Washington, DC – Today, U.S. Representatives Young Kim (CA-40) and Wiley Nickel (NC-13) introduced the Ending Scam Credit Repair Act (ESCRA) to combat fraudulent practices in the credit repair industry. The bill targets credit repair organizations (CROs) that exploit consumers by charging high fees without delivering on promises to improve credit scores. By strengthening CROs regulations, the bill will ensure transparency and accountability in the industry.

The bipartisan Ending Scam Credit Repair Act empowers consumers by ensuring that CROs only receive payment after delivering documented improvements to credit reports, while increasing civil penalties for violations.

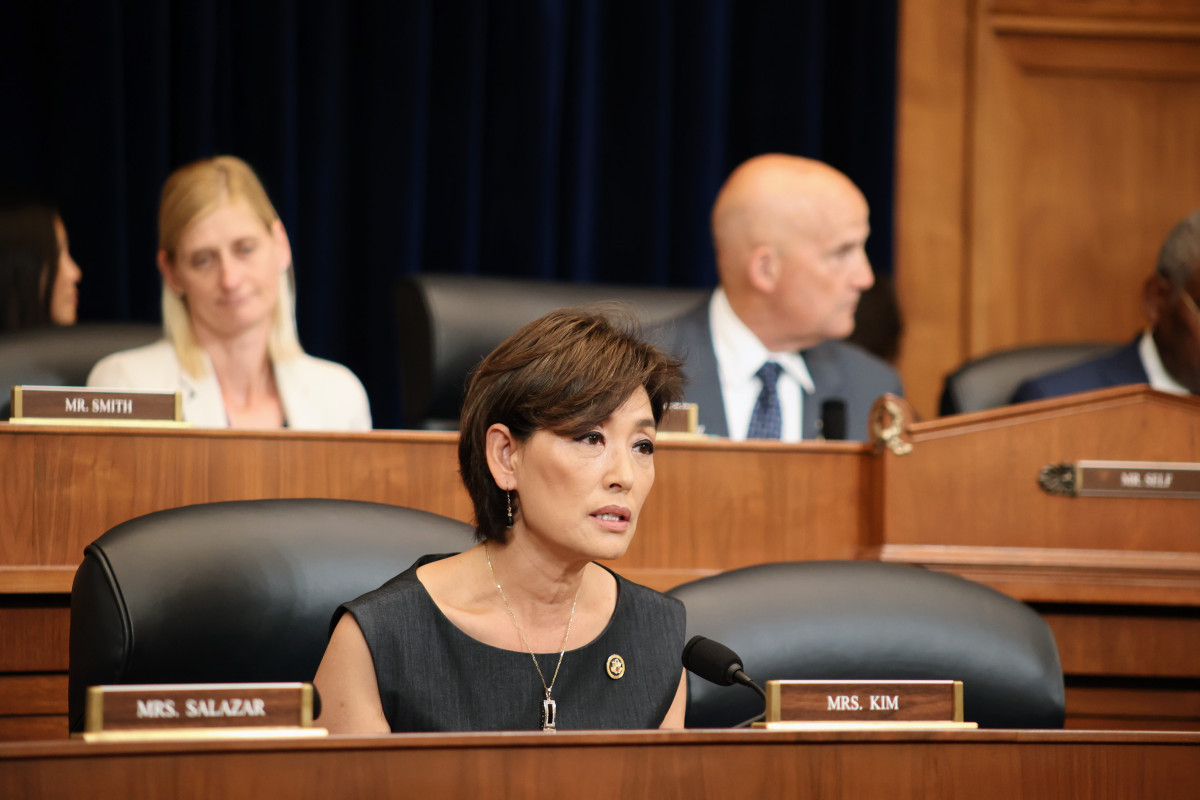

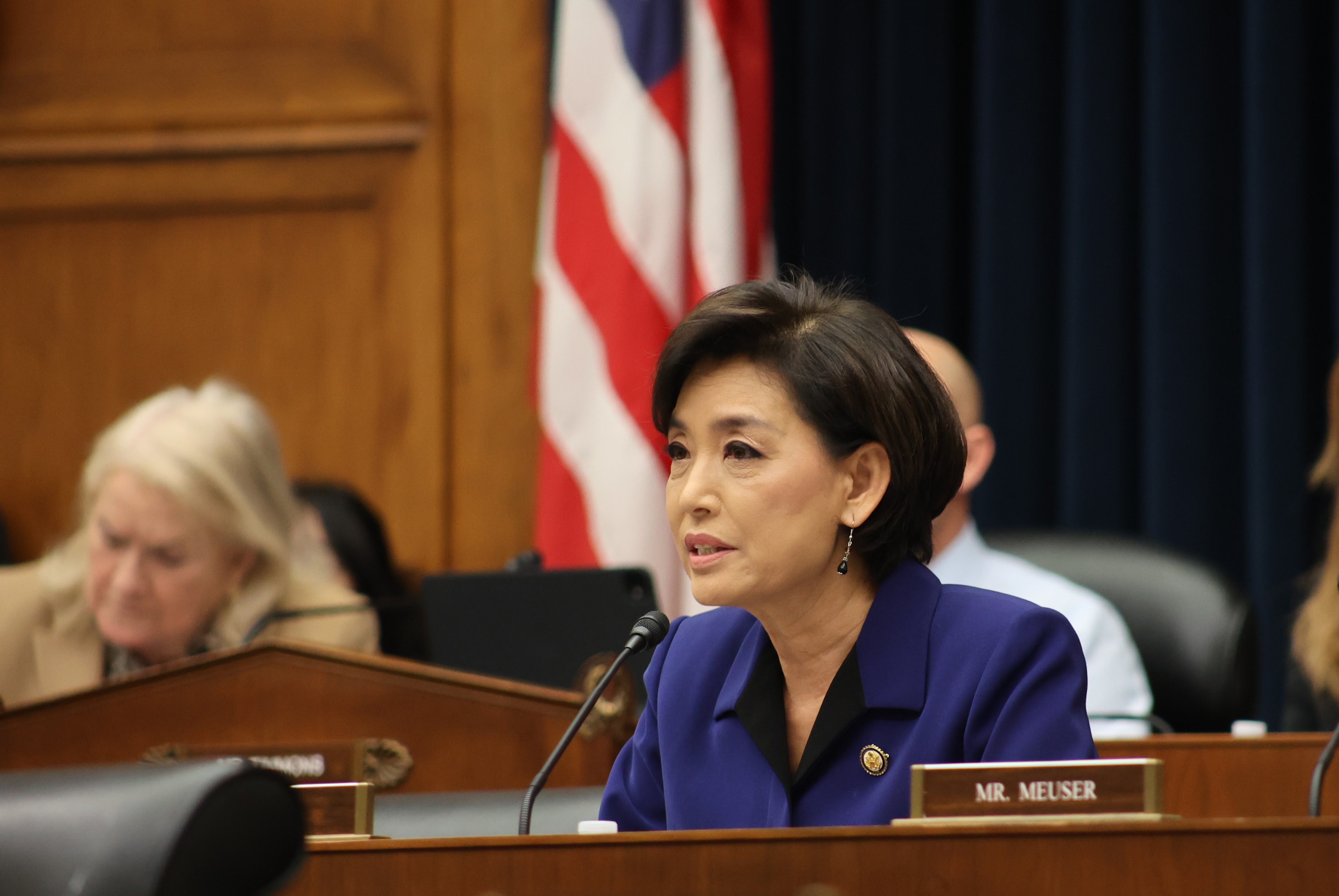

“Credit scores can be the key to unlocking the American dream. Fraudulent CROs should not get away with scamming hardworking Americans seeking to improve their scores,” said Congresswoman Young Kim. “The Ending Scam Credit Repair Act creates accountability and transparency for consumers and hikes penalties for scammers. I’m thrilled to introduce the bipartisan Ending Scam Credit Repair Act and will continue to work on commonsense solutions to protect the American dream.”

“Too many hard-working Americans have been scammed by bad actors in the credit repair industry,” said Congressman Wiley Nickel. “Our bill puts a stop to these deceptive practices by banning upfront fees, improving dispute transparency, and requiring state registration. Consumers deserve real results, not empty promises and financial loss.”

“Financial-services companies and consumer advocacy groups are grateful for congressional action on behalf of consumers, having seen first-hand the real harm credit repair organizations cause consumers, often charging hundreds of dollars a month, but yielding few if any positive results,” said Bill Himpler, President and CEO, American Financial Services Association (AFSA).

“Paying for credit repair is almost always a waste of money,” said Andrew Pizor, senior attorney, National Consumer Law Center (NCLC). “The amendment from Representatives Nickel and Kim will help ensure consumers are not prey to credit repair scams and that they don’t get charged unless they get the results they are paying for.”

Edward Boltz, Legislative Chair of the National Association of Consumer Bankruptcy Attorneys (NACBA), whose members represent people in and after bankruptcy, agreed that the “Ending Credit Repair Scams Act” will stop credit repair jamming schemes which mislead consumers by holding themselves out as “lawyers,” but “will also now make it clear that honest attorneys can provide advice and assistance to those who need real help with credit report errors.”

Read the full bill text HERE.