Now his loan will not be forgiven, despite completing the application in good faith and using the funds appropriately, said Tracy Ward, director of Self-Help Venture Fund’s SBA 504 loan program Wednesday.

“This Black-owned microbusiness, instead of being able to recover, is being held back by an unexpected $20,000 debt trap,” Ward charged before a U.S. House Committee on Small Business hearing on the PPP loan forgiveness process.

The witnesses applauded the SBA for its quick rollout of the COVID-19 relief funds to eligible small businesses to cover payroll and other specific costs to remain afloat during the pandemic, with the intention that they would be forgiven instead of repaid. With nearly 12 million PPP loans distributed, the SBA has supported close to 50 million jobs throughout this economic crisis. About a year ago, the forgiveness process opened up for applications.

The SBA has already granted loan forgiveness to 46% of the PPP loans, said Chairwoman Nydia Velasquez, D-N.Y.

But the agency has been “building the plane while it was already in the air” from the beginning, Ward said.

It took an average of nine days for a PPP loan to be approved, said Leslie Payne, assistant vice president of commercial lending at Affinity Federal Credit Union. The loan forgiveness process, on the other hand, is taking an average of 47 days.

All the witnesses pointed out that the constant changes from the get-go made it difficult for lenders to navigate the process, let alone borrowers who were applying to the program without the help of experienced firms like community-based banks or community development financial institutions.

For example, Ward pointed to a loan calculation adjustment that took place this year for microbusinesses, the self-employed, sole proprietors, and independent contractors. Congress ensured it was applied retroactively to small farmers, but not to other microbusinesses. Had this change been applied retroactively to all, Ward said, a North Carolina Black-owned child care business would have received $14,000 instead of the mere $2750 the owner received to assist her operations. She also called for the SBA to rescind a Jan. 15 rule that denies forgiveness for borrowers, like the independent contractor, who have made good faith errors.

Another change that seemed to unnerve some lawmakers at the hearing was the recently created PPP Direct Forgiveness Portal. Launched by the SBA on July 28, the portal aims to streamline and simplify the forgiveness process online for those who borrowed $150,000 or less.

Both Ward and Marla Bilonick, president and CEO of the National Association of Latino Community Asset Builders, said the simplified application process should be extended to $350,000 or less.

Ranking member Blaine Leutkemeyer, R-Mo, pointed out most of the fraud or identity theft issues are likely to happen in loans under $350,000.

Nevertheless, Bilonick countered, increasing the threshold would only be a 7.7% increase of the loans already going through the simplified process – noting that is still 94.2% of all PPP loans. It would also free up SBA and lender resources to “focus on the larger and higher risk loans,” Ward added, needed to review the supporting documentation for these larger loans.

The SBA would still review the smaller loans to ensure they are eligible for forgiveness or partial forgiveness, she explained, and the agency reserves the right to request any additional documentation at any point.

Leutkemeyer claimed the SBA had sent “threatening” emails to community-based banks that had opted out of using the portal. Robert Fisher, president and CEO of Tioga State Bank, received one of these emails on Monday letting the lender know they may be audited.

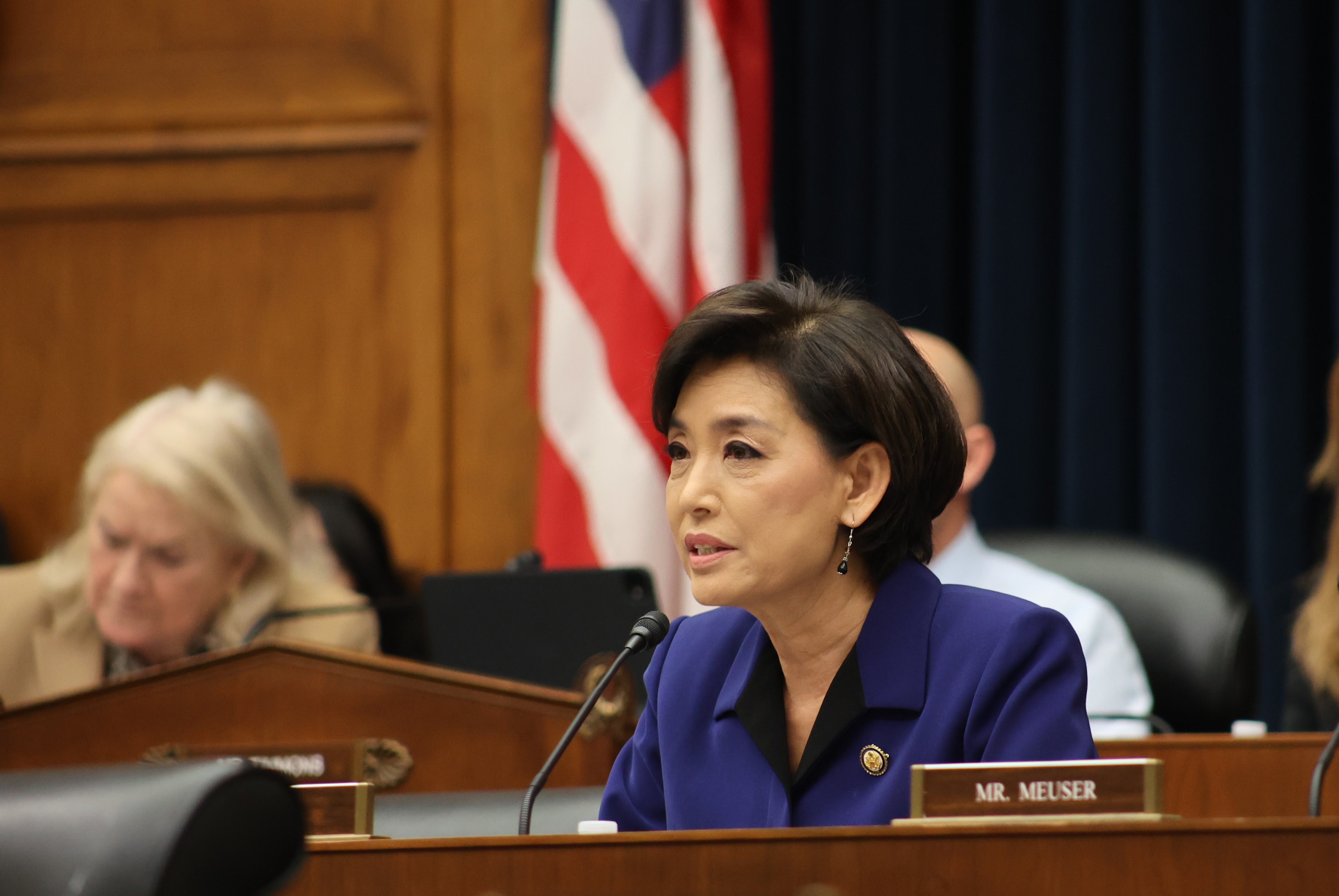

The SBA later clarified that these audits would target lenders not actively reaching out to their borrowers or processing their forgiveness too slowly, “the damage has been done,” said Rep. Young Kim, R-Calif.

Fisher commended the SBA for their portal, but said the change was made “late in the game.” Tioga State Bank created its own portal earlier on. Direct communication with the SBA if borrowers have questions or technical difficulties “has frankly been a major concern,” he added.

Due to their close ties to the community, he explained, this “relationship lending” has allowed Tioga State Bank to be the “buffer” between the borrowers and the SBA, noting the bank has a 40-year history with the SBA.

“We believe we owe it to our borrowers to ensure a smooth process from origination until full forgiveness,” he said.