New York and California Republicans are plotting a way forward while the House GOP tax package remains stalled over the state-and-local tax deduction cap.

GOP members of the bipartisan SALT Caucus—dedicated to reinstating the full state-and-local tax deduction that the 2017 tax law capped at $10,000—are blocking their party’s tax bills from full House passage because it does not address the issue.

While that legislation has no chance of passing the Democratic-controlled Senate, the impasse threatens to hold up movement on any bipartisan tax pact that could revive business tax breaks like that both parties support. High-tax state Republicans also see this moment as their chance to make good on campaign promises to raise the SALT limit before facing voters again in 2024.

Even though their numbers are small, and the New York and California Republicans haven’t reached consensus on a specific SALT proposal, the Republicans’ thin House majority still gives them leverage.

“To be honest, the SALT Caucus hasn’t landed on a single sort of negotiating strategy except for saying no,” Rep. Mike Garcia (R-Calif.) said in an interview Thursday in his Capitol Hill office, “which is still a very good strategy when you have a five-seat majority.”

Republicans have proposed a number of bills to raise or eliminate the cap. Rep. Mike Lawler of New York has legislation that would increase the limit to $20,000 for married filers. Rep. Nick LaLota of New York would raise the cap to $60,000 for individuals and $120,000 for joint-filers. Rep. Nicole Malliotakis of New York has floated income caps to prevent wealthy individuals from qualifying for the deduction.

And Garcia has legislation that would nix the cap altogether, restoring the full deduction. For now, Garcia said he would be comfortable doubling the deduction to $20,000 for individuals.

