Business groups aren’t done lobbying Congress for more coronavirus relief, with new pleas to extend a popular small-business program that’s set to expire in just two weeks.

The March 31 application deadline for the Paycheck Protection Program (PPP) has trade groups pressing for swift action from lawmakers less than a week after President Biden signed a $1.9 trillion rescue package into law.

Proponents of a bill to extend the program through the end of May argue it will provide the financial support needed to keep businesses afloat until the country’s adult population is vaccinated and lockdown measures are lifted.

Supporters got a major boost on on Tuesday night when the House overwhelmingly passed the measure in a 415-3 vote. The bill now heads to the Senate.

The main groups pushing for the extension represent small businesses in industries like retail, travel and restaurants.

“We want to make sure that people are applying for relief through any mechanism possible and PPP is an important part of the recovery toolbox,” said Sean Kennedy, executive vice president of public affairs at the National Restaurant Association.

A $28.6 billion stabilization fund for the restaurant industry garnered bipartisan support and was included in the $1.9 trillion American Rescue Plan, which received no GOP backing. Kennedy said it’s unclear how quickly those funds are going to run out.

Industry sources and experts said they were surprised the two-month extension that’s being sought now wasn’t part of the American Rescue Plan.

“We were consistently told it was a Byrd Rule violation, as it required a policy change to extend the program,” said an industry source familiar with discussions, referring to the same rule that prevented a minimum wage provision from being included in the overall package.

The PPP was established in March 2020, when the $2.2 trillion CARES Act was signed into law. Congress passed another round of funding for the program at the end of December.

Some industry sources suggested the Biden administration might not be embracing the PPP because of its origins in the Trump administration.

“I do think there is less ownership of the program by Biden folks, but they also want to make it work in a more targeted way. However, paying little to no attention to it as part of the American Rescue Plan conversation was frustrating given it was developed in a bipartisan way and small businesses still need assistance and fixes needed to the program,” the industry source said.

The White House did not respond to a request for comment about why the extension wasn’t included in the American Rescue Plan Act.

Sen. Jeanne Shaheen (D-N.H.), who helped craft the PPP when it was first established in the CARES Act, said she fought for it to be included in Biden’s COVID-19 relief plan.

“The American Rescue Plan contains robust assistance for small businesses, but despite my efforts and others, unfortunately does not include an extension for the PPP. That needs to be addressed swiftly,” she said. “During negotiations in the Senate, I made it very clear that this must be a priority.”

