- Many people affected by the SALT deduction cap, including in California, are middle-class workers.

- Trump has recently proposed ending taxes on Social Security, tips and overtime for certain workers.

Days after mingling with wealthy donors in Beverly Hills and the Bay Area, former President Trump said that if he is reelected, he would reinstate a tax break that benefits residents of high-tax states such as California.

A cap on the federal tax deduction for state and local taxes, or SALT, was a controversial part of Trump’s 2017 tax overhaul in states with high taxes and property values, such as California, New Jersey and New York, where the former president is scheduled to rally supporters on Wednesday.

“I will turn it around, get SALT back, lower your Taxes, and so much more,” Trump wrote Tuesday on Truth Social, his social media platform. “I’ll work with the Democrat Governor and Mayor, and make sure the funding is there to bring New York back to levels [it] hasn’t seen for 50 years.”

Eliminating the cap is one of several tax proposals the former president had made recently, including not taxing Social Security, tips and overtime income for certain workers.

The SALT proposal is unlikely to dramatically change presidential votes in the largely Democratic states most affected by the $10,000 deduction cap, but it could be a factor in critical congressional races in places such as Orange County and Long Island that will determine which party controls the House of Representatives.“Donald Trump took away your SALT [deductions] and hurt so many Long Island families,” Senate Majority Leader Charles E. Schumer (D-N.Y.) wrote in response to Trump’s post on X. “Now, he’s coming to Long Island to pretend he supports SALT. It won’t work.”

Eliminating the cap also would likely please the former president’s donors. On Sept. 12, Trump headlined an evening fundraiser in Beverly Hills where the top tickets cost $250,000 per person.

Trump’s 2017 tax law slashed corporate taxes and reduced personal rates, while capping the deductions for state and local tax deductions, which were previously unlimited. It immediately prompted controversy in swaths of the country with high property values, and created strange bedfellows among Republican and Democratic lawmakers from these states.

Nearly two-thirds of the benefit from repealing the cap would go to the top 1% of taxpayers, according to an analysis by the left-leaning Institute on Taxation and Economic Policy.

Still, many people affected by the cap, including in California, are middle-class workers. In 2015, more than 6 million Californians filed for the deduction, reducing their federal taxable income by an average of $18,438, according to the Urban-Brookings Tax Policy Center.

The SALT cap is “a legislative middle finger to the middle-class families in our community,” Rep. Mike Garcia (R-Santa Clarita) said at an August town hall in his district. “It’s penalizing blue states, which I live in.”

Garcia’s race against Democrat George Whitesides to represent northern Los Angeles County will be crucial in determining whether Republicans maintain their narrow majority in the House.

Whitesides said on his campaign website that he supports expanding the SALT deduction.

