MSN United States

(Bloomberg) — President Donald Trump is growing frustrated with demands to significantly boost the cap on the state and local tax deduction, according to a senior administration official, signaling a deadlock as Republicans aim to quickly pass a giant tax-cut bill.

Trump told lawmakers in a meeting on Tuesday not to let the SALT deduction or differences over social safety-net cuts impede the measure. But afterward members of warring factions told reporters they were still dug in in opposing the bill unless their changes are made.

Trump urged Republicans from New York and other high-tax states to wait to try to raise the SALT limit further until after Congress is done with the tax legislation, the official said, a proposal that is likely to draw backlash from SALT lawmakers who see the president’s “one big, beautiful bill” as their sole shot to address a political priority that dates to 2017.

Still, Republican leaders are continuing negotiations with SALT advocates. Representative Nick LaLota emerged from House Speaker Mike Johnson’s office on Tuesday afternoon, saying they received an “improved offer.”

LaLota said House leaders’ plan was not yet acceptable, but was optimistic they could reach a deal by the end of the day. He didn’t disclose the details of the latest offer.

Trump told lawmakers in a closed-door meeting on Tuesday he wants to keep the SALT deduction limit at $30,000, the level in the draft legislation. That’s three times the current $10,000 cap.

Increasing the SALT cap beyond what’s in the bill would be more costly and risk angering ultraconservatives concerned about the size of the tax cuts.

House Freedom Caucus Chairman Andy Harris, a Maryland Republican, stormed out of Johnson’s office late Tuesday night, telling reporters not to follow him.

Axios reported late Tuesday that the tentative deal would raise the SALT deduction to $40,000 a year for people making as much as $500,000. The income phaseout would grow 1% a year over a decade, and then the deduction would become permanent, according to Axios.

Such an offer would quell some of the concerns of the SALT caucus, who rejected an earlier $40,000 cap that lasted only for four years. After four years, the limit would snap back to $30,000 with a $400,000 income limit.

SALT caucus members said they do not want a temporary increase and have said they want a doubled cap to avoid a marriage penalty on joint filers.

Trump in his meeting with House Republicans singled out members from New York, New Jersey and California who have rejected the $30,000 deduction limit, saying it is insufficient to win their votes.

“My middle class constituents should not be shut out of this process,” LaLota said.

Several SALT advocates have said they are willing to block Trump’s bill without a bigger deduction, and are unlikely to heed the president’s advice to address the issue later. Those lawmakers believe the tax reconciliation package is their only real opportunity to secure more SALT in the foreseeable future because they have negotiating leverage to hold up Trump’s top legislative priorities.

Trump botth as a presidential candidate and in the White House has pledged bigger SALT deductions, a policy reversal after his first-term tax cut legislation imposed the current $10,000 cap.

He is also losing patience with a faction of conservative hardliners pushing for deeper cuts to Medicaid health coverage for the poor and disabled, the official said. The president implored Republicans to stick together and pass the legislation, the official said, adding that Trump expects every Republican to vote for the bill on the floor.

During the meeting with House Republicans, the president spoke individually with holdouts both from high-tax states and conservative hardliners, said Representative Lauren Boebert of Colorado.

Yet ultraconservatives said they were no more swayed by Trump’s arguments than were SALT lawmakers.

“We aren’t doing enough on Medicaid,” Harris said after the meeting adding that that he would still oppose the tax bill as written.

The current version of the legislation places new work requirements on able-bodied adults and imposes fees for health care services on more Medicaid beneficiaries.

Representative Andy Biggs, a Republican hardliner from Arizona, said he was unmoved by calls to move quickly on the bill, saying he was more focused on the final product than the timeline.

SALT Negotiations

Johnson was positive about the chances for a deal. He still plans for the House to vote on the package by the end of the week.

“We’re going to get an agreement on everything necessary to get this over the line,” he said Tuesday.

Earlier: New Yorkers Vow to Block House GOP Tax Bill Over SALT Limit

Stephen Miran, who chairs the White House Council of Economic Advisors, said he was confident Trump would be able to quickly reach a deal on SALT with House Republicans.

“The president will deliver SALT relief to American households. I don’t know exactly what the number will shake out,” Miran told Bloomberg Television on Tuesday. “The president is one of the best negotiators in history and he’s shown over a career spanning decades that he can forge hundreds of deals and I think he’ll forge another one right in front of us now.”