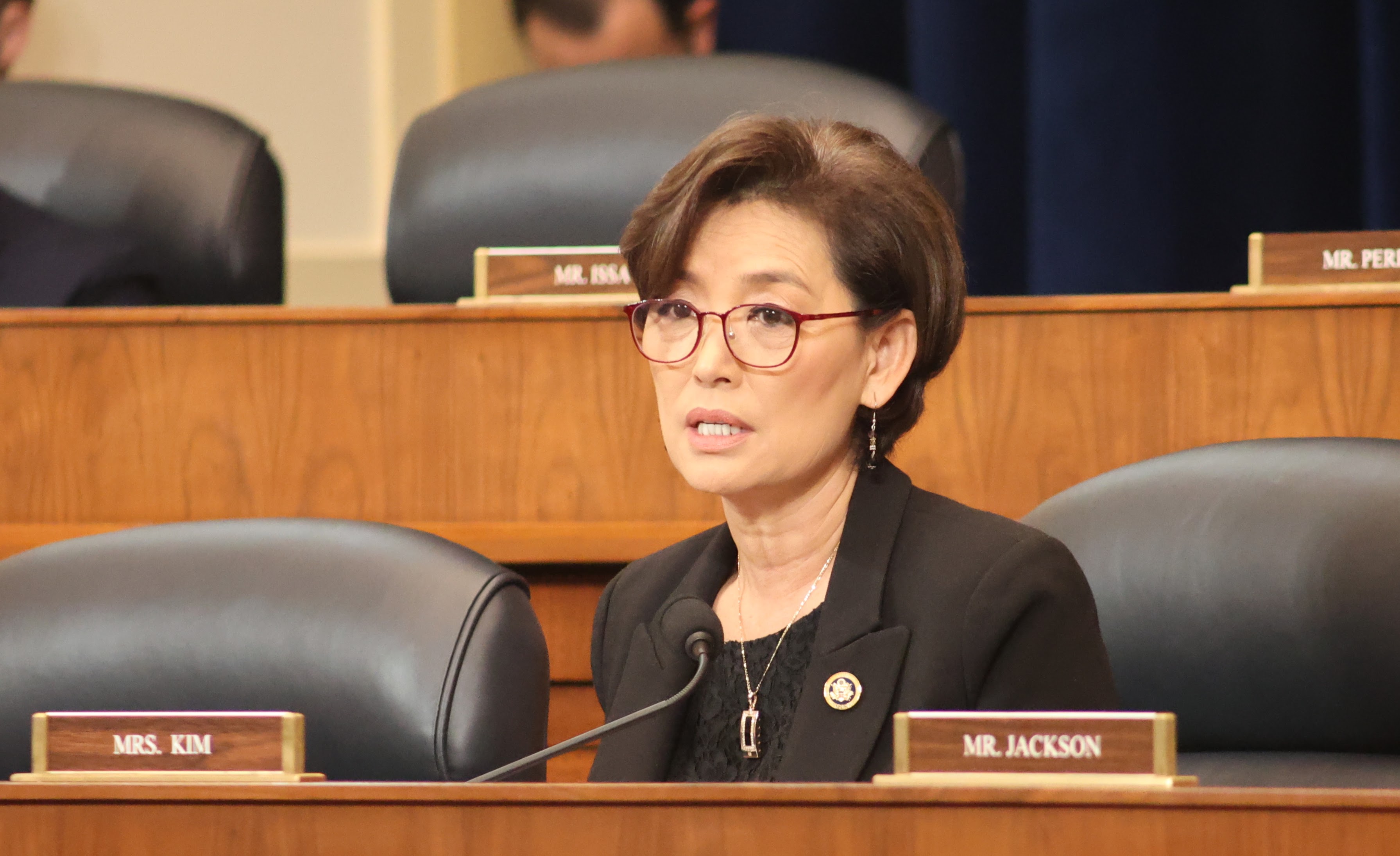

Rep. Young Kim (R-Calif.) is among those arguing a PPP extension is necessary because the program has about $88 billion in unspent funds left in it.

“Providing commonsense, targeted relief to our communities during COVID-19 is a bipartisan priority, which is why Democrats should have worked with Republicans to get the nearly $1 trillion in unspent COVID-19 relief to those who need it before ramming through another $1.9 trillion bill,” Kim said.

Kim is one of the co-sponsors of the PPP Extension Act of 2021, along with House Small Business Committee Chairwoman Nydia Velázquez (D-N.Y.) and others. The House-passed bill would extend the deadline for PPP applications to May 31 and provide another 30 days for the Small Business Administration to process applications.

Sen. Susan Collins (R-Maine), Senate Small Business and Entrepreneurship Committee Chairman Ben Cardin (D-Md.) and Shaheen are sponsors of the the Senate version. Cardin is holding a hearing on Wednesday to examine the PPP, which came under criticism in earlier rounds as well-connected applicants were able to quickly secure funds while others struggled to navigate the application process.

The extension bill has support from groups like the U.S. Chamber of Commerce, National Retail Federation, International Franchise Association, American Bankers Association, American Farm Bureau, U.S. Travel Association and National Federation of Independent Business.

Experts note that extending the PPP would come at little to no cost for taxpayers.

“To the extent that we’re not talking about an additional appropriation, I don’t see why anyone would be against the extension at this point because we’re not changing the eligibility criteria,” said Jennifer Berman, employee benefits attorney and CEO of MZQ Consulting LLC.

She added that “it didn’t make a lot of sense” that the extension wasn’t included in the American Rescue Plan.

The PPP has provided more than 7.5 million loans to small businesses, according to the Senate Small Business and Entrepreneurship Committee.

Berman said there is still demand for the small-business loans, just not at the same level as last year when the country was in the depths of the coronavirus recession.

“We’re not seeing the demand of the program that we did last summer. I think most folks have been through at least their first round of funding,” she said. “There’s certainly going to be the folks who didn’t want to take the money who find themselves in a situation that they don’t have a choice.”

Biden announced policy changes to the PPP in February aimed at targeting assistance to businesses with 20 or fewer employees and minority-owned businesses. The administration instituted a 14-day period, which ended on March 9, when only businesses with fewer than 20 employees could apply for the loans.

Two restrictions were also eliminated from the program, one that restricted individuals with prior nonfraud felony convictions from receiving assistance and another that restricted individuals who are delinquent on their federal student loans.

Chris Hurn, founder and CEO of Fountainhead, one of 14 SBA-approved nonbank lenders in the U.S., said those changes make the extension even more critical.

“I think it’s absolutely essential that they extend it, particularly given the regulatory changes that the administration and the agency made. To properly implement those, you’re going to need more time,” he said.

He said since March 9, when the 14-day period ended, the demand for loans has picked up substantially.

“I think we’ve probably covered a lot of small businesses, but I think we only scratched the surfaces of the smallest of the small businesses.”