On June 14, Congressman Joe Neguse, Co-Chair of the Innovation and Entrepreneurship Caucus, and Congresswoman Young Kim (R-CA) unveiled bipartisan legislation to increase access to Small Business Administration (SBA) resources for traditionally underserved individuals, communities, and small businesses. Specifically, the bill would authorize the SBA to create a MicroCap Small Business Investment Company license that will allow qualified underrepresented investment managers to participate in the program. Managers would not need to have prior fund management experience. Instead, they must have proven business expertise and a track record of successful business management. This would allow a more diverse group of fund managers to obtain SBIC licenses. MicroSBIC’s would be required to invest at least half of their capital in “smaller enterprises” and a quarter in rural and underserved communities and important sectors like manufacturing. Companion legislation to the bill is being sponsored by Senator John Hickenlooper in the Senate.

“Investing in diverse voices and diverse ideas is good for innovation, for business and for our economy,” said Congressman Joe Neguse. “Our bipartisan bill will address lack of diversity at the source, by increasing the diversity of fund managers and ensuring that traditionally underserved individuals, communities and small businesses, including rural communities, have equal opportunity to investment capital, and a better chance to succeed.”

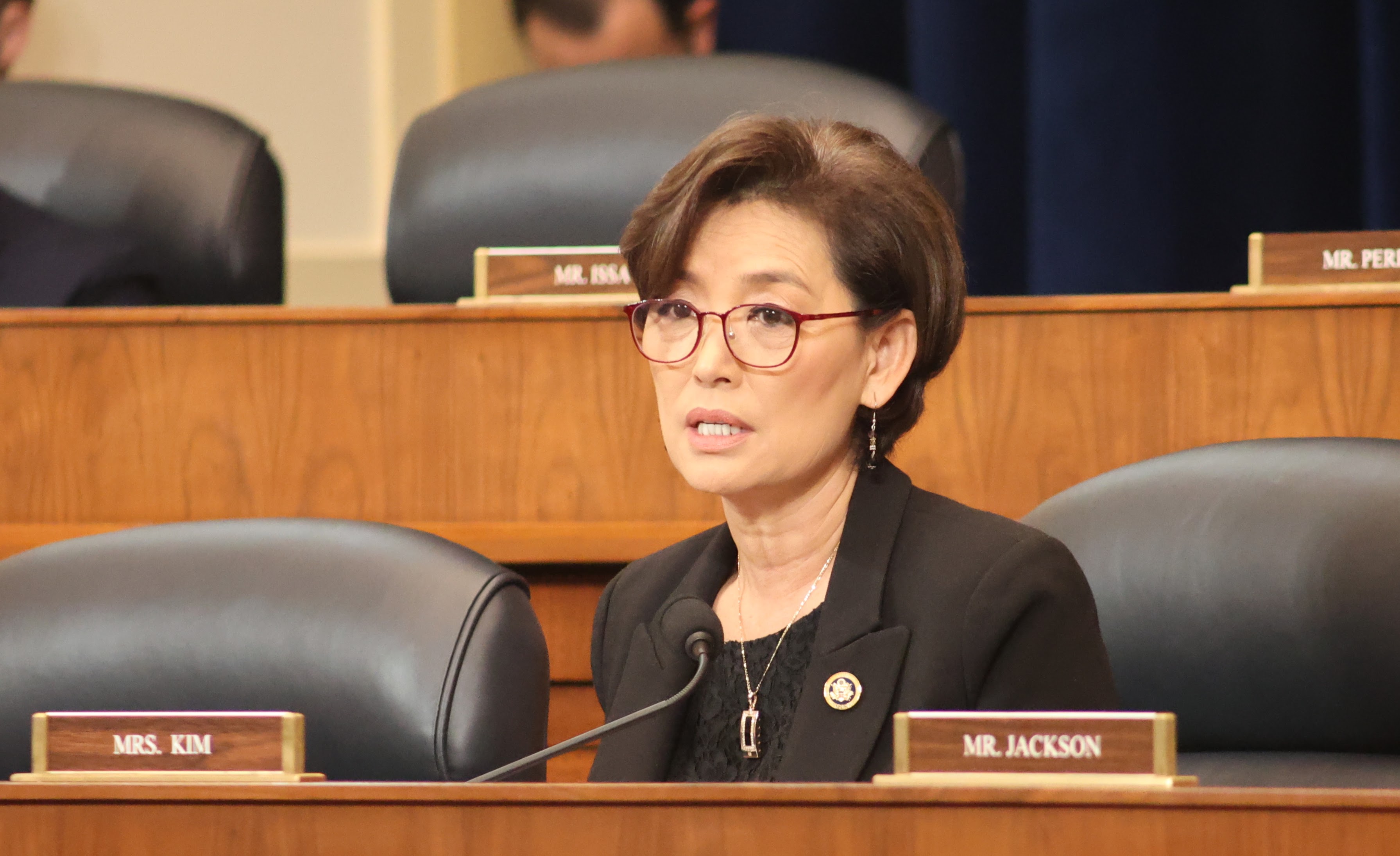

“As we reopen communities and recover from the COVID-19 pandemic, we must make sure our economy can adapt and compete in the 21st century and beyond, which requires expanding opportunities for Americans of all backgrounds,” said Congresswoman Young Kim, who serves as ranking member of the Small Business Subcommittee on Innovation, Entrepreneurship and Workforce Development. “I’m proud to join my colleague to introduce a bipartisan bill that will broaden the diversity in the talent pool of venture capital firms and incentivize small business owners from low-income, underserved communities to access capital to grow their business or get back on their feet. I’ll continue to do all I can to create policies that foster innovation, economic opportunity and job growth.”

“There’s a lack of diversity when it comes to who controls investment capital and who receives it,” said Senator Hickenlooper. “Increasing the diversity of fund managers will make investments in small businesses more equitable from end to end. That’s what this bill aims to do.”

“This bill ensures equitable access to investment capital from end to end by equipping a more diverse range of fund managers, small business owners and individuals. We are incredibly grateful for Congressman Neguse’s leadership on this bipartisan legislation for ensuring that black business owners have greater opportunities to succeed in the marketplace,” said Malcolm Evans, Chair of the Colorado Black Chamber of Commerce.

“To make sure economic prosperity touches all corners of society, we need to support the spirit of entrepreneurism wherever it thrives. By expanding access to venture capital resources for “small businesses” and diversifying the range of individuals who are engaged in identifying promising candidates, Representative Neguse’s initiative will help keep the avenues for entrepreneurial pursuits and innovation wide open for all who dare to follow their vision business success,” said John Taylor, President and CEO of the Boulder Chamber of Commerce.

The SBA operates the Small Business Investment Company (SBIC) program, which was established to improve small businesses’ access to capital and help them grow. To participate, investment companies firms must be licensed with the SBA. White men control 93 percent of venture capital funding. and a majority of the venture capital is invested in Boston, New York City, and Silicon Valley. Less than 1 percent of venture capital funds go to companies with Black founders and only 2 percent to Latino founders.

Neguse’s bill would create a new “MicroCapSBIC” entry-level license designation within the existing SBIC program that would help:

- Expand the universe of eligible investment managers among to spur investment and access to capital to help small businesses grow;

- Grow the number of smaller funds in underserved markets; and

- Create more investment vehicles serving small businesses in rural parts of the country, underserved markets