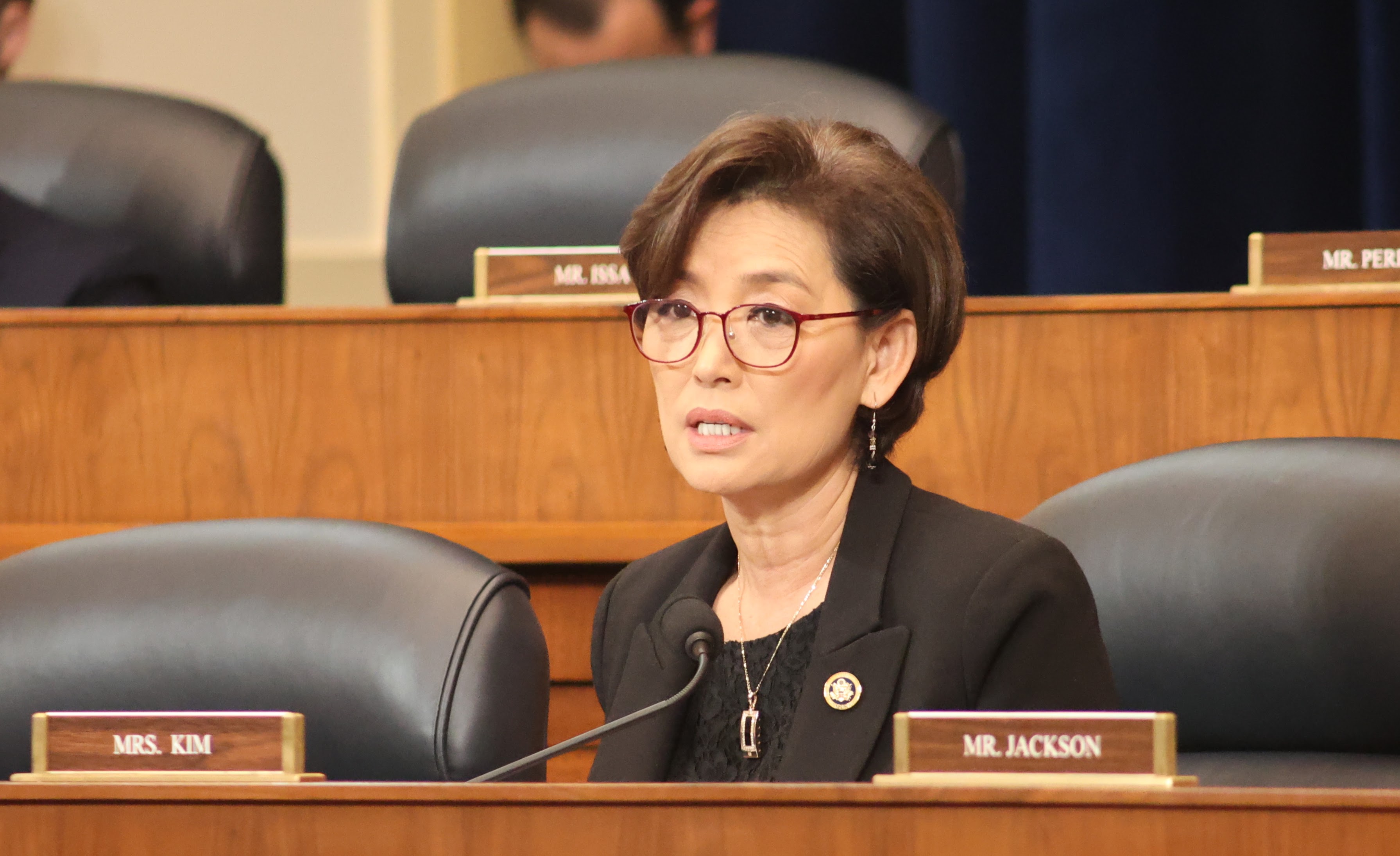

Representative Young Kim, R-Calif., has taken a stance against tax increases, which especially would hurt businesses run by the nation’s veterans. Recently, Kim voted against President Biden’s so-called Build Back Better Act. The plan passed in the Democrat-controlled House of Representatives.

Quoting an estimate by the Tax Foundation, Kim said the bill’s $1.75 trillion price tag would be paid for by hitting the average California taxpayer with an additional $1,410 a year in higher taxes.

“Americans across the country are facing new challenges making ends meet due to record-high prices on everyday goods, housing costs, taxes, and supply chain shortages, and nearly half of small business owners have been unable to find workers,” said Kim.

During Veterans Small Business Week, she joined other House members in sponsoring a resolution honoring the veterans.

“More than 2.5 million successful veteran entrepreneurs, after dedicated service in our nation’s uniform, continue to give back to our communities and employ roughly 5 million Americans,” she said in announcing her support for the resolution. “These men and women are heroes who not only helped protect America’s freedoms but also directly support our local economy.”

Kim is an immigrant small-business owner, a group crucial to Orange County’s economic dynamism. Her experience in creating business and jobs landed her the position in the House of Ranking Member of the House Small Business Subcommittee on Innovation, Entrepreneurship, and Workforce Development.

While Kim’s home in Orange County relies heavily on a healthy small business economy, high taxes add difficulties as they recover from the losses from the 2020 pandemic. Additionally, these businesses are seeing record inflation, increasing gas prices, and an unstable regulatory climate.

Congresswoman Kim said, “Our service members have our backs; it’s our responsibility to have their backs, too.”