California Republican members of Congress want the state to kill its tax on health savings accounts.

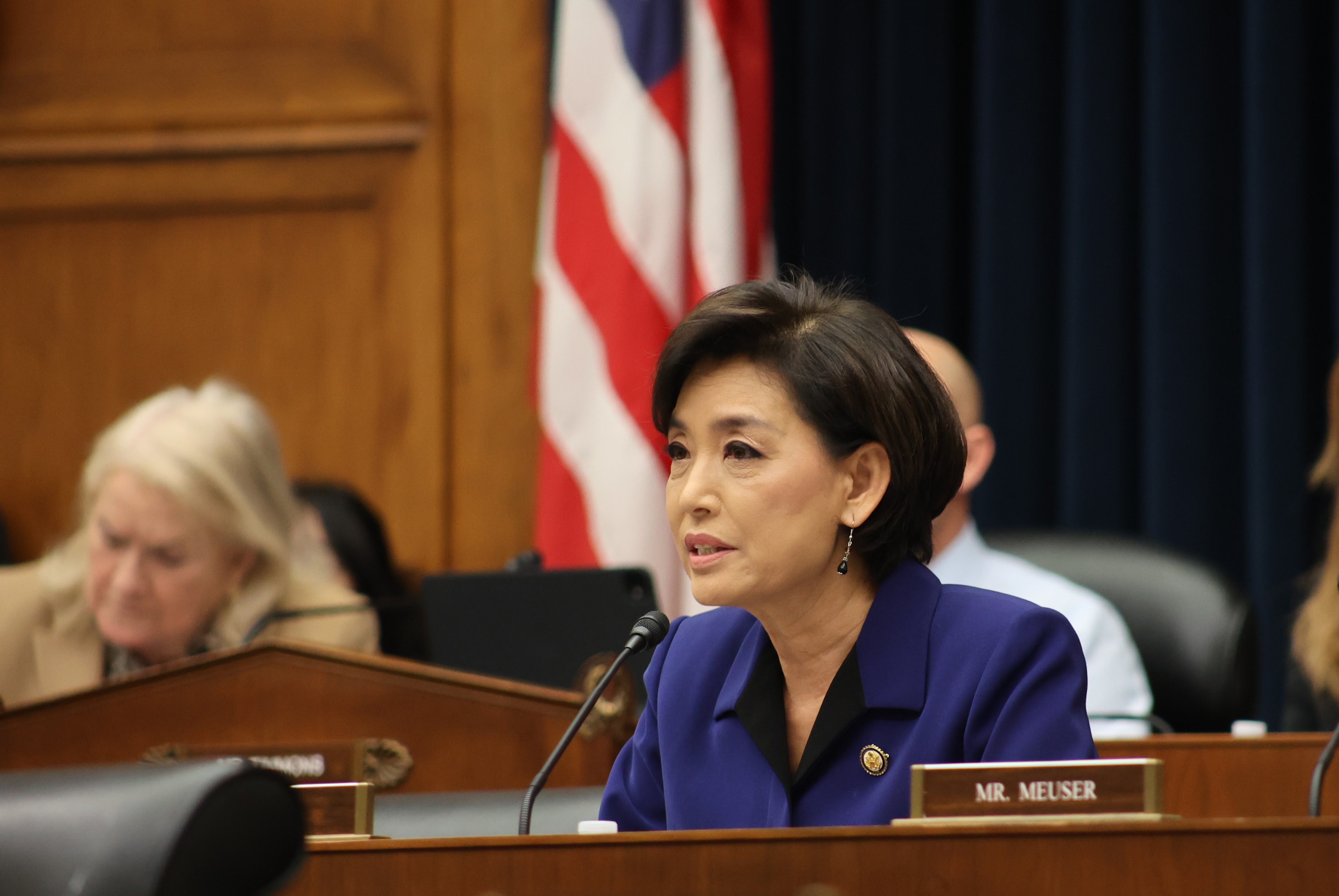

Led by Rep. Michelle Steel, R-Seal Beach, six Republican members of California’s congressional delegation, including Rep. Young Kim, this week sent a letter to Gov. Gavin Newsom, urging him to end the state tax on health savings accounts.

Dubbed HSAs, these accounts allow someone to set aside money on a pre-tax basis to pay for qualified medical expenses.

California and New Jersey are the only two states in the U.S. to tax these plans. When Congress established HSAs as part of the 2003 Medicare Modernization Act, the majority of states automatically conformed to the federal tax code, which defines HSAs as tax-exempt accounts. Over the years, most states fell in line with exempting HSAs except for California and New Jersey.

“These harmful taxes impact hardworking Americans the most who want to offset the costs of health care or plan for future medical expenses,” the letter reads.

The governor’s office has received the letter and it’s being reviewed, said spokesperson Brandon Richards. He declined to comment further.

Steel said she’s heard from constituents who are “suffering under Sacramento’s heavy taxes.” According to tax preparation software TurboTax, California has the highest personal income tax rate in the country.

“I think this is going to relieve them because healthcare costs have been rising,” said Steel, who represents the 45th congressional district. “Millions of Californians are in crippling medical debt and this is going to help, at least a little bit.”

Under the federal tax code, HSAs offer three tax advantages: pre-tax contributions, tax-free growth and tax-free spending.

But because the state does not recognize HSAs as tax-exempt accounts, for state income tax purposes, a California taxpayer who contributed to an HSA is “required to increase their state adjusted gross income by an amount equal to the sum of the taxpayer’s HSA deduction on their federal tax return, the interest earned on the HSA and the contributions made by the taxpayer’s employer,” the letter reads.

For example, if a single taxpayer had $55,000 as their federal adjusted gross income, earned $1,000 interest and received $1,000 in employer contributions to their HSA, their state adjusted gross income would be increased to $57,000.

“With this taxation in place, there are serious concerns that Californians may not seek access to care, worsening health care outcomes and costing more for the patient and the taxpayer in the long run,” the lawmakers said in the letter.

There have been efforts in the California Legislature to align the state tax code regarding HSAs with the federal tax code. Most recently, a bill from Sen. Kelly Seyarto, R- Murrieta, would “allow income-eligible taxpayers to claim a tax deduction equal to the amount the taxpayer contributes to a HSA.”

“As healthcare costs perpetually increase in the current inflationary environment, it is essential we provide Californians with affordability options and flexibility to suit their unique circumstances,” Seyarto said.

Senate Bill 230 did not advance out of the Senate but was granted reconsideration, which means Seyarto could bring it back before the committee next year. He has not yet decided whether he will resurrect in 2024, spokesperson Hildur Sam said.

There have been other efforts similar to Seyarto’s that did not successfully make it through the legislative process, including by former Assemblymember Steven Choi — a Republican who represented an area that encompassed Villa Park, Orange, North Tustin and Lake Forest — in 2021.

According to an estimate by the California Franchise Tax Board, nearly aligning the state tax code for HSAs with the federal tax code would mean California would lose $110 million in revenue in fiscal year 2022-23, $80 million in 23-24 and $85 million in 24-25. The state faces a nearly $32 billion budget deficit.