Washington, DC – Today, U.S. Representative Young Kim (CA-40) introduced the Small Dollar Loan Certainty Act to strengthen access to capital for consumers and small businesses.

In May 2020, federal agencies issued guidance for responsible small-dollar loans, allowing banks and credit unions to offer automated small loans and create responsible lending principles. The Small Dollar Loan Certainty Act aims to put this guidance into law to provide certainty to the small-dollar market and protect consumers.

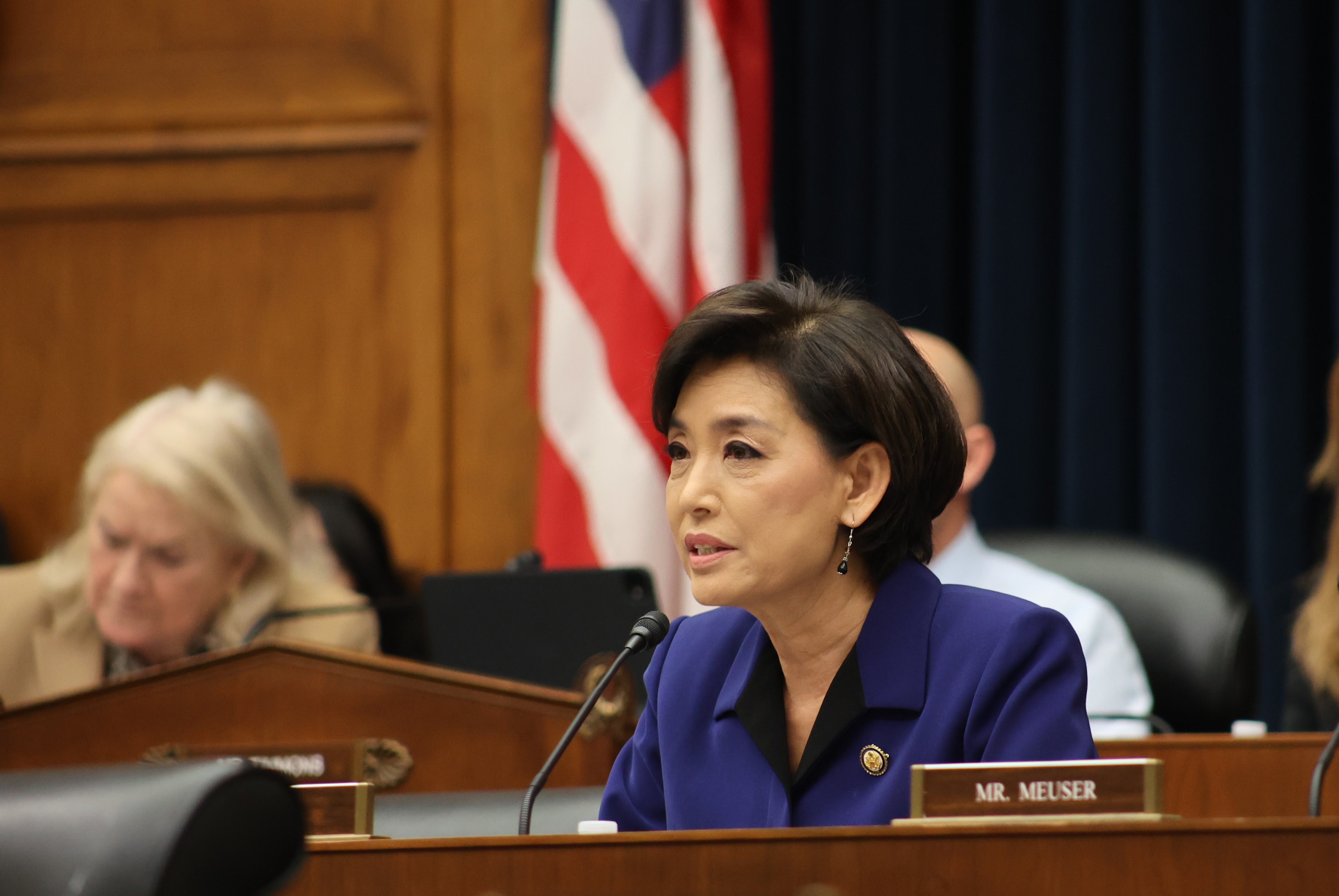

“Policies from Congress should make life easier for Americans, not harder. The Small Dollar Loan Certainty Act will provide clear principles for financial institutions providing small-dollar loans and ensure working Americans can access the capital they need,” said Rep. Young Kim. “I am committed to doing my part on the Financial Services Committee to reduce regulatory costs, defend consumer rights, and protect the American dream for future generations.”

The Small Dollar Loan Certainty Act amends the Truth in Lending Act to allow covered entities – insured depository institutions or Federal credit unions – to offer small-dollar credit products to consumers by:

- Establishing requirements for providing small-dollar installment loans and lines of credit;

- Compelling the use of a robust underwriting process to determine creditworthiness;

- Requiring funds to be distributed to consumers within five days of approval;

- Banning fees against consumers associated with a small-dollar credit product; and,

- Creating a safe harbor for covered entities that comply with this bill.

Read the bill HERE.