FIRST ON FOX: Goldman Sachs issued a memo Thursday to congressional campaigns, warning that overregulation is blocking small businesses from accessing capital, an issue that could be a key issue during the 2024 election.

The memo — which was authored by the Goldman Sachs 10,000 Small Businesses Voices initiative and comes exactly one year before the 2024 election — calls on both Democrats and Republicans to back policies that keep small businesses competitive and ensure America is “the best place to become an entrepreneur, grow a business, and hire workers.” It also says lawmakers will benefit at the ballot box if they support small businesses.

“As economic recovery continues with mixed indicators, small businesses should be the top concern,” the memo, first obtained by Fox News Digital, states. “Access to capital challenges for small business owners are at an all-time high since the onset of the pandemic. This undermines future growth potential for many small business owners, who are job creators, influential community leaders, and engaged voters.”

“Those seeking public office should speak to these concerns and stand firmly against any rule to increase barriers to affordable capital,” it concludes.

According to a survey conducted by Goldman Sachs and referenced in the memo Thursday, 78% of small business owners are concerned about their ability to access capital, and just 29% say they can currently afford to take out a loan, given current interest rates. And the issue, if it doesn’t ease soon, could result in 21% of small businesses closing, 67% halting expansion plans and 85% altering their growth forecast.

Overall, the survey showed considerable angst among small business owners about the broad state of the economy. In the past year, 33% of small business owners said they applied for a new business loan or line of credit, with 65% of those who did so reporting that they found it difficult to access affordable capital. In addition, 31% of small business owners said 2023 has been the most difficult when looking back over the last four years.

The memo took particular issue with a recent Federal Reserve rulemaking proposal, the so-called Basel III Endgame rule, which it argued would include new requirements for banks to increase capital reserves, thus threatening borrowers’ ability to access credit and increasing the cost of remaining lendable capital.

“While the effects of Basel III Endgame would likely be felt broadly across the country’s economy, the new rules would be especially devastating to U.S. small businesses,” the memo states. “Small businesses already have a tougher time finding access to affordable capital and accessing lines of credit. This rule would exacerbate this. Even the Federal Reserve, which is proposing this new rule, has admitted that this proposal would further increase the cost of capital.”

“With interest rates at two-decade highs, the Basel proposal would make a difficult situation even worse, increasing the cost of capital and making access to credit even harder,” it adds. “If implemented, small businesses and underserved communities would disproportionately suffer the consequences, from being outright unable to access capital to being forced to pay higher, unaffordable interest rates.”

On July 27, the Federal Reserve issued the regulatory proposal that it said would “further strengthen the banking system by applying a broader set of capital requirements” for the banking sector. The action, if finalized, would require financial institutions to hold as much as 19% more capital in reserve, depending on the size of the bank.

The proposal, which has received stark opposition from banking groups, may limit banks’ capacity to offer mortgages, car loans, credit cards and small business loans, according to the Bank Policy Institute.

“If these standards are adopted, they will have a devastating impact on our efforts to increase Black homeownership and disadvantage all first-time, and, in particular, first-generation homebuyers who do not have the benefit of multi-generational wealth or higher-than-average incomes,” the National Housing Conference, Mortgage Bankers Associaton, NAACP, National Association of Realtors and National Urban League wrote in a letter to the Federal Reserve.

According to the Goldman Sachs memo on Thursday, the Federal Reserve proposal would have the largest impact on underserved communities and make it harder for minority-owned businesses to access loans and credit.

And the memo pointed to four lawmakers, two Democrats and two Republicans, who have already criticized the proposal and called for more lawmakers to join them in pushing back on the rulemaking.

“In my view, the regulation in this case is a quelching effect on access to capital,” said Rep. Steven Horsford, D-Nev. “Capital is king. Capital is what people need — small businesses need to hire people, to buy products, to buy supplies, to grow their businesses. As a small business owner myself, I have felt the struggle of not being able to land a contract but then not fully service it because I didn’t have access to capital.”