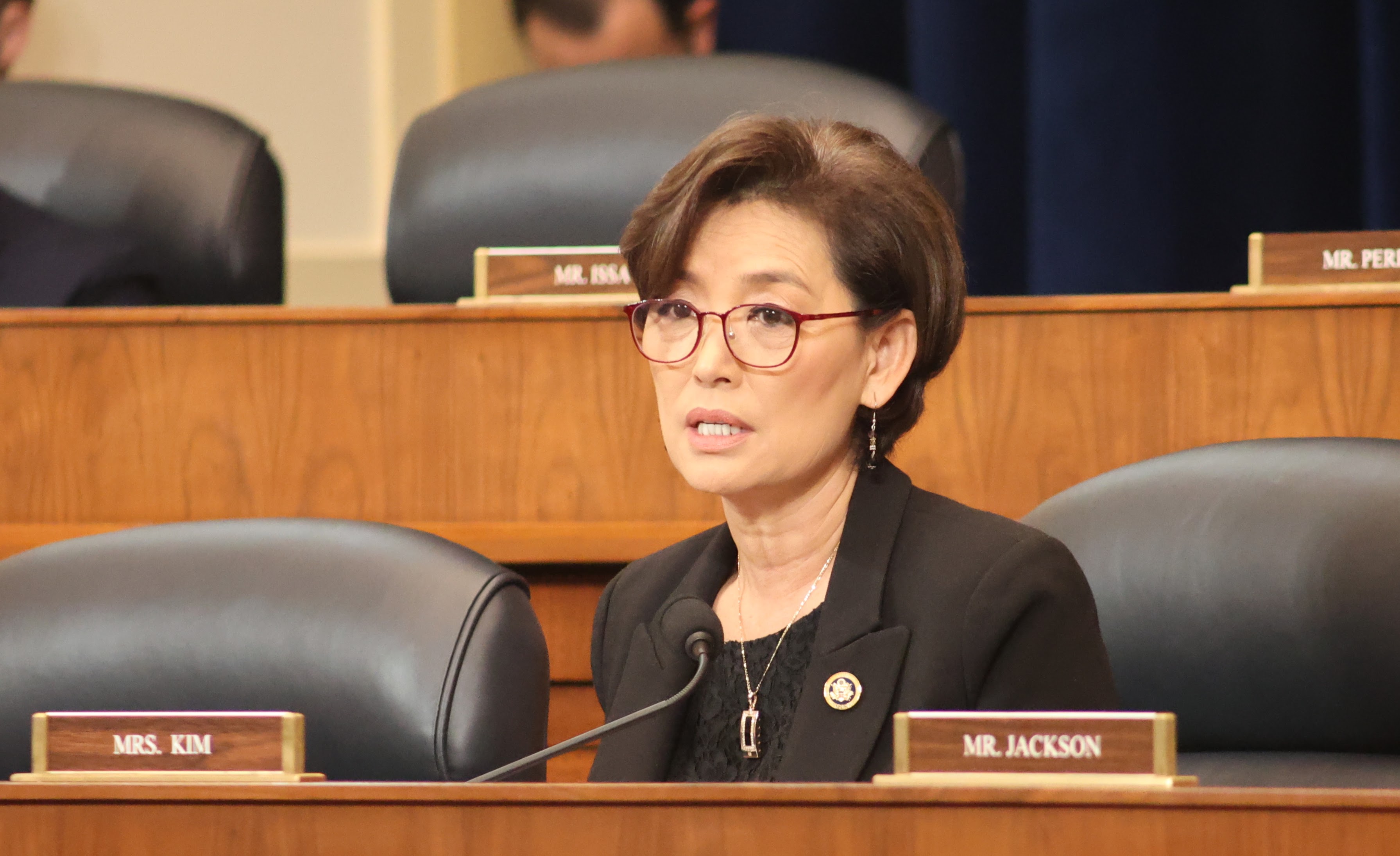

Rep. Andrew Garbarino (R-N.Y.), one of the chairs of the SALT Caucus, said his staff is working with Rep. Young Kim’s (R-Calif.) and Ways and Means staff to sort through different fixes, the costs, and how to pay for it.

Garbarino said that while some note that other members won’t vote for the package if there is a SALT provision included, they still won’t agree to it without one. An agreement on SALT now, in the GOP tax package, may also help get a SALT solution enacted in an end-of-year tax package, Garbarino said.

“Hopefully we can find something that works for everyone,” Garbarino told Bloomberg Tax.

Kim, who’s also a SALT Caucus chair, said the full group of high-tax state lawmakers caucus hasn’t met yet since lawmakers returned to Washington.

“It is very clear that there is no vote without the SALT Caucus members,” Kim said in a brief interview. “So we’re going to try to use that as a conversation starter with the leadership as we continue this dialogue.”

Ways and Means Rift

Some Ways and Means Committee Republicans are skeptical of including a provision to address the deduction, included in the 2017 tax law to pay for corporate and individual tax cuts.

Rep. Kevin Hern (R-Okla.), a member of the tax panel, noted the House GOP package includes a temporary boost to the standard deduction. An analysis from the Urban-Brookings Tax Policy Center analysis found that the standard-deduction boost would shrink the percentage of households likely to claim the SALT deduction from 9.3% to 7.3%.

Hern said it’s not a good look for the SALT members to block passage of legislation that would also provide research and development tax breaks and an increase in the standard deduction.

“Not going to be a good Republican message to sell, or a Democrat message, for that matter,” Hern said in a Tuesday interview with Bloomberg Tax.

Others, though, were more optimistic.

“Discussions need to be had,” Rep. Adrian Smith (R-Neb.) said. “I think there’s a place to bring folks on board.”

SALT Republicans on the Ways and Means panel said they’re continuously talking with Committee Chair Jason Smith (R-Mo.) about the issue. Rep. Michelle Steel (R-Calif.) and Malliotakis both said they discussed the topic with Smith while traveling with the committee over August recess.

The Ways and Means chair said at a recent member day hearing that the SALT issue affects various areas of the country differently, responding to Rep. Anthony D’Esposito’s (R-N.Y.) comments advocating removing the $10,000 limit.

Ways and Means Ranking Member Richard Neal (D-Mass.) and Rep. Mike Thompson (D-Calif.) noted that Democrats crafted a solution with the Biden administration’s Build Back Better legislation. The House-passed version contained a provision that would increase the cap to $80,000, but that stalled in the Senate.

“It was not the Democrats that put SALT removal on the books,” Thompson said. “There are folks on both sides who are working hard to address this.”