compliance and more time serving our local communities.”

The bill requires the Federal Reserve, Office of the Comptroller of the Currency, and Federal Deposit Insurance Corporation to conduct a comprehensive review of the CBLR framework and report their findings and recommendations to Congress within 150 days, with final rules to be adopted within one year of enactment.

Read the bill HERE.