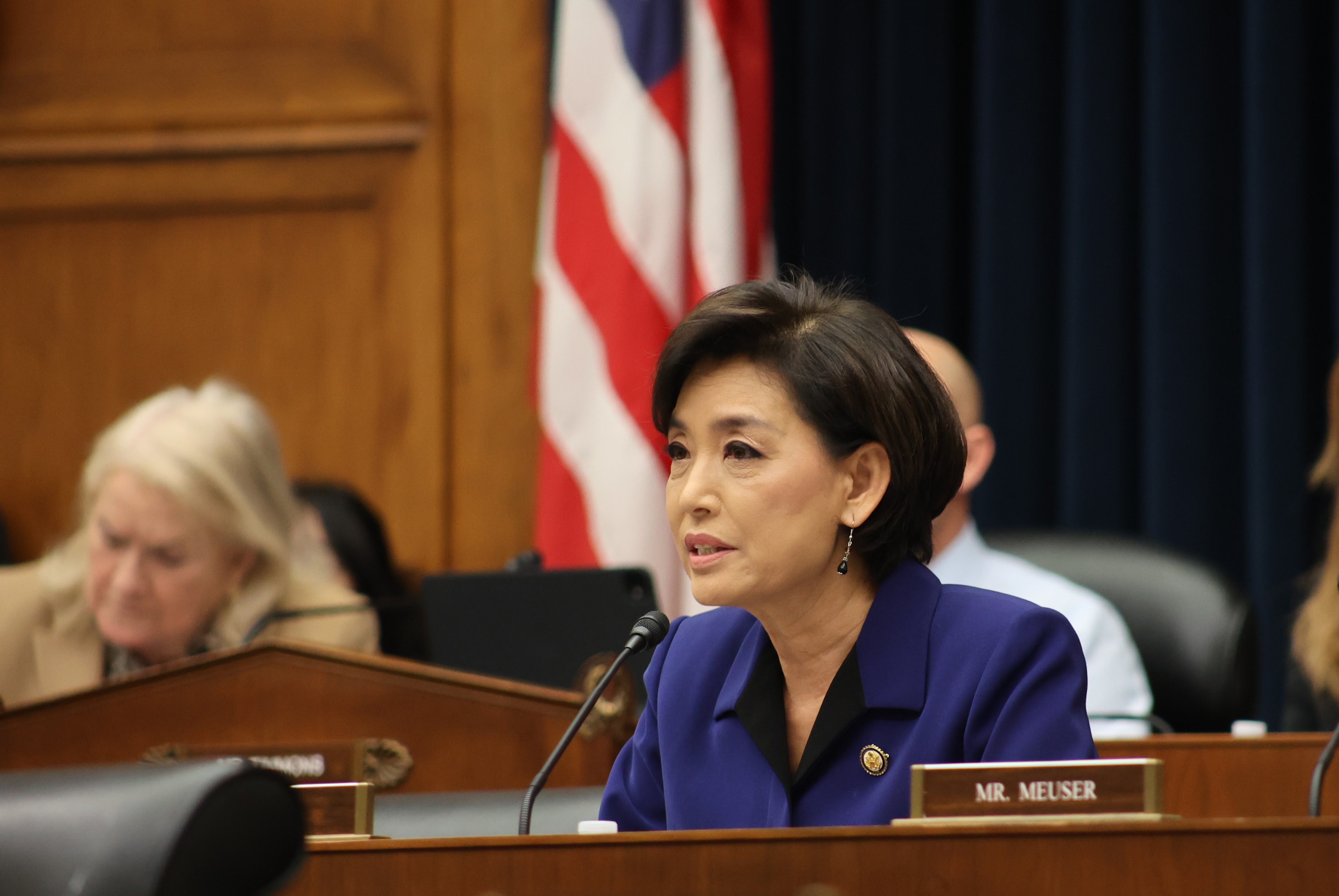

Washington, DC – Today, U.S. Representative Young Kim (CA-40) voted in support of the Tax Relief for American Families and Workers Act of 2024 (H.R. 7024), a bipartisan and bicameral package that aims to make life more affordable for families, support small businesses, and create new jobs and opportunities to the U.S.

The Tax Relief for American Families and Workers Act:

- Expands the child tax credit;

- Boosts allowances for research and development;

- Allows businesses to deduct interest payments;

- Increases tax relief provisions for losses due to natural disasters and wildfires;

- Strengthens the low-income housing tax credit; and,

- Removes the double tax on residents of Taiwan with income from U.S. sources.

“Californians are struggling to make ends meet due to persistent inflation and rising living costs made worse by tax-and-spend sprees by the Biden administration and Sacramento’s supermajority. I’ll always support initiatives to make life more affordable for my constituents, and this bipartisan, commonsense tax package helps do that,” said Rep. Kim. “The Tax Relief for American Families and Workers Act expands the child tax credit to help families get by and boosts research and development opportunities to support American small businesses and manufacturers, create more U.S. jobs, and boost our nation’s competitiveness. It’s a win-win for our economy and national security. I am glad to support this bill as I continue to fight for a solution to repeal the cap on state and local tax deductions burdening my constituents.”