The House Financial Services Committee voted on Tuesday to advance a raft of nearly a dozen bills cracking down on Iran and otherwise addressing the situation in the Middle East, including new sanctions and other new regulations, with around half of the bills receiving unanimous support.

The committee meeting was geared in large part at responding to the Oct. 7 Hamas attack on Israel and Iran’s role in supporting Hamas.

“Today our committee will stand with our Israeli allies as we work to further isolate Iran and its proxies from the global financial system… I would concur that the administration has done an admirable task of rising to this occasion,” Chairman Patrick McHenry (R-NC) said in his opening statement. “The legislation we’ll consider today builds on these ongoing efforts.”

The “Iran-China Energy Sanctions Act,” led by Reps. Mike Lawler (R-NY), Josh Gottheimer (D-NJ), Byron Donalds (R-FL) and Barry Loudermilk (R-GA) would place sanctions on all Chinese financial institutions that engage in transactions with sanctioned Iranian financial institutions relating to the oil trade. Lawler said the legislation takes particular aim at small oil refineries inside China. The bill advanced with unanimous support.

“These banks will have to force the [Chinese oil refineries] to deal with the exit of the Iranian oil trade or risk losing their access to the US dollar,” Lawler explained. “We have to force China’s own banks to cut them off.”

The “Stopping Illicit Oil Shipments Act of 2023” introduced by Rep. Maxine Waters (D-CA) would seek to crack down on so-called ghost ships, which change their country of origin and other identifiers in transit — a technique frequently used by Iranian oil tankers and others under sanctions. The bill specifically targets insurance for ship and port owners. It would also seek to set up a whistleblower program to support sanctions investigations. The committee voted unanimously for the bill.

“This bill effectively holds ports and the companies that service these vessels accountable, directing U.S. insurance companies to cancel their insurance coverage if a ‘ghost ship’ docks,” Waters explained.

The “Iran Sanctions Accountability Act of 2023” led by Rep. Blaine Luetkemeyer (R-MO) would require the administration to issue specific regulations to ensure that humanitarian exemptions on Iran sanctions are not used in furtherance of malign activities. This issue has been a key area of concern relating to the recent $6 billion hostage deal with Iran. It would also direct the administration to oppose funding to the Iranian government through the World Bank. It passed unanimously.

“My legislation today would help ensure that future humanitarian assistance to Iran, whether it relates to the $6 billion in Qatar or not, is subject to appropriate due diligence,” Luetkemeyer said.

Waters, the ranking member, said she and other Democrats could support the bill because it did not eliminate humanitarian waivers as other legislation considered during the meeting would.

Reps. French Hill (R-AR) and Juan Vargas (D-CA) led the “Holding Iranian Leaders Accountable Act of 2023,” which would require reports to Congress and to the public on the assets of top Iranian officials and leaders of Iranian proxy groups. The committee approved the bill unanimously.

“It’s long overdue for Iranian civilians who suffer under this regime to see exactly how their rulers live,” Hill said.

The “OFAC Licensure for Investigators Act” by Rep. Joyce Beatty (D-OH) would launch a pilot program allowing private-sector firms to conduct small financial transactions, under law enforcement supervision, with sanctioned entities to help advance investigations. The committee unanimously approved the bill.

Beatty said the bill “seeks to enhance the tools at our disposal to investigate sanctioned people and entities, and to hold bad actors accountable.” It would allow actors like cryptocurrency analysis firms and banks’ financial intelligence units to aid law enforcement in gathering data about malign actors and their networks, she explained.

The committee considered multiple other measures relating to the recent $6 billion hostage deal, which received more opposition from Democrats.

Rep. Zach Nunn (R-IA) and Luetkemeyer’s “Revoke Iranian Funding Act of 2023” would freeze the $6 billion and require a report to Congress on the finances of Iranian leaders and notifications to Congress before any further waivers are issued. The committee approved the bill by a 37-13 vote. Democratic Reps. Brad Sherman (D-CA), David Scott (D-GA), Juan Vargas (D-CA), Josh Gottheimer (D-NJ), Vicente Gonzalez (D-TX), Steven Horsford (D-NV), Ritchie Torres (D-NY), Wiley Nickel (D-NC) and Brittany Pettersen (D-CO) voted with Republicans in favor of the bill.

