Financial illiteracy is a longstanding problem in America that spans social economic status and race. In the 21st century, financial education should be considered incomplete if digital assets are omitted from initiatives, grants and syllabi. Particularly, given that communities of color, the working class, and young people are the earliest and largest holders of cryptocurrencies.

April is National Financial Literacy Month, which is observed by most of the regulatory agencies with oversight over digital assets. The emerging innovation economy must surely compel government to adopt a new approach to fiscal education to better prepare the public for the future of money and commerce.

Let’s look at what is being planned in Washington

The Financial Literacy and Education Commission, based at the Department of Treasury’s Office of Consumer Policy, is the nerve center of federal activities every April. It’s comprised of 24 agencies, including the Consumer Financial Protection Bureau, Commodity Futures Trading Commission, Securities and Exchange Commission, Office of the Comptroller of the Currency, White House Domestic Policy Council, and others. The Commission created a subgroup on digital asset financial education in 2022.

FLEC’s next public meeting is April 10 at 1PM ET.

Congressional Fair

This issue is also a priority for the legislative branch.

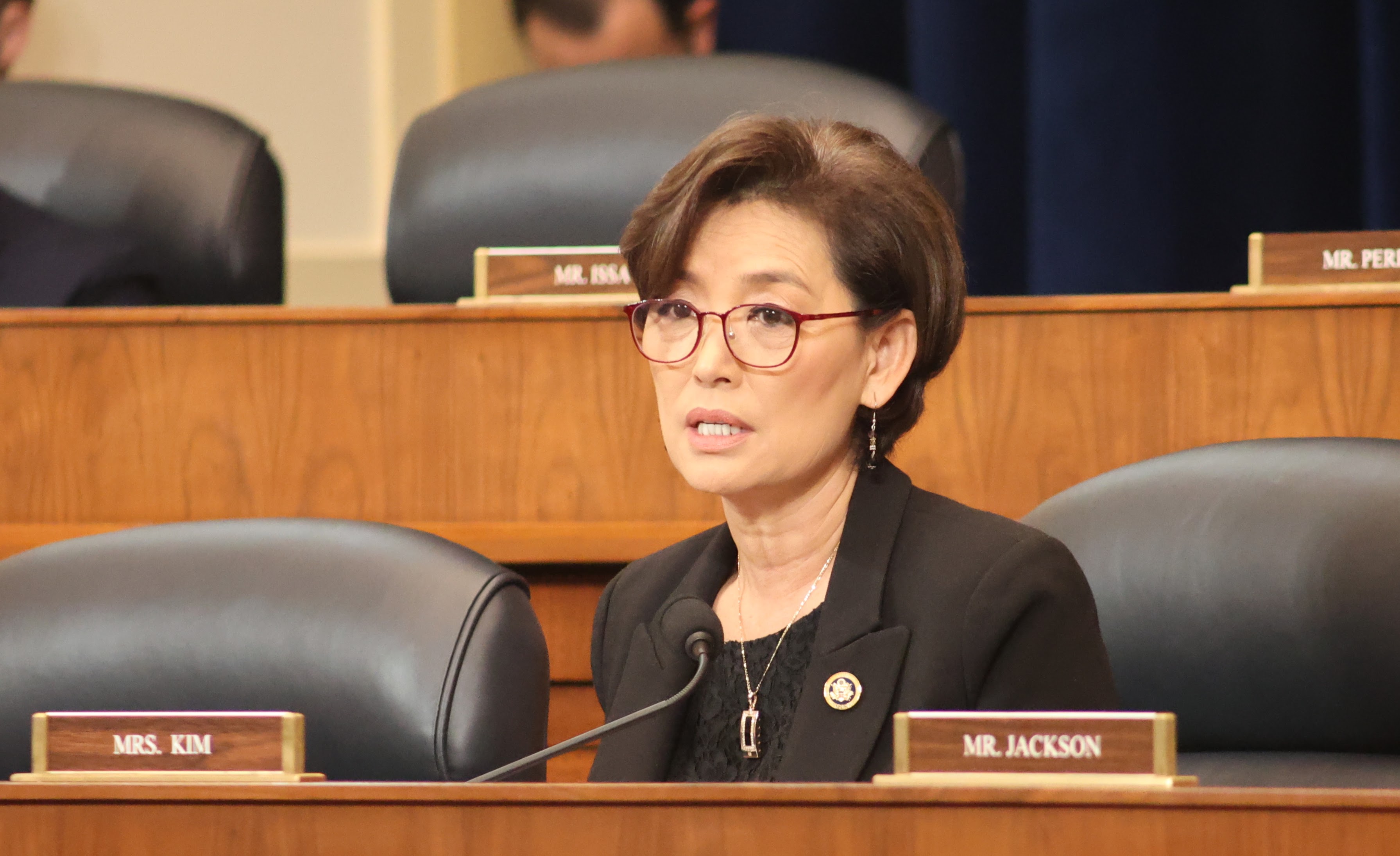

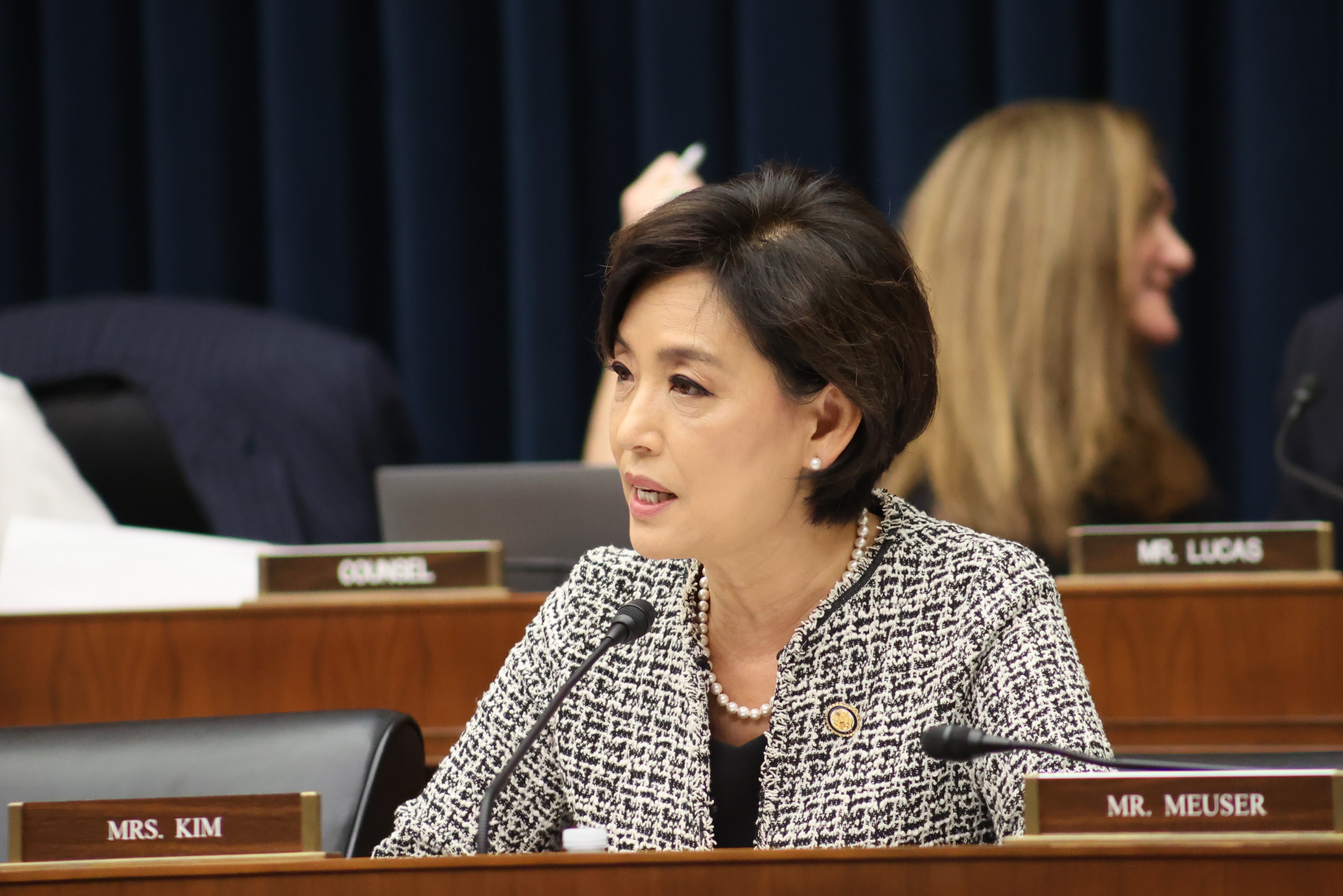

U.S. Representatives Joyce Beatty (OH-3) and Young Kim (CA-40) last year launched the Financial Literacy and Wealth Creation Caucus, which has decentralized finance among its target topics. The bipartisan group is hosting a resource fair on April 18 to commemorate the annual milestone. But for the Co-Chairs, tackling this issue extends beyond just one month. At a recent POLITICO event in March, here’s how they described financial literacy.

“It transcends any politics,” Congresswoman Kim said. “All Americans should be aware of finances, so they can take better control of their future and live the American dream.”

“It starts with redirecting and making people think about how they can learn more about, become educated on financial literacy,” Congresswoman Beatty said. “It is more than just saying save dollars or make an investment.

Web3 Education

Advocacy groups across the country also have activities planned. And Web3 and DeFi companies are injecting digital assets in the financial literacy narrative.

Hedera HBAR 0.0% is kicking off a regional Education Learning Briefing Series to focus on responsible innovation on Capitol Hill on April 30, which will include local forums in Columbus, OH; Anaheim, CA; and Boston, MA.