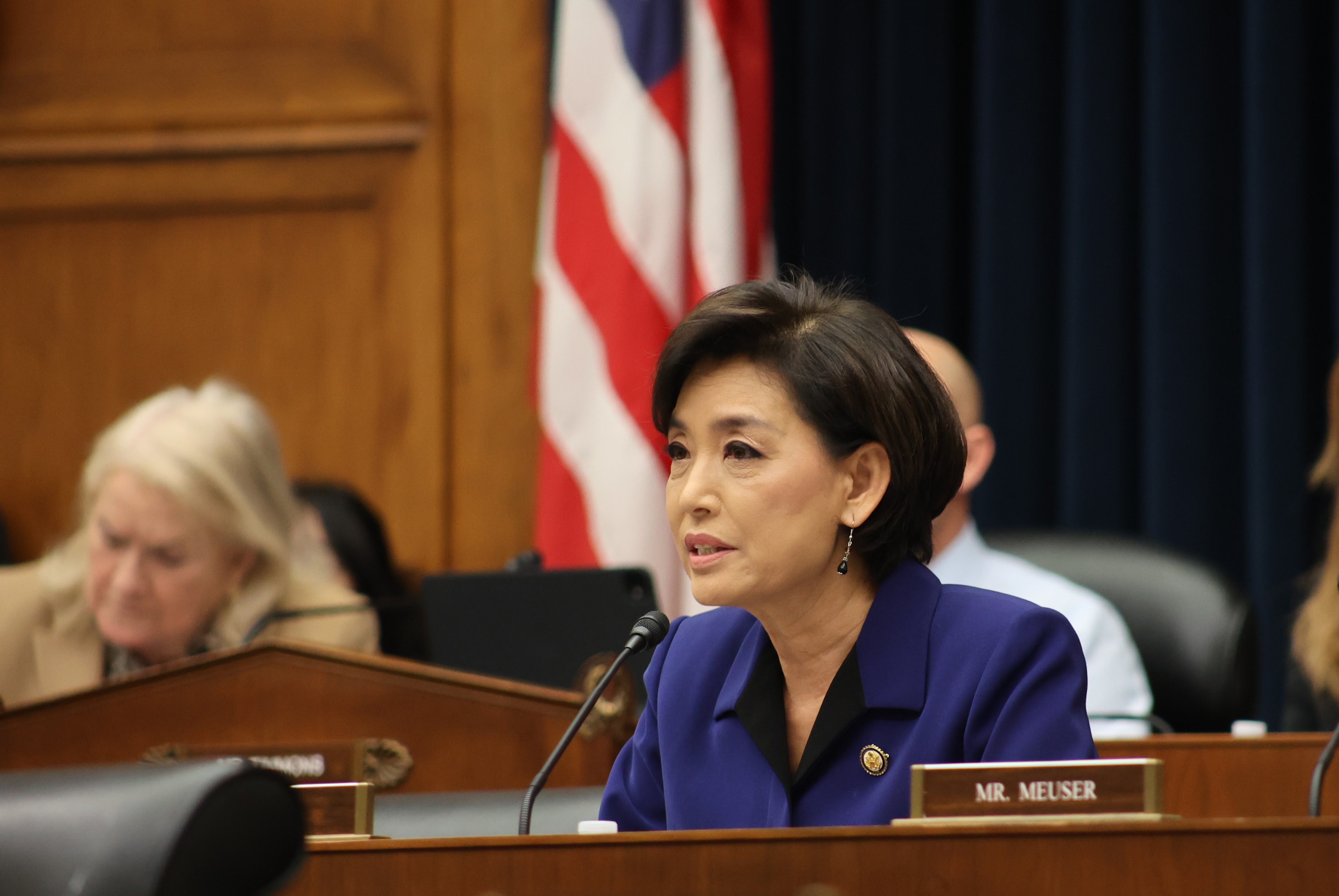

For years, Garcia has said that repealing the deduction cap is one of his top priorities. He is vice chair of the House’s SALT Caucus, a bipartisan group opposed to the cap. Other California members include Reps. Young Kim (R-Anaheim Hills), Anna Eshoo (D-Menlo Park), Katie Porter (D-Irvine), Jimmy Panetta (D-Carmel Valley Village), Julia Brownley (D-Westlake Village), Judy Chu (D-Monterey Park), Ted Lieu (D-Torrance), Jimmy Gomez (D-Los Angeles) and Michelle Steel (R-Seal Beach).

Garcia praised Trump’s 2017 tax overhaul, saying it was a “pro-growth bill” that benefited families. But he said the cap on state and local tax deductions “sucked for us as Californians and New Yorkers,” even though it was put in place “to pay for some of those things.”

In 2021 and 2023, Garcia introduced the SALT Fairness Act, which sought to eliminate the cap entirely. Neither version made it out of the House Ways and Means Committee. Panetta and Steel co-sponsored the legislation in 2021.

Trump has flirted with doing away with the cap before, noted Rep. Josh Gottheimer (D-New Jersey).“President Trump gutted SALT and raised taxes on hardworking middle class Jersey families,” Gottheimer posted Tuesday on X. “Now he wants to fix the problem he caused? And without any specifics? Sounds like the arsonist volunteering at the fire department.”