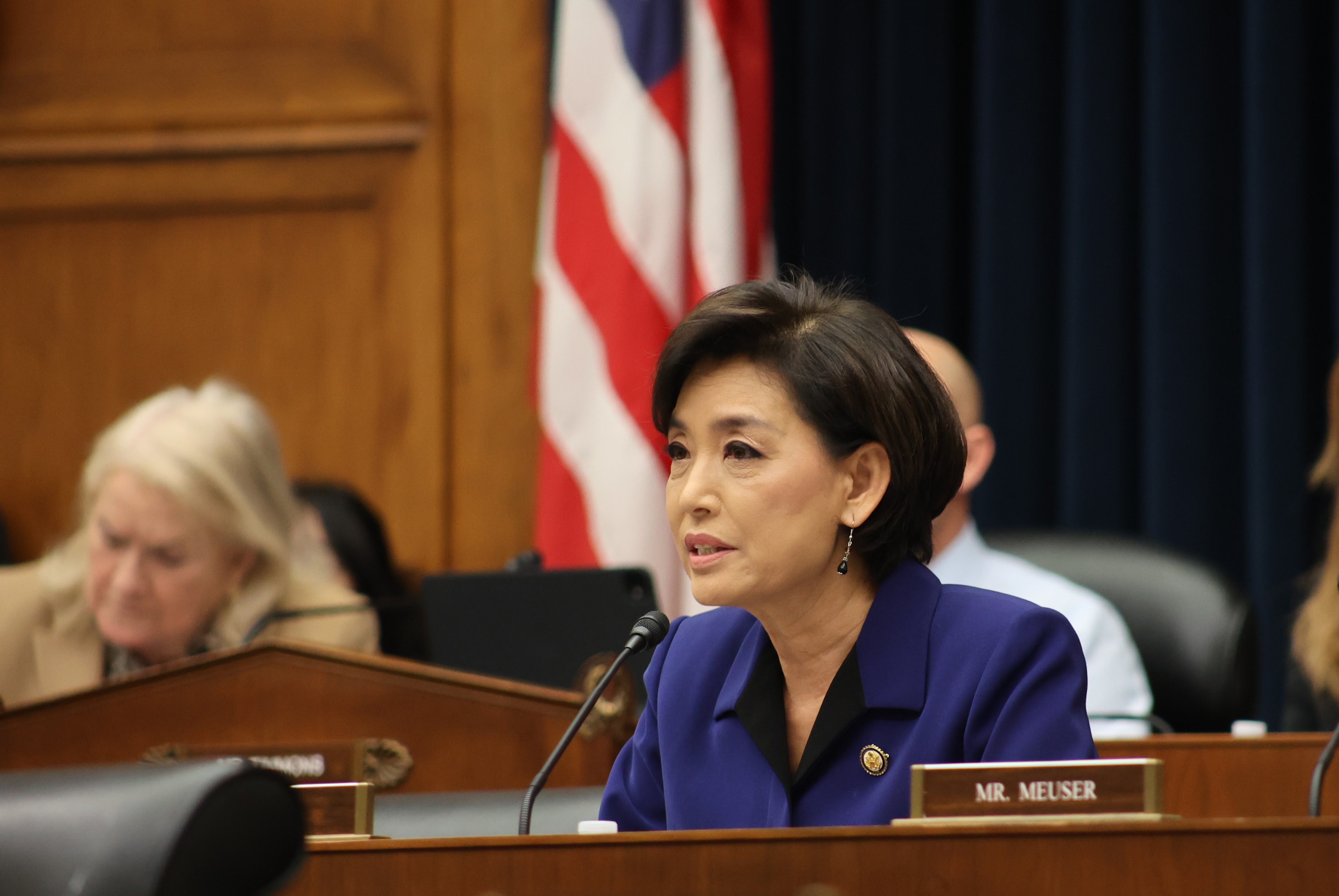

The holdout lawmakers — who also include New York’s Mike Lawler, Andrew Garbarino and Elise Stefanik, New Jersey’s Tom Kean and Young Kim of California — have threatened to reject any tax package that does not raise the SALT cap sufficiently.

Earlier: Trump Plans to Rally Fractious House Republicans on Tax Cuts

Republicans are trying to keep revenue losses from their tax-cut package down to a self-imposed limit of $4.5 trillion over 10 years. The current package has a $3.8-trillion revenue loss.

–With assistance from Nacha Cattan, Steven T. Dennis, Tyler Kendall, Jamie Tarabay, Jonathan Ferro, Ari Natter, Maeve Sheehey, Skylar Woodhouse and Jack Fitzpatrick.