Consumer Financial Protection Bureau Director Rohit Chopra answered questions from members of the House Financial Services Committee during a four-hour hearing last Thursday.

The U.S. House of Representatives is controlled by Republicans, and the committee is chaired by Republican Congress member Patrick McHenry (R-NC).

The hearing, titled “The Semi-Annual Report of the Bureau of Consumer Financial Protection,” ranged in tone from heated back-and-forth exchanges with Republicans, to praise and support from Democrats.

Chopra’s testimony last week followed the CFPB fending off an existential challenge to its existence last month when the Supreme Court upheld the bureau’s funding structure by a 7-2 vote.

At the beginning of his testimony, Chopra touted some of the CFPB’s historical and recent accomplishments.

“Since its creation, the CFPB has returned $20.7 billion to consumers,” he said, adding, “we are currently on track to save people $20 billion in junk fees every year.”

Here are six takeaways from the marathon hearing.

Medical credit card debt to be listed on credit reports

The CFPB proposed regulations last Tuesday that would erase medical debt from Americans’ credit reports, with the potential to raise the credit scores of those affected by an average of 20 points. But that relief would not extend to medical credit cards, Chopra clarified in exchanges with Congress members Blaine Luetkemeyer (R-MO) and Rashida Tlaib (D-MI).

“Medical credit cards are [a] fairly more advanced innovation of recent years,” Chopra told Luetkemeyer. “We have been studying this market because it’s been growing quite quickly and it has been a source of some significant consumer complaints. We have not taken any sort of specific action on it,” he said.

Republicans concerned about fraud prevention

Congress members Andy Barr (R-KY) and Mike Flood (R-NE) raised the issue of growing fraud costs, with Barr noting it is a “major risk” to the financial system and saying that regulations such as the recent credit card late fee cap would decrease the ability of financial institutions to protect consumers.

“Your junk fee agenda is going to limit [financial institutions’] ability to prevent fraud,” Barr told Chopra.

Flood cited estimates from the Federal Trade Commission that U.S. consumers “reported losing more than $10 billion for fraud in 2023.”

He also asked Chopra to commit to an open banking policy that would “not discourage industry efforts to build critical tools to detect and prevent fraud,” a goal with which Chopra agreed.

”I’m totally aligned with that goal,” Chopra told Flood. “We are working to make sure that we can implement the rules to promote competition [and] protect data, but also to make sure that we are deterring, detecting and stopping fraud.”

Republicans concerned about fraud prevention

Congress members Andy Barr (R-KY) and Mike Flood (R-NE) raised the issue of growing fraud costs, with Barr noting it is a “major risk” to the financial system and saying that regulations such as the recent credit card late fee cap would decrease the ability of financial institutions to protect consumers.

“Your junk fee agenda is going to limit [financial institutions’] ability to prevent fraud,” Barr told Chopra.

Flood cited estimates from the Federal Trade Commission that U.S. consumers “reported losing more than $10 billion for fraud in 2023.”

He also asked Chopra to commit to an open banking policy that would “not discourage industry efforts to build critical tools to detect and prevent fraud,” a goal with which Chopra agreed.

”I’m totally aligned with that goal,” Chopra told Flood. “We are working to make sure that we can implement the rules to promote competition [and] protect data, but also to make sure that we are deterring, detecting and stopping fraud.”

Chopra explains immigration status context for credit card applications

Republicans knock buy now, pay later being treated as credit

The CFPB issued an interpretive rule last month that said consumers should expect the same protections from the buy now, pay later industry that they are granted when using credit cards.