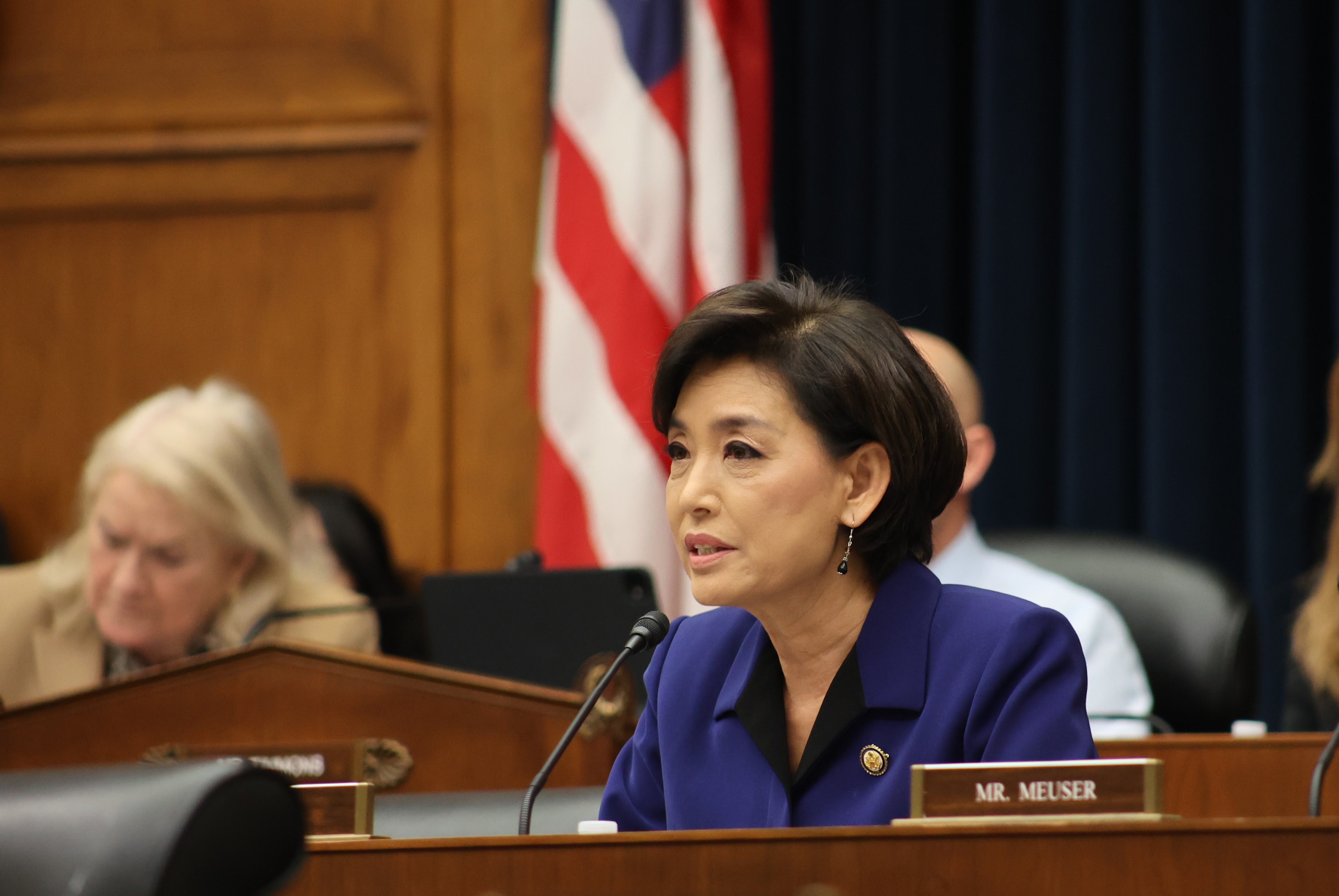

“I’m deeply concerned that the Basel III Endgame and the other proposals would make credit more expensive for small businesses, as they will reduce lending for low-to-moderate income households and put our banks at an international competitive disadvantage,” added GOP Rep. Young Kim of California.