Nunn said that the bill would “ensure that those assets do not flow to Iran, and the government of Iran and the weaponization of Iran” and “ensure that our adversaries are not skirting sanctions, breaking rules under our nose, or using nontraditional methods to fund terrorist organizations.”

Waters said the bill “undermines all presidents’ ability to negotiate credibly in a moment when diplomacy is vital” and “abandons” long-standing bipartisan sanctions exemptions for humanitarian aid.

The “Freezing HAMAS Act” by Rep. Dan Meuser (R-PA) would re-freeze the $6 billion in Iranian assets released as part of the recent hostage deal, as well as prohibit any further sanctions relief to Iran. The bill was approved 37-13. Sherman, Scott, Vargas, Gottheimer, Gonzalez, Horsford, Torres, Nickel and Pettersen again voted yes.

“While we unequivocally support the safe return of American citizens from Iran, the methods employed… was deeply concerning and has proven counterproductive to our broader security objectives,” Meuser said. “Iran’s ongoing support for terrorist organizations and its recent involvement in facilitating terror attacks against Israel necessitates a strong and immediate response.”

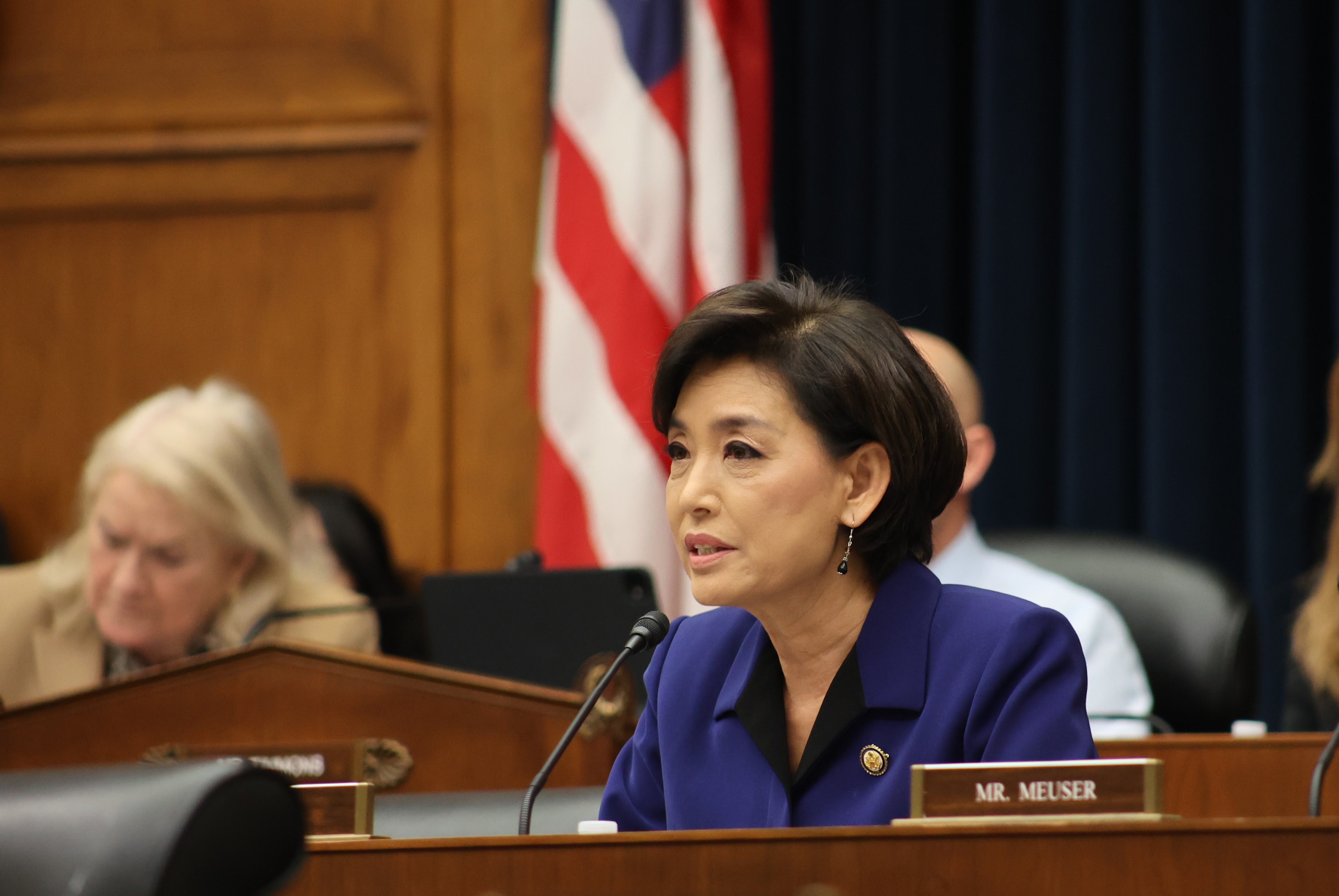

The “Iran Counterterrorism Act of 2023” by Rep. Young Kim (R-CA) would limit the president’s ability to waive any sanctions on Iran unless the regime ceases support for terrorism. Barring that, sanctions could only be waived following a formal congressional review period, during which Congress could vote to block the waiver. The bill passed by a party-line 30-19 vote.

“My bill… will help ensure that future waivers can also be scrutinized by Congress before it’s too late and the money is out the door,” Kim said.

Waters argued that the bill “paralyzes the tools that we have to engage [the Iranian people,] turning the target of US sanctions on victims of the repressive Iranian regime” by slowing down the potential provision of emergency humanitarian aid to the Iranian people. She said it would also harm relations with U.S. allies.

Additionally, the committee sought to cut off funding that Iran could receive through the International Monetary Fund.

The “No U.S. Financing for Iran Act.” introduced by Rep. Bill Huizenga (R-MI), would prohibit any U.S. financial institution from transactions with Iran, except those of a humanitarian nature, direct the administration to oppose the provision of financial assistance to Iran at the International Monetary Fund and prohibit the Export-Import Bank from providing financing to projects involving Iran. The bill was approved by a 34-12 vote, with Sherman, Scott, Gottheimer, Torres, Nickel and Pettersen in favor.