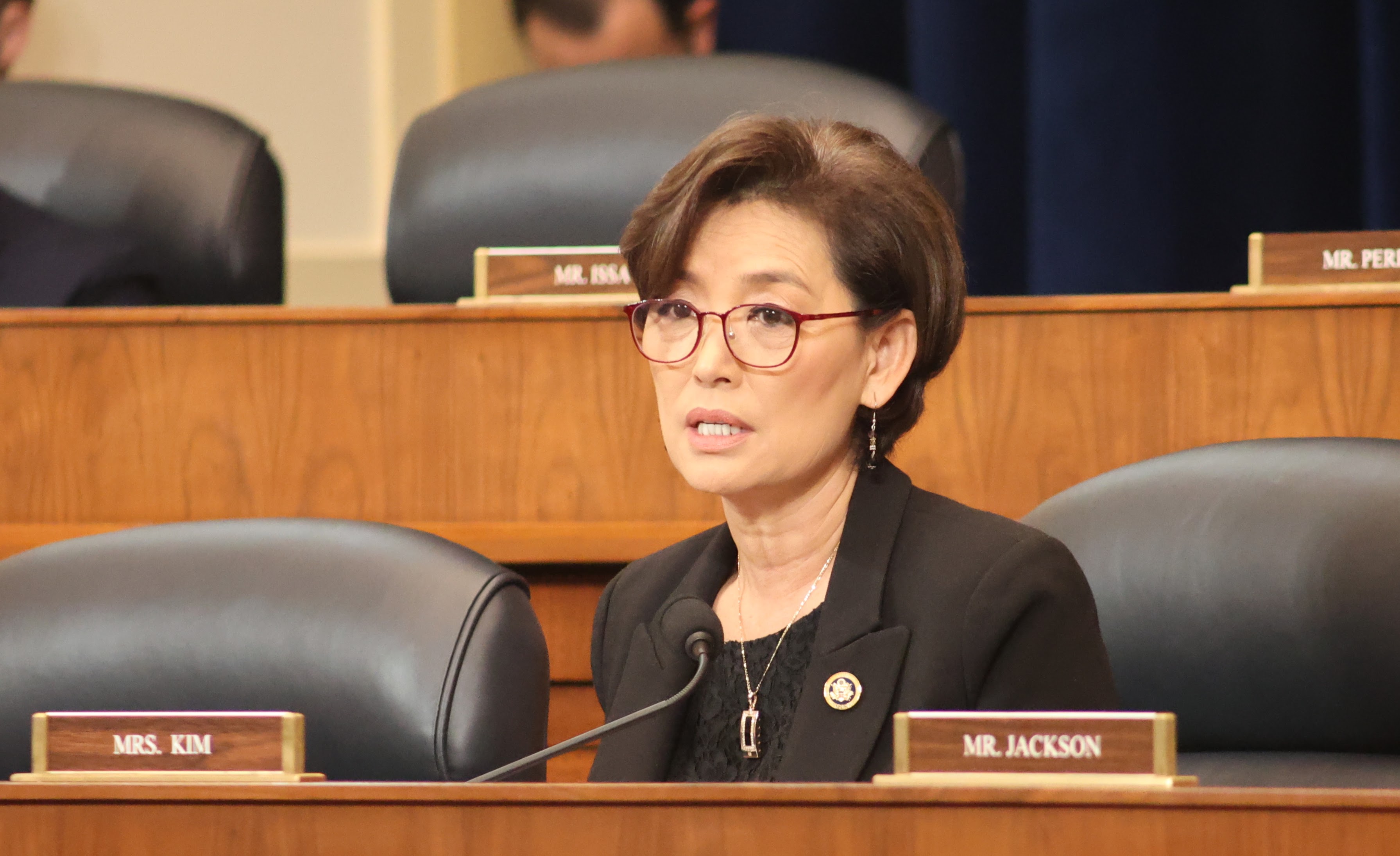

Congress members Young Kim (R-CA) and Byron Donalds (R-FL) both questioned the bureau’s decision to regulate the industry in this way, with Kim saying the CFPB was “effectuating a substantial policy change through interpretation or enforcement.”

Chopra acknowledged differences between credit cards and BNPL loans, saying “a lot of the things that apply to credit cards do not apply to [BNPL] right now. But there [are] some pieces of it as it relates to billing statements, dispute scenarios that did apply, and we wanted to make sure that there was some consistency around that.”

Democrats want more legislation, regulations around remittances

The bureau raised concerns about false advertising and hidden fees in remittances in March, as part of its campaign against junk fees. Congress members Gacia and Juan Vargas (D-CA) asked Chopra to speak more about the issue.

“I do think there’s a lot of hidden fees there,” said Vargas. “I know we’ve been working with it, but we need to do more.”

Chopra agreed with Vargas that “we need much… cheaper and faster and safer remittances,” adding that “this is also an important national security issue as well.”

Republicans agree with CFPB on data privacy concerns

One area of common ground between Republicans and Chopra was data privacy. McHenry asked Chopra about the Graham-Leach-Bliley Act and and Warren Davidson (R-OH) talked about legislation he was developing called the Payment Privacy Act.

Davidson thanked Chopra for his work on privacy issues and told the Director he had “really been encouraged by your commitment to privacy and I hope that we can make that truly bipartisan.”

“We’re working on the Payment Privacy Act,” Davidson said. “It’s very complimentary to the 1033 process that you’ve been undertaking and I appreciate your collaboration and feedback on that.”