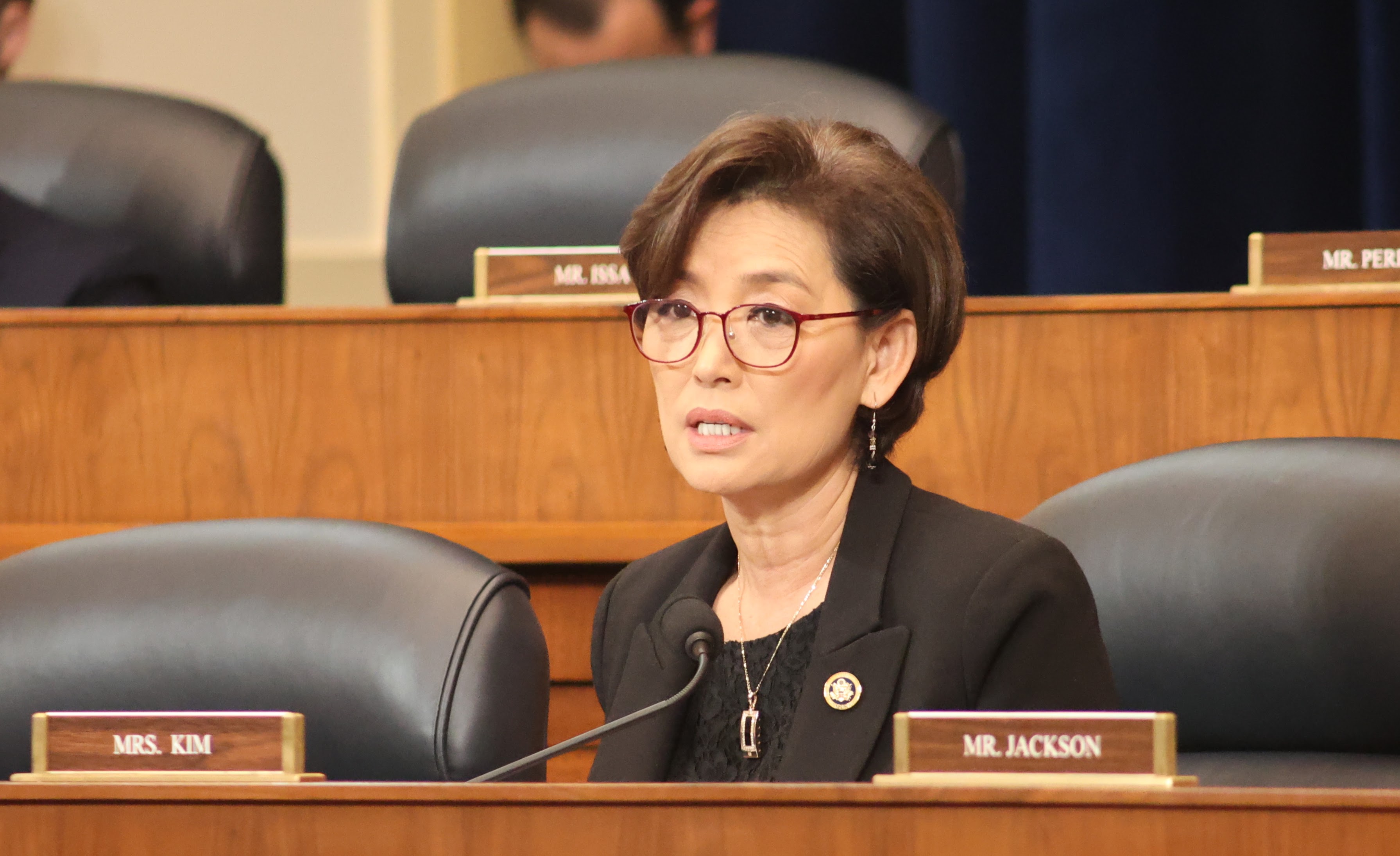

Washington, DC – As first reported in POLITICO, U.S. Representative Young Kim (CA-40) led a letter with 18 colleagues to Consumer Financial Protection Bureau (CFPB) Director Rohit Chopra expressing concern with his “informal dialogue” with the European Commission without an explicit authorization from Congress.

Financial Institutions Subcommittee Chairman Andy Barr (KY-06), Digital Assets, Financial Technology and Inclusion Chairman French Hill (AR-02), and Reps. Pete Sessions (TX-17), Bill Posey (FL-08), Roger Williams (TX-25), Barry Loudermilk (GA-11), Alex Mooney (WV-02), Dan Meuser (PA-09), Scott Fitzgerald (WI-05), Andrew Garbarino (NY-02), Ralph Norman (SC-05), Byron Donalds (FL-19), Mike Flood (NE-01), Zach Nunn (IA-03), Mike Lawler (NY-17), Monica De La Cruz (TX-15), Erin Houchin (IN-09), and Andy Ogles (TN-05) joined Rep. Kim in sending the letter.

“The CFPB has no authority for engaging with the European Commission or making international deals ‘to improve policy,” the members wrote. “The CFPB’s mandate is to enforce federal consumer financial protection law and to protect the interest of U.S. consumers. The CFPB has no implicit authorization from Congress to engage in policymaking decisions with foreign nations or foreign agents subject to the direction and control of foreign governments. In fact, the Dodd-Frank Act only directs the CFPB to coordinate with the U.S. federal and state regulators to “promote consistent regulatory treatment of consumer financial and investment products and services.” In contrast, other regulators, including those with a financial stability mandate, have been granted express authorization from Congress for international policy coordination.”

“Given the CFPB’s troubling pattern of opacity, lack of accountability, and unlawful actions under your leadership, we are concerned that the transatlantic dialogue in a non-public format will lead to secret policy decisions that harm U.S. consumers, small businesses, startups, and financial institutions, and potentially undermine U.S. legal frameworks,” the members added.

Read the full letter HERE.