Huizenga said the bill “tightens the grip on the Ayatollahs, on the government itself” but that it is narrowly tailored.

Waters argued that the “language is so overly broad that it effectively closes” the Export-Import Bank would penalize developing countries reliant on the IMF. She said the Treasury Department had also warned the bill could “harm national security because of limits on certain types of trade.”

The “End Financing to Hamas and State Sponsors of Terrorism Act,” introduced by Reps. Brian Steil (R-WI) and Pettersen would require the administration to develop a multilateral strategy with the G7 and other partners to disrupt Hamas financing, report to Congress on the sources of Hamas’ financing and efforts to disrupt it and prohibit the administration from providing funding to Iran via Special Drawing Rights at the International Monetary Fund. By a 36-13 vote, the bill advanced. Sherman, Scott, Gottheimer, Torres, Nickel and Pettersen voted in the affirmative.

The IMF funds are “a potential lifeline to the Ayatollah and a source of funding for terrorism, weapons proliferation, and other malignant activities of the regime,” Steil said.

Rep. Sean Casten (D-IL) introduced an amendment that would have required specific information in the report to Congress on Hamas’ use of cryptocurrency in financing its operations. It failed by a party-line vote.

McHenry said the amendment was “poorly drafted and ill-considered,” accusing Casten of trying to “make a point” — an assertion Casten rejected.

McHenry said the committee would work on the crypto issue in other vehicles, but Waters argued that the issue cannot be put off, and suggested that the cryptocurrency industry was opposing scrutiny of Hamas’ use of cryptocurrency.

By a voice vote, the committee advanced Rep. Emmanuel Cleaver’s (D-MO) “Armed Conflict Migration Act of 2023,” which seeks to provide support through international financial institutions for individuals potentially displaced by the war in Gaza.

Cleaver said that the bill would help address financial burdens on countries that might otherwise be reluctant to take in displaced Palestinians. He further emphasized that any Palestinians who leave Gaza should have the right to return home at the end of the war.

Throughout the meeting, several members invoked the gruesome Hamas attack footage they had watched hours earlier, emphasizing the need to take assertive action against the terrorist group and its sponsors in Tehran.