KTLA – Some lawmakers are trying to crack down on what they call predatory “credit repair” schemes, when companies promise to improve your credit score but don’t deliver.

If you’ve ever gotten a call or seen ads online from a company promising to improve your credit score if you pay upfront, Andrew Pizor with the National Consumer Law Center says, “it’s almost always a waste of money.”

Pizor says so-called “credit repair” organizations can’t remove negative information, like a missed payment, from your credit report if it’s accurate.

“These companies can’t do anything to take it off no matter what they say,” Pizor said.

A new bipartisan bill is trying to prevent people from being exploited by those claims.

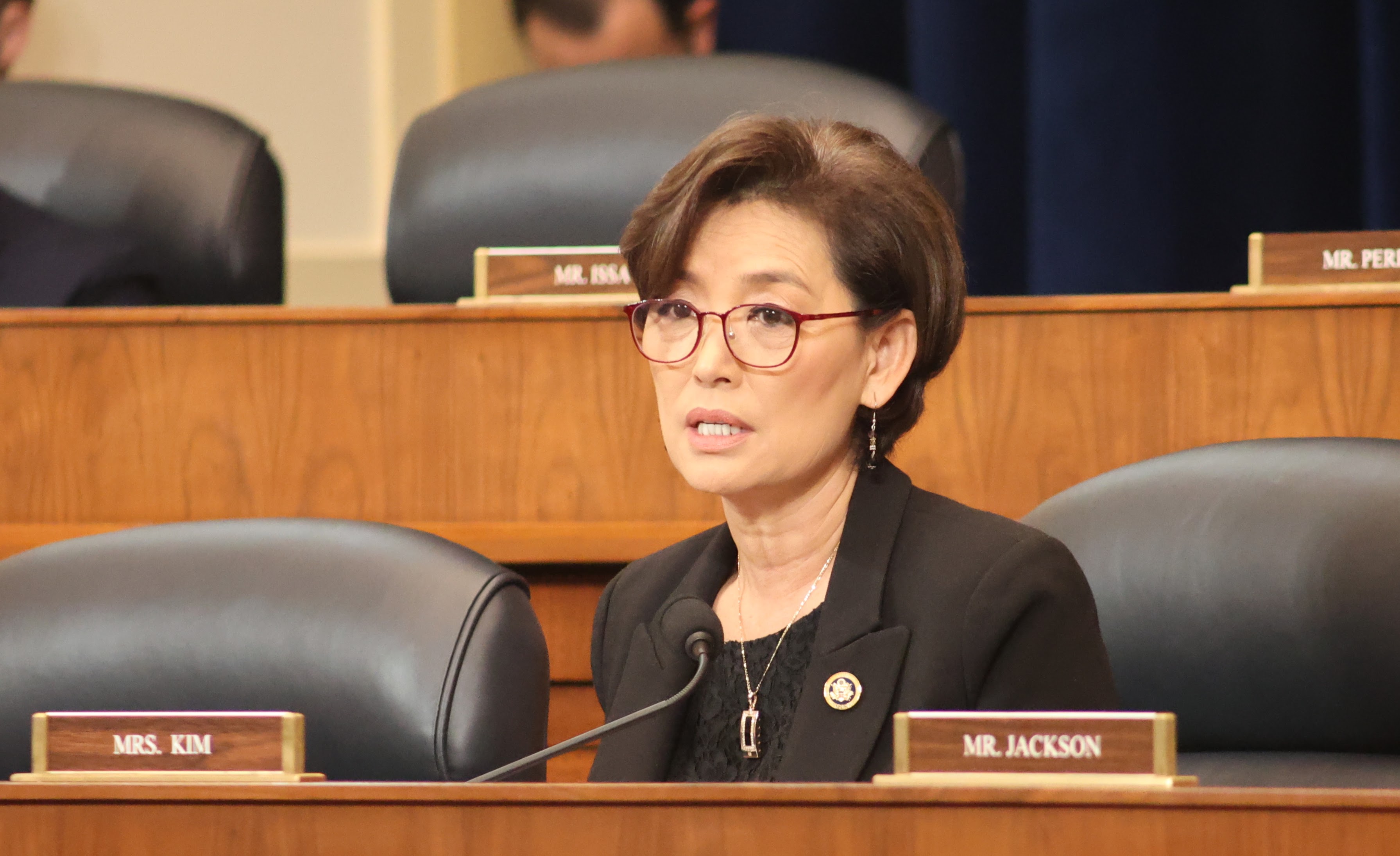

“We want to end those scammers who are preying upon those vulnerable Americans,” Rep. Young Kim (R-Calif.) said.

California Republican Congresswoman Young Kim and North Carolina Democratic Congressman Wiley Nickel introduced the “Ending Scam Credit Repair Act.”

“To make sure there is accountability and also transparency for consumers,” Kim said.

The bill bans upfront fees, increases civil penalties for violations and requires companies be licensed by the state they operate in.

In cases of real errors to credit reports or identity theft, Pizor says you can dispute the problem yourself or contact the Consumer Financial Protection Bureau for help.

After that, if the report is accurate, Pizor says “You should go to a nonprofit credit counselor. They can help people with building their credit in legitimate ways.”

Kim says she and Nickel are working to gain co-sponsors and hope to see the bill pass the House when Congress returns.