Lawmakers in the House and Senate from high-tax, Democratic-leaning states introduced legislation on Thursday to repeal a provision in former President Trump‘s 2017 tax cut law that limits the state and local tax (SALT) deduction.

The bill’s introduction comes amid a push from a number of blue-state lawmakers for a rollback of the cap to be included in coronavirus relief legislation.

“The full SALT deduction must be restored,” Rep. Thomas Suozzi (D-N.Y.), the lead sponsor of the House version of the bill. “Without the full SALT deduction, families will leave New York and the last thing we need in the midst of the health and economic devastation of COVID-19 is to lose our residents and taxpayers. Congress must act immediately.”

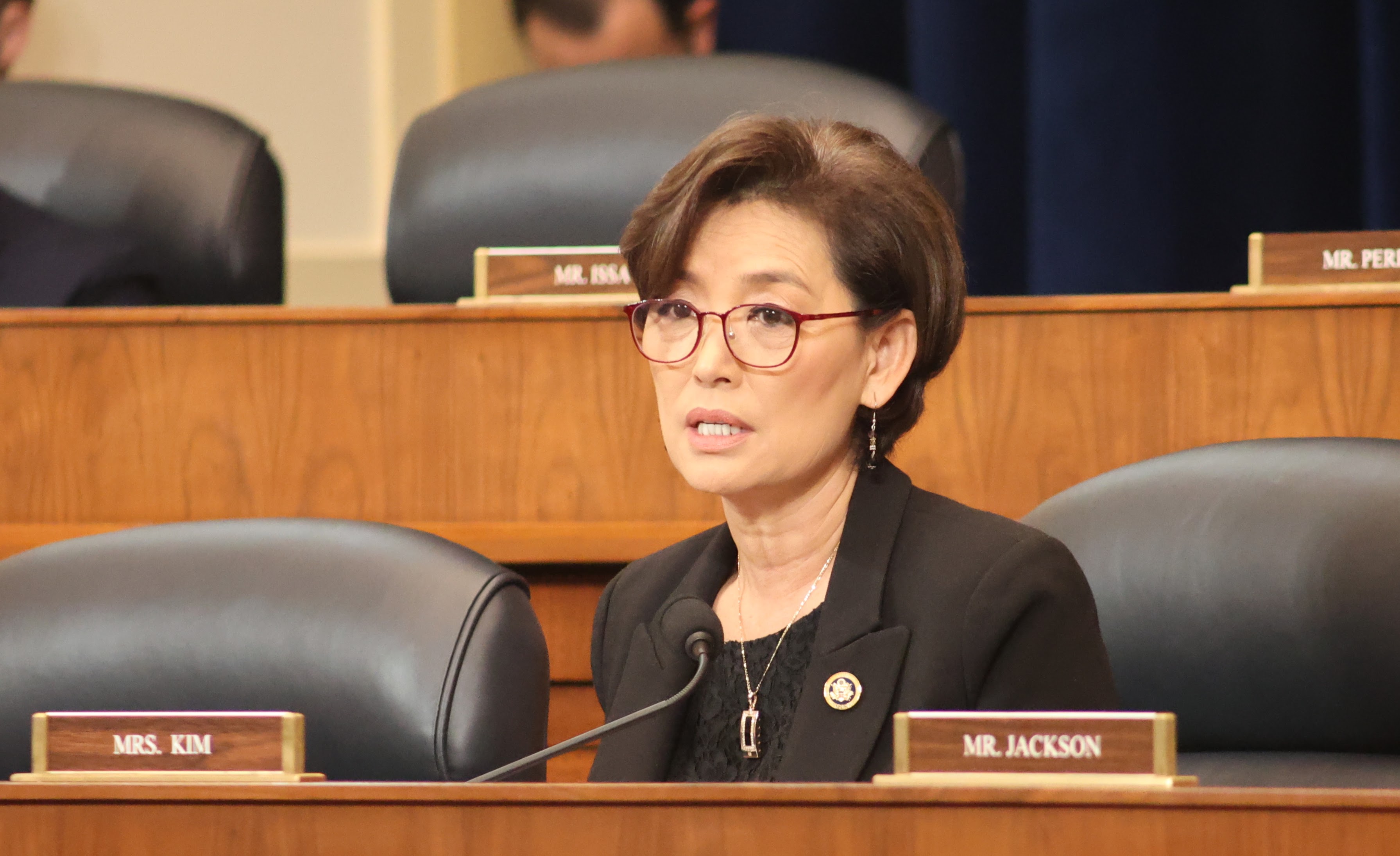

Suozzi’s bill is co-sponsored by six lawmakers from high-tax states, including Republicans Chris Smith (N.J.), Andrew Garbarino (N.Y.) and Young Kim (Calif.).

Senate Majority Leader Charles Schumer (D-N.Y.) introduced a version of the bill in the Senate, which is co-sponsored by Democratic senators from New York, New Jersey and Illinois, along with incoming Senate Finance Committee Chairman Ron Wyden (D-Ore.).

The 2017 tax law capped the SALT deduction at $10,000. Politicians from high-tax states have been opposed to the cap, arguing it hurts their residents and limits their states’ abilities to provide robust public services. But Republicans, as well as some left-leaning tax experts, are defending the cap on the deduction, saying that repealing it would primarily benefit high-income taxpayers.

- Texas woman charged in Capitol riot says she bought into Trump ‘lie…

- Sanders confronts Tanden over past ‘vicious attacks’

The House passed two coronavirus relief bills last year that included a temporary repeal of the SALT deduction cap, but those weren’t taken up by the Senate. The New Jersey House delegation on Wednesday urged congressional leaders and the Biden administration to include repeal in the next relief package.

It could be challenging for lawmakers to get a repeal of the cap included in a relief package this year, since Republicans and some centrist Democrats want to limit the price tag of a stimulus measure.

Repeal of the SALT deduction cap was not included in a $1.9 trillion proposal floated by President Biden. Treasury Secretary Janet Yellen said during her confirmation hearing that she wants the department to study the impact of the cap on state and local governments before taking a position on